Small shops held their own.

The new year got off to a positive start with our comparative sales data for January showing a small increase of 0.17 percent in the rolling average results across all stores.

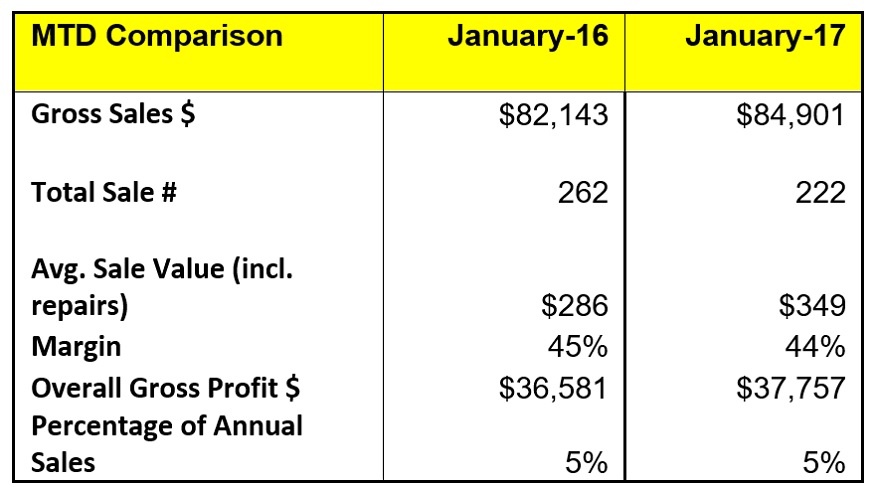

This resulted in the annual 12-month rolling sales figure increasing from $1,594,175 to $1,596,933 between December and January. Monthly sales for January 2017 came in at $84,901, an increase of 3.35 percent over January 2016’s monthly sales of $82,143.

As the chart above shows, sales volume slowed from 262 units in January 2016 to 222 units for January 2017, a drop of 15 percent, continuing the recent trend of lower sales volume by unit. This was compensated by an increase in average retail sale achieved of $349, up 22 percent from the $286 average retail achieved in January 2016. Margin saw a slight drop from 45 percent to 44 percent, however, gross profit still increased on the back of the additional sales, rising from $36,581 to $37,757, or an increase of 3.2 percent.

Larger versus smaller store performance

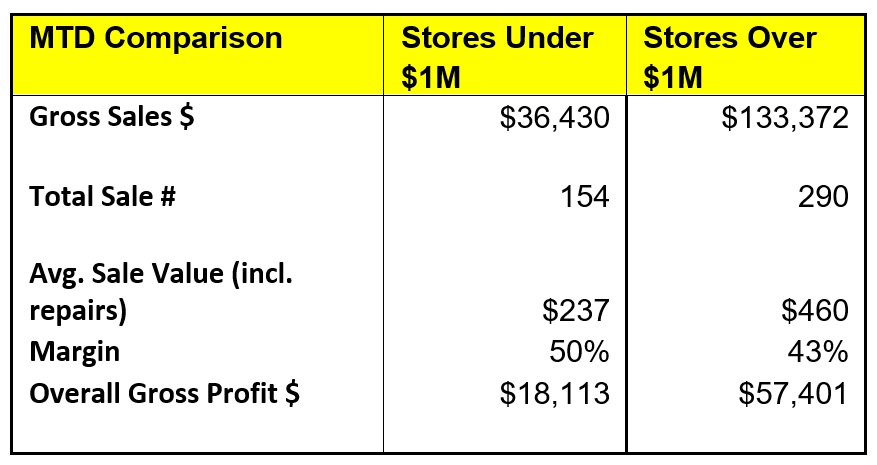

Our data includes a breakdown of stores between those that are achieving sales in excess of $1 million and those that don’t. This gives us the opportunity to compare larger versus smaller stores across the range of results achieved. When comparing this data it’s interesting to note how these different-sized businesses achieve their results, in particular how they make up their respective levels of profit.

When comparing the results for January between larger and smaller stores, we see that the typical larger store is achieving sales that are more than 350 percent higher than the smaller stores are achieving. There are three main areas that contribute to the difference in performance.

Advertisement

Sales units: Understandably bigger stores sell more products. In the January figures above we are seeing larger store average units sold of 290 compared to smaller stores with 154 units. This represents a difference of 88 percent.

Average retail sale value: Larger stores sell more higher-priced items. With an average retail selling price of $460 including repairs, the average large store achieves an average sale that is 94 percent higher – nearly twice as much – as the average small store.

Margin: The average small store is achieving keystone in these January figures. The average large store is some 14 percent lower in the margin being achieved at just 43 percent.

These numbers are one month only but the trend is no different across our annual figures. Larger stores have consistently being achieving a greater number of units and a higher average sale but at a lower margin (although 43 percent for January is lower than the larger store overall trend)

The sale unit numbers make sense but why should larger stores be better at selling higher-priced items?

Why should smaller stores achieve a better margin?

Advertisement

Let’s address the first issue. Before putting forward the argument that bigger stores do more diamond business because they have more diamonds to sell let’s compare diamonds in the one area we can compare – percentage of sales achieved in diamonds. Diamonds represent 53 percent of sales for larger stores. They represent 56 percent of sales for smaller stores. These numbers are not just because the larger stores sell more diamonds relative to everything else.

So maybe they just get those few really big sales – the sort that can seriously increase your average but have a lower profit percentage? That would certainly lift the average and drop the margin. So does this mean only large stores can get those really big higher dollar sales? That depends.

There is a fourth factor that may make a significant difference – the level of inventory being held. Here is the inventory holding at the end of January for smaller and larger stores:

Smaller: $630,631

Larger: $2,230,703

With an inventory level that is 353 percent higher we see the one number that most closely correlates to the sales levels being achieved (remember larger stores achieved a sales figure 350 percent higher in January). Could it simply be that bigger stores get three times the sales because they have three times the selection? Does having a larger selection make you more of an option for those one-off bigger ticket items? Do larger stores just discount more to get the sale? Are smaller stores just assuming they can’t sell bigger ticket items because they are small?

Advertisement

What are your thoughts?

DAVID BROWN is president of the Edge Retail Academy. To learn how to complete a break-even analysis, contact inquiries@edgeretailacademy.com or (877) 569-8657.

This article is an INSTORE Online extra.