Profit Center?

An Unconventional Source

It may not be your core business. But with Diamond Banc by your side, the time is right to enter the asset-based loan business.

There are few certainties in life, as the saying goes, except death and taxes. To this mix, American businesses and consumers can add one more: The need for capital. Banks have been tightening their lending practices since the dark recession days of 2008, but the reality is that people still need cash. That’s why more and more consumers are turning to the time-honored tradition of collateral-based loans.

Jewelers are in a perfect position to offer such loans yet many demure, believing that such a service taints them with the brush of a less savory industry. But as more and more jewelry stores close their doors, the pawnshop industry is thriving. According to the National Pawnbrokers Association, there are approximately 10,000 pawn-based businesses active today, up by about 10% from 2010. And some of these “lenders of last resort” are trying to attract high-end customers, reinventing themselves as more palatable emporiums for customers who are asset rich and cash poor. Buoyed by television shows like “Pawn Stars” and “Hardcore Pawn,” the industry is getting a makeover and consumers who may never have considered using their fine jewelry and watches as collateral for a loan are starting to change their minds.

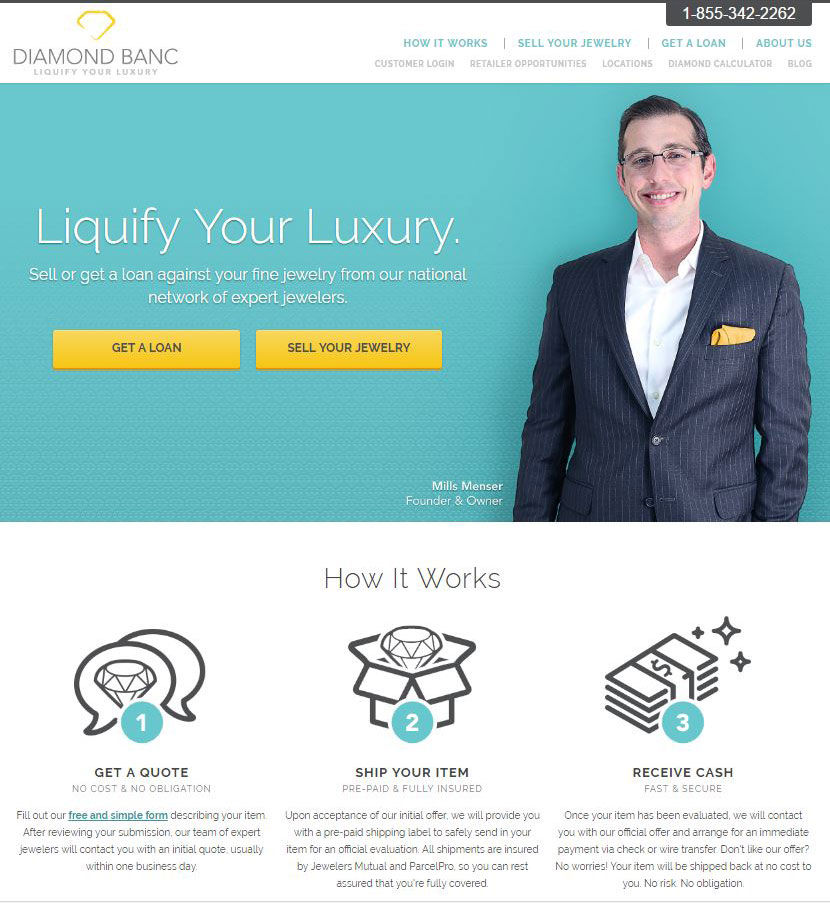

These are the very people that Diamond Banc, the jewelry industry’s leading asset-based lender, says retail jewelers should target. “You’re providing a service that some of your customers need,” says Mills Menser, Diamond Banc’s founder and CEO. “Why not take advantage of this market? After all, these people are already doing business with you. And who better to know the value of their fine jewelry and watches than their jeweler?”

It’s easier to start an asset-based lending service than you may think. By allowing Diamond Banc to handle the loan and all of its transaction details, you are freed from sticky little things like securing a pawn license. (Believe it or not, pawnbrokers and pawn transactions are among the most heavily regulated, governed by 35 statutes and regulations including the consumer protection and anti-money laundering laws.) The customer typically applies at Diamond Banc’s website (www.diamondbanc.com) and loans are secured by diamonds, fine diamond or signed designer jewelry, or luxury watches. After the jewelry is reviewed, Diamond Banc presents the loan and its terms. Once accepted, jewelers receive a monthly check for 20 to 40% of the collected interest fees until the loan is paid in full. Most loans carry an average term of six to 12 months.

Most consumers apply for asset-based loans using Diamond Banc’s website.

Most consumers apply for asset-based loans using Diamond Banc’s website.

Advertisement

One retailer who has built a mutually beneficial relationship with Diamond Banc is Capetown Diamond Corporation in Roswell, Georgia. Founded by Carl Marcus in Beverly Hills, the company (formerly known as Marcus & Company) has grown substantially over the years with a philosophy that combines exceptional customer service with an old fashioned drive to excel. Jonathan Marcus, Carl’s son, says that Diamond Banc has been a good fit for the company. “We do a lot of business with certified pre-owned Swiss watches, so we’re used to buying and selling,” he says. “We’re also pretty old-school here, so having Diamond Banc at the back end makes for a good combination. They’re very high-tech.”

The local angle is also good, says Marcus, meaning that Capetown Diamond is the “feet on the ground,” attracting local customers for Diamond Banc’s services. “They’re there to take care of the details and we’re here for our customers if they want to get a loan without using a bank. We hope to see this segment of our business increase over the next few years.”

Marcus uses Google Ads to let potential customers know that Capetown Diamond offers asset-based loans, but for many jewelers, a simple tent card on a countertop, or a mention on a sales slip is enough to let people know the service is available should they ever need it.

After all, why let business such as this walk out your door when there’s an easy, no-cost-to-you way to build a new profit center? Diamond Banc will be there every step of the way. You bring in the customers. Diamond Banc brings you the rest.

In addition to asset-based lending for consumers, Diamond Banc also offers a full range of asset-based loan solutions for the jewelry industry. Contact Diamond Banc directly for more information on how to tap your market’s potential.

Advertisement

1-855-DIA-BANC

www.diamondbanc.com