EDGE GROUP JEWELERS show 25% YoY gain in September; cash management holds key to Christmas success.

With the busy holiday season on the horizon, most jewelers in our group showed a very healthy increase on their September results from the comparative figures for 2013. Sales were up from $84,674 to $106,438, an increase of over 25 percent on the equivalent one-month period. The impact on our YTD rolling results was a nice bump, with average-store annual sales rising from $1,429,996 to $1,451,760, a one-month increase of 1.5 percent, or an annualized increase of over 18 percent. Given that we are starting from an already healthy sales level this is a very impressive performance and implies perfect timing for those stores looking to gather up cash to invest in fresh inventory over the next few months.

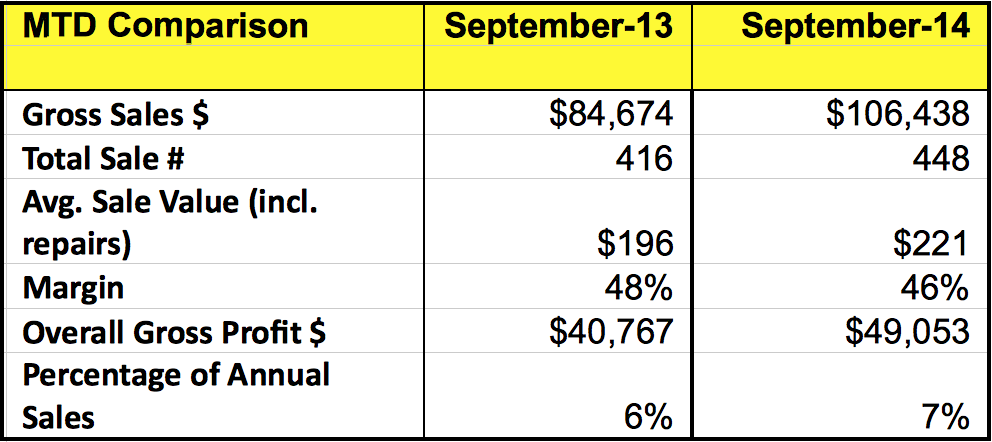

As the figures show, the sales increase came from across-the-board gains in both sales units and average sale. Units sold increased 7.6 percent from 416 to 448 with the average retail value of a sale jumping from $196 to $221, an increase of just under 13 percent. Margin did drop, however, from 48 percent to 46 percent. This represents $2 less profit for every $100 of sales achieved and would be a $2,000 drop in profit for a store achieving $100,000 of sales for the month. Overall, however, gross profit increased from $40,767 to $49,053 (up 20.3 percent) and augers well for the busy December season.

As we mentioned, this provides a good cash injection for businesses looking to round up money for the busy holiday season … or does it? Showing $9,000 extra gross profit doesn’t always translate into $9,000 extra cash in the bank as we’ve discussed before. Extra staff or marketing may have helped generate the greater sales and this comes at a cost, and the proceeds may already be earmarked for retiring debt, clearing up overdue accounts or a host of other reasons.

So how do businesses ensure they have enough cash to cover the upcoming months outlay? Here are a few suggestions to get you through any impending cash crisis:

Advertisement

- Review your expenses. Pre- December is a cash drain while post-December normally brings a cash gain. What expenses can you reduce or defer until after the busy period ahead? Larger capital purchases can sometimes wait (especially those that the landlord may be forcing upon you!). Reviewing your expenses is a good exercise on a regular basis but especially when you get to this time of year.

- Talk with vendors. They make money when you make money. Sit down with your key vendors and discuss your December targets and what inventory you will need to achieve these goals. Ask them what credit terms they can extend until the new year, but make a commitment to them that you will reorder the items that sell well. Too many store owners use their vendors as a bank but don’t “pay the interest.” You vendors won’t make money until you re-stock the items. Those who commit to their vendors will find a vendor ready and willing to offer more.

- Set budgets. You may be good at budgeting the rest of the year but do you break your December sales down on a daily basis? This is your most important time of the year with many stores completing 20 percent of their annual sales in one month; 10 percent can be done in a matter of four to five 5 days. It’s worth this level of planning when you can manage a month’s sales in just one day. Planning out your monthly sales budget can help you set targets but it can also make it easier to plan your inventory flow. Many stores order (and sit on) inventory from late October onwards but a quick look at your sales for December will show much of this product isn’t required until mid-December. Getting inventory in later (and reordering promptly when it sells) can be more efficient. Which is better, $50,000 of cost of goods sold turning over once or $50,000 of reorders sold over and over several times? The second method may only require $20,000 of cash tied up in comparison — much more gentle on the bank balance.