I SPEAK TO A lot of jewelers every week, many about pricing from my price book and also in order to help jewelers with QuickBooks. Usually, I either see the numbers in their QuickBooks or I flat out ask:

“How are sales this year?”

“How are shop sales?”

“How is custom business coming?”

When I ask question No. 3, usually I get a confused answer. See, since I’ve been in the jewelry business (which is since the age of 10), defining “custom design” gets a bit confusing.

“Custom design” to me means sitting with a customer, sketching out the new design created by you according to the customer’s wishes, and making a wax to be cast either using a CAD program or carving a wax by hand — then having the wax cast in metal, your jeweler filing it up, setting stones and polishing the piece. Or even fabrication by wire and stock. To me, this is a custom piece.

Advertisement

Many jewelers outsource to a manufacturer to make, alter a ring from the showcase that they have in stock, or send the picture to the vendor who makes the ring or item in their factory. So when this item comes into the store (usually ready to deliver or you just need to set the center stone), it pretty much bypasses your shop.

This is a special order, just as if you ordered a ring from the case, but in pink gold. If you ordered a ring in pink gold, they might have it in their stock or maybe they start from scratch.

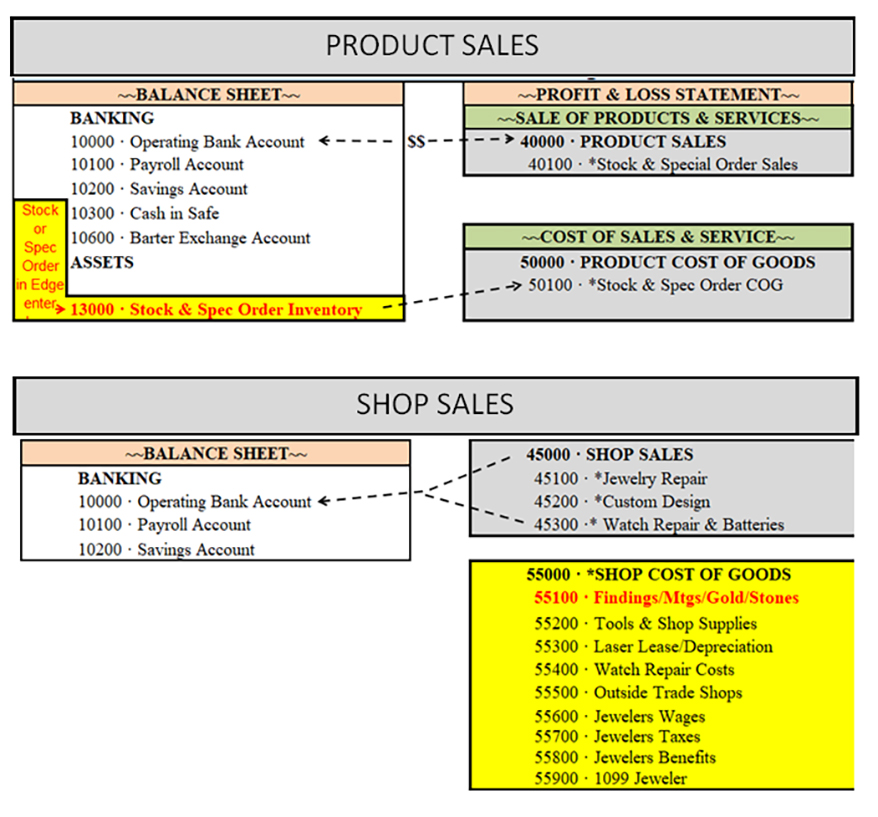

Why does this matter? If it is like I just said, a special order, then in your GMROI reports, this will benefit the numbers for that category and vendor. The invoice for this goes in your Stock & Special Order inventory in QuickBooks. When sold, the cost leaves these accounts and goes to Stock & Special Order cost of goods and the sale goes to Stock & Special Order sales on the profit and loss statement.

But if you call it a SHOP sale, the complete sale for the mounting you made goes under shop sales “Custom Design Sales,” meanwhile all of the costs go into “Shop Cost of Goods”

Allocating it correctly will help you in your planning for both areas of the store and tell you true profits for the shop.

Advertisement