Total sales down again in July for Edge survey group as jewelers sell fewer but higher priced goods.

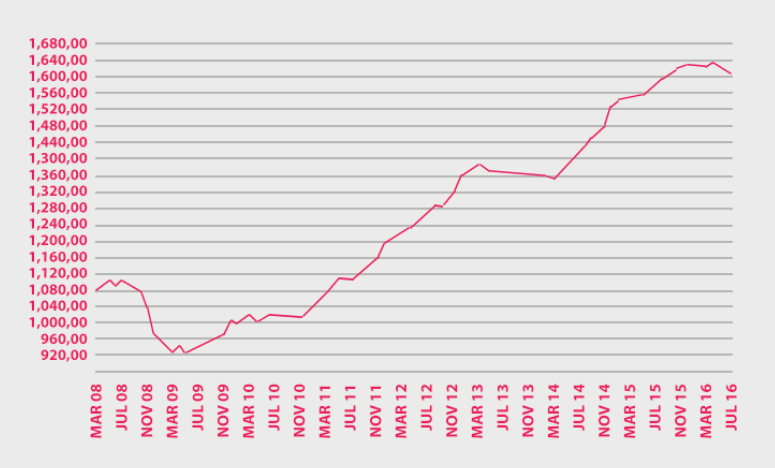

Retail sales data contributed by stores in our survey group showed a third straight year-on-year decline in July. This is the first time we’ve seen this since early 2014.

Average store retail sales for July fell to $104,063 from $111,211 in July 2015, a drop of 6.4 percent. Again sales volume was the main contributing factor with unit sales falling to 285, down 21 percent from last July’s total of 363.Average retail sale achieved was up from $280 to $332, but this was not sufficient to offset the decline in units sold. Gross profit was down 7 percent from $50,965 to $47,401 with margin maintained at 46 percent.

The result is a 0.44 percent decline in rolling 12-month sales compared to the previous month, slightly less than the drops seen in May and June. That still represents a decline of over $7,000 in real terms compared to July 2015, which is a sizeable loss of income for most small businesses.

US AVERAGE STORE GROSS SALES

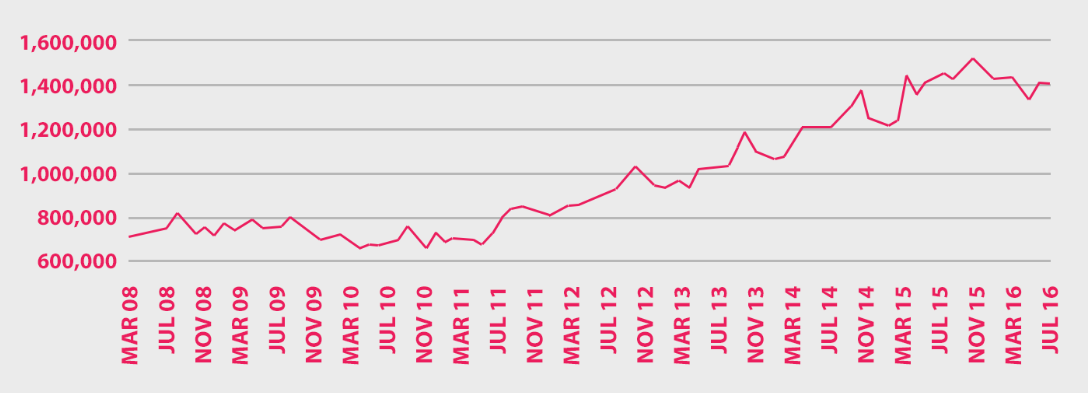

This month our focus is on inventory, the biggest asset for most store-owners. Since the end of the Great Recession we have seen a slow and steady climb in the average value of inventory being held by most store-owners with the exception of the seasonal fluctuations around December and January. The last eight to nine months, however, have seen a tapering off of this growth and even a slight decline in the amount of money being held in inventory.

Advertisement

US AVERAGE STORE AVERAGE INVENTORY

No doubt a contributing factor in this has been the very noticeable decline in units being sold causing many store owners to feel they don’t need the number of items on show. Turnover in terms of number of units will have dropped, and the growth in average retail sale achieved suggests many store-owners need to reinvest their cash in higher priced items. Whether this is happening, and whether there are enough stores making a significant offering at the higher end of the market is a question that each individual store needs to address.

The extended decline in unit sales, particularly for lower priced items, further points to the changing role of the independent jeweler to being a provider of high end, and highly trusted, products. Lower priced items, while still profitable, are becoming more challenging due to the lower margins that have come about through the creation of new brands at that end of the market, and the greater range of retailers and online providers branching out into lower-priced jewelry lines.

The scenario outlined above represents an overall trend and points toward each store needing to evaluate its own individual situation. With December just around the corner it’s now time to get your inventory into order.

Take the time to review your inventory holdings in each of your key departments. How does your average retail price of inventory being held compare to your average retail sale in that category? What is the trend compared to a comparable period 12 months or more ago? It’s important to review where your inventory is tracking, how many units you are carrying in each department and what your average retail value of inventory is in each department relative to the average retail sale being achieved.

Advertisement

As a rule of thumb the average value of your inventory should be around 20 percent higher than the average retail sale being achieved in that department. For example, if you are achieving an average retail sale of $2,000 in your diamond rings you would expect to see an average retail value in your holding of inventory for this department of $2,400, or 20 percent higher.

Inventory is the lifeblood of your business. You need to take the time to regularly review it against the sales being achieved to ensure you are staying on top of the sales trend for each and every department.

David Brown is president of the Edge Retail Academy. To learn how to complete a break-even analysis, contact inquiries@edgeretailacademy.com or (877) 569-8657.

This article originally appeared in the May 2016 edition of INSTORE.