August provided a strong increase in sales across our database of stores compared to the equivalent month in 2014. Sales were up over 20 percent for the month with average total store sales at $127,255 compared to $105,769 for last year. This increases the rolling 12-month sales figure to $1,592,699 from $1,576,123, an increase of 1.05 percent from last month. Annualized this would provide growth of 12.6 percent should it continue.

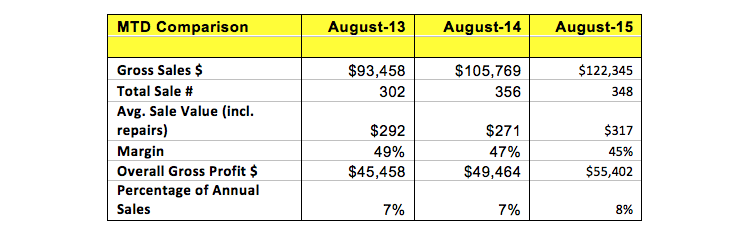

The trend has continued for the last three years, with sales increasing from $93,458 in August 2013, to $122,345 in August this year, a gain of 30 percent in total. As the numbers above show, total monthly sales units increased from 302 to 356 but dropped back slightly in 2015. 2014 growth came from more items at a lower average sale. 2015 growth has seen slightly lower sales again but a very strong increase in average sale. The current average retail sale value of $317 is an increase of 8 percent on 2013 levels.

Of concern is the drop in gross profit as a percentage (margin) with the average margin of 49 percent dropping in 2013 down to 45 percent. If margins had been maintained at 49 percent, gross profit achieved would have been just on $60,000, or $4,500, (almost 10 percent) more profit than was actually achieved.

Advertisement

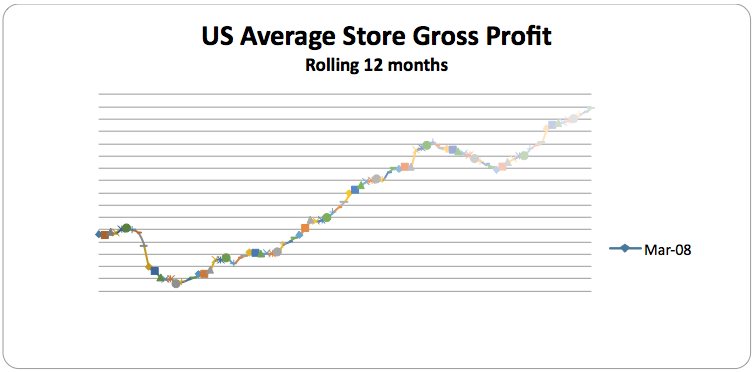

As this chart shows, gross profit is growing well and has continued its upward trend for the year, however it’s not a level of growth that matches the sales increase.

Protecting margin is a double-edge sword and must be tackled on two fronts. Losing margin happens either because the amount of markup being applied to product has been reduced or the amount of discount being given away at the counter has increased. Where a store has achieved a certain level of margin in the past then it is unlikely that there is a conscious decision to reduce margin – this leaves an increase in discount as the main culprit for narrowing margin.

So why has discounting increased? It will generally be caused by a change in a variable. The main variables are:

A change in the amount of discount being sought by customers

A change in the amount of discount being offered by the salesperson

How do you tell which it is? The best way to determine if it is salesperson-related is to compare your salesperson reports. Has the staff changed? If the staff is the same as before, are they offering larger discounts than they did previously? If the staff has changed, how does the discount compare between staff members? If associates are achieving a similar level of average sale, and they have sold enough items during the year to take out the margin of error, then you would expect to see a similar markup. If most staff are similar in markup but there is someone who is outside the margin of error for achieved margin then you may have a problem with one staff member giving too much away.

If there is consistent discount being achieved across all staff and the margins don’t vary by any great degree then there is another factor that is affecting things. They may be getting greater pressure from customers to offer a reduced price. If so, then what is your policy on this and how have you trained your staff to deal with customer discount requests? If you havent trained them, then there will be no consistency in how they respond and this may cause customer confusion in terms of their expectations.

Advertisement

If you are looking to set a discount policy then Step 1 needs to be learning to say No. Before you gasp with shock, I would recommend you try it. Let’s start simply by setting the policy for the day that for any customer purchasing an item under $200 the answer to a request for a discount is No.

Now you don’t put it like that, an appropriately worded reply is required, but offer no discount on items under $200 for a day and then discuss the response the following day with staff. How many customers walked out? Chances are the number will be fewer than you think. How much extra profit did you make on the buyers who accepted the “no” versus what you lost in profit from the sales?

Again, compare these variables. You might be pleasantly surprised to find the profit gained by not discounting more than offsets the amount lost from customers who walked. Experiment with smaller sales for a day or two then depending on the results look at rolling out a policy across the store on larger items.

It takes a lot of extra sales to make up for every percentage in lost margin. The proof will be in the results, so be willing to experiment. The results may be a pleasant surprise.

David Brown is president of the Edge Retail Academy. To learn how to complete a break-even analysis, contact inquiries@edgeretailacademy.com or (877) 569-8657.