Margin trends that reflect changes in commodities prices suggest something is askew

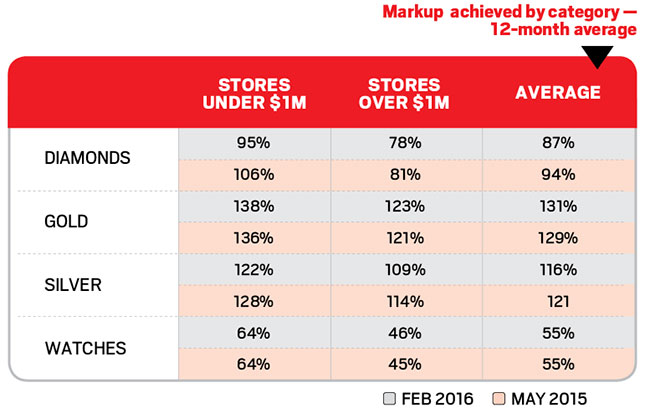

Looking at the changes in margins at big and small jewelry stores over the past nine months reveals some interesting trends. In diamond jewelry, for example, smaller stores (less than $1 million in sales) have seen their margins fall from 106 percent to 95 percent, while at larger stores they have dropped only slightly less, from 81 percent to 78 percent. In silver, margin has also declined, from 128 to 122 percent at smaller stores, and from 114 percent to 109 percent at larger stores.

In contrast, margins on gold have improved, but again by almost the same degree: from 136 percent to 138 percent at smaller stores, and from 121 percent to 123 percent at larger stores. Meanwhile, the margin achieved on watches has remained the same.

Such uniform price movements suggest that margins are being affected by the prices of the raw materials, which prompts an important question: Is that what a customer chooses to buy?

We think not.

Pricing fine jewelry on the basis of the raw inputs is no different to a Picasso selling based on the current market value of paint and canvas. Customers don’t buy silver, gold or diamonds. They buy the feeling they get when they wear an exquisite piece. If you sell based on raw material cost you offer nothing more than your competitor down the road. Business success is dependent on creating a brand that delivers value above and beyond the raw materials with which you work.

Advertisement

This article originally appeared in the May 2016 edition of INSTORE.