ON THE SURFACE, when a customer says “yes” and reaches into their wallet to provide a sales associate with their credit card, the purchase decision may seem quite linear. They’ve been shown a great product that fits their needs, and they wish to own it. Simple, right? A purchase decision, though, is actually much deeper with a complex mix of physical, mental and emotional components that factor into the equation. Marketing research with specific consumer targets does, however, make it possible to determine elements that influence the target in specific ways.

This year, The Plumb Club initiated a multi-faceted research study with the assistance of Paola Deluca, The Futurist, and Qualtrics, a world-renowned survey and analytics firm. The insights shared illustrate the various factors that lower the barriers in order to allow the purchase and help a jewelry customer decide if a product, brand or retailer is relevant and meaningful to them, and if they fit with that customer’s self-appraisal.

So, who is this target consumer? Well, roughly 70% of all jewelry is purchased by adults of ages 25 – 60 (Gen X and Gen Y) with the largest share belonging to millennials (Gen Y). The average millennial spends $203 on jewelry annually, which is 157.9% above the average American. This group is “techno-savvy” and reliant on digital devices. This customer also craves tailored and personalized experiences, wants transparency, ecological and social commitments from their brands and selling channels, as well as diversity and inclusivity. They further want to be free to express themselves and their personality prominently, whether that be on social media or in their purchase decisions.

Following are some of the survey insights that consumers say influence their buying.

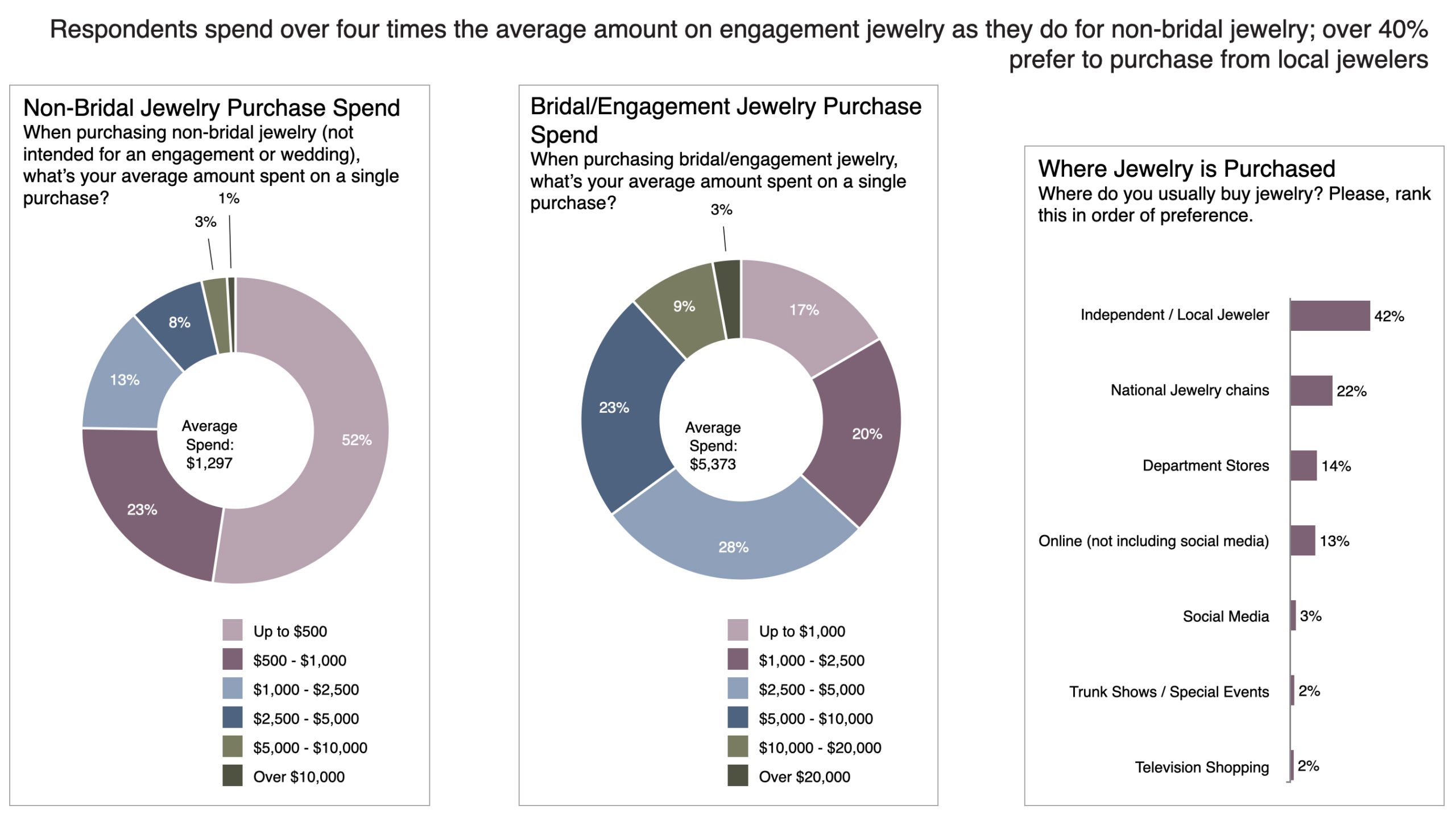

Consumers are interested in purchasing jewelry for special occasions (54%), but often for no needed reason (24%). Retailer websites, as well as family and friends, are the most important influencer (39% respectively) and the three most important factors while purchasing jewelry are quality (31%), price (24%) and design (23%).

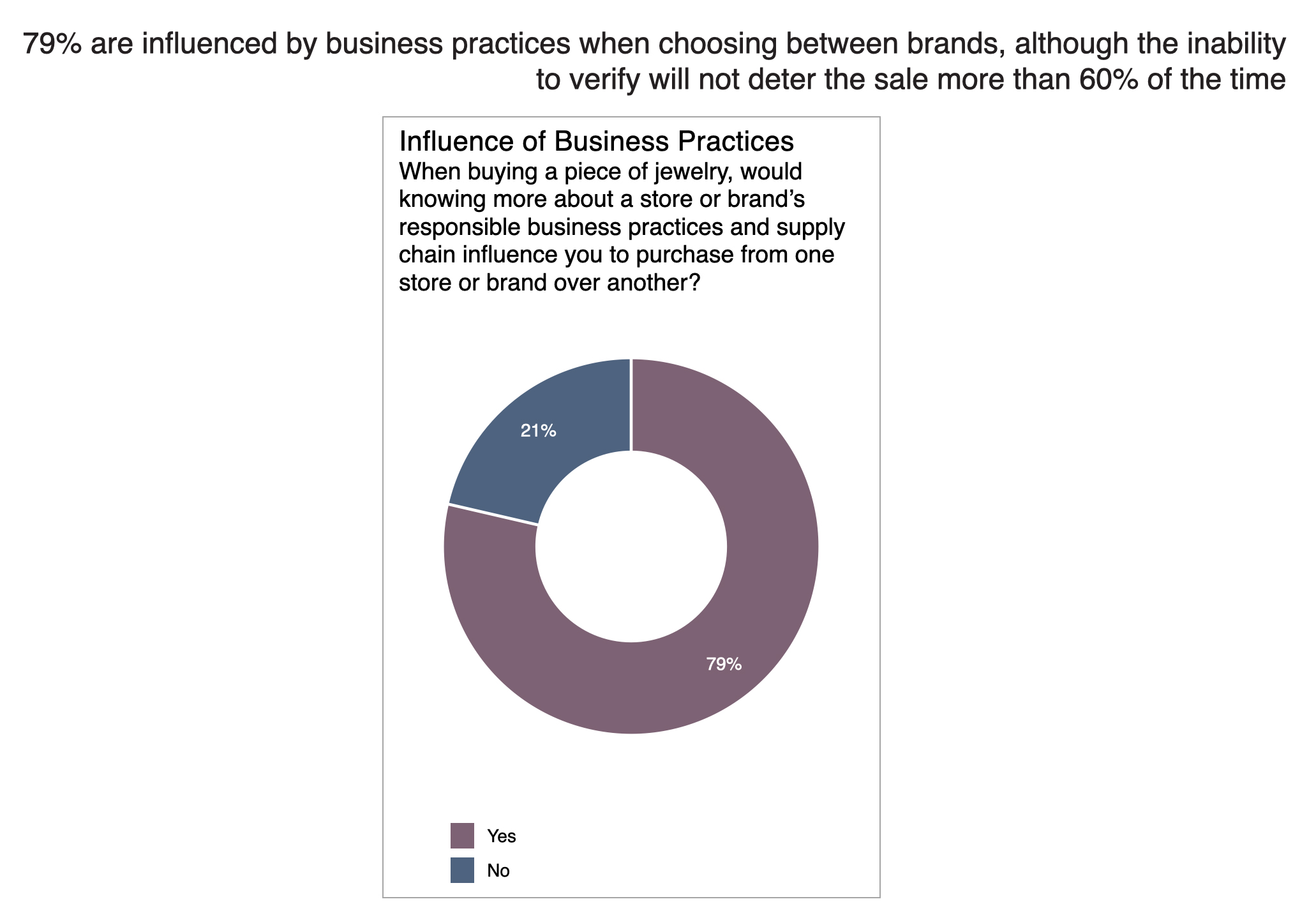

79% of consumers say that knowing more about a store or brand’s responsible business practices and supply chain would influence their purchase from one store or brand over another.

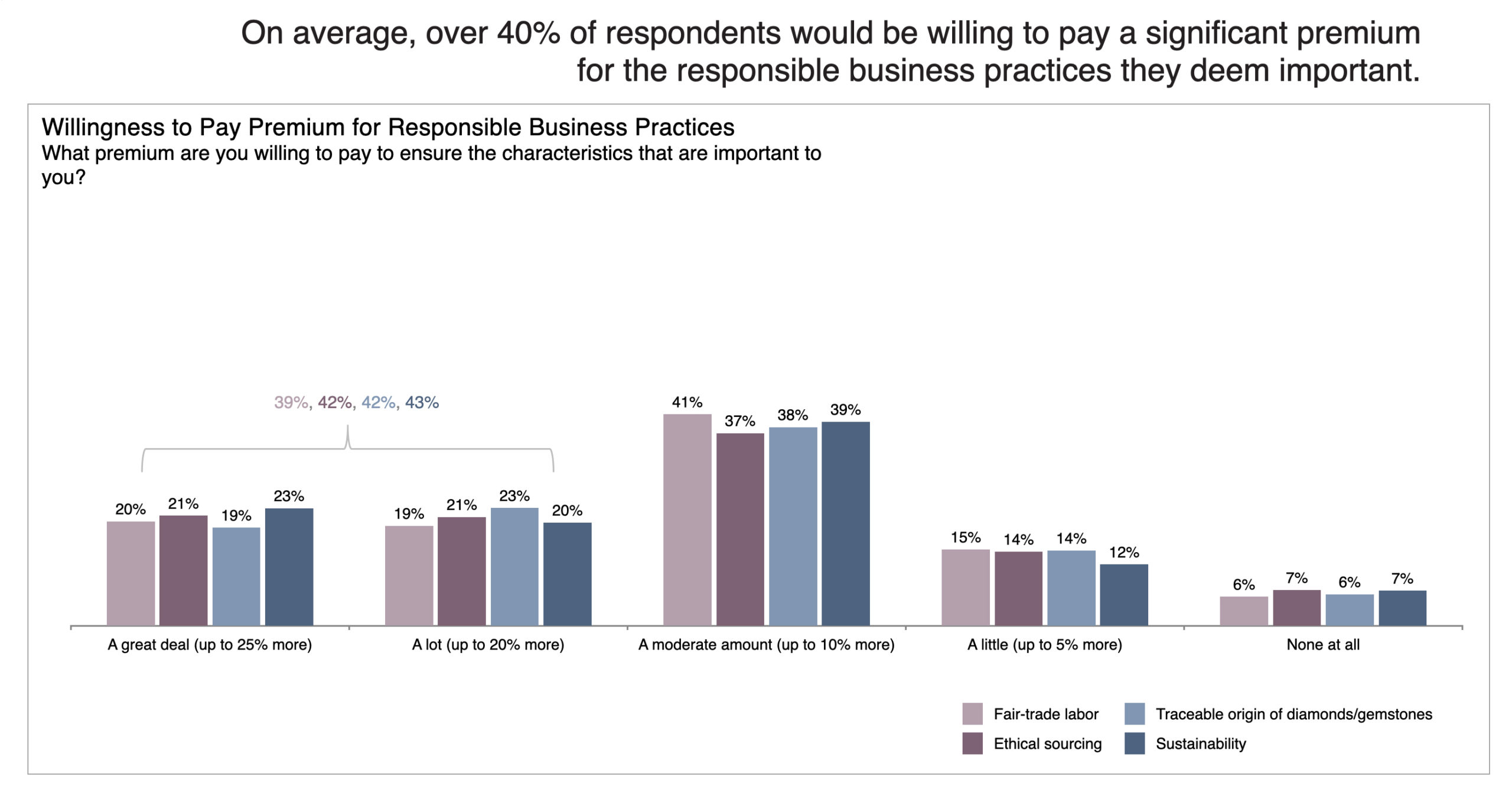

Fair-trade labor, ethical sourcing, traceable origin of diamonds and gemstones, as well as sustainability, are important to consumers with 42% saying that they would pay a great deal (up to 25% more) or a lot (up to 20% more) for those characteristics. 39% said they would pay a moderate amount (up to 10% more).

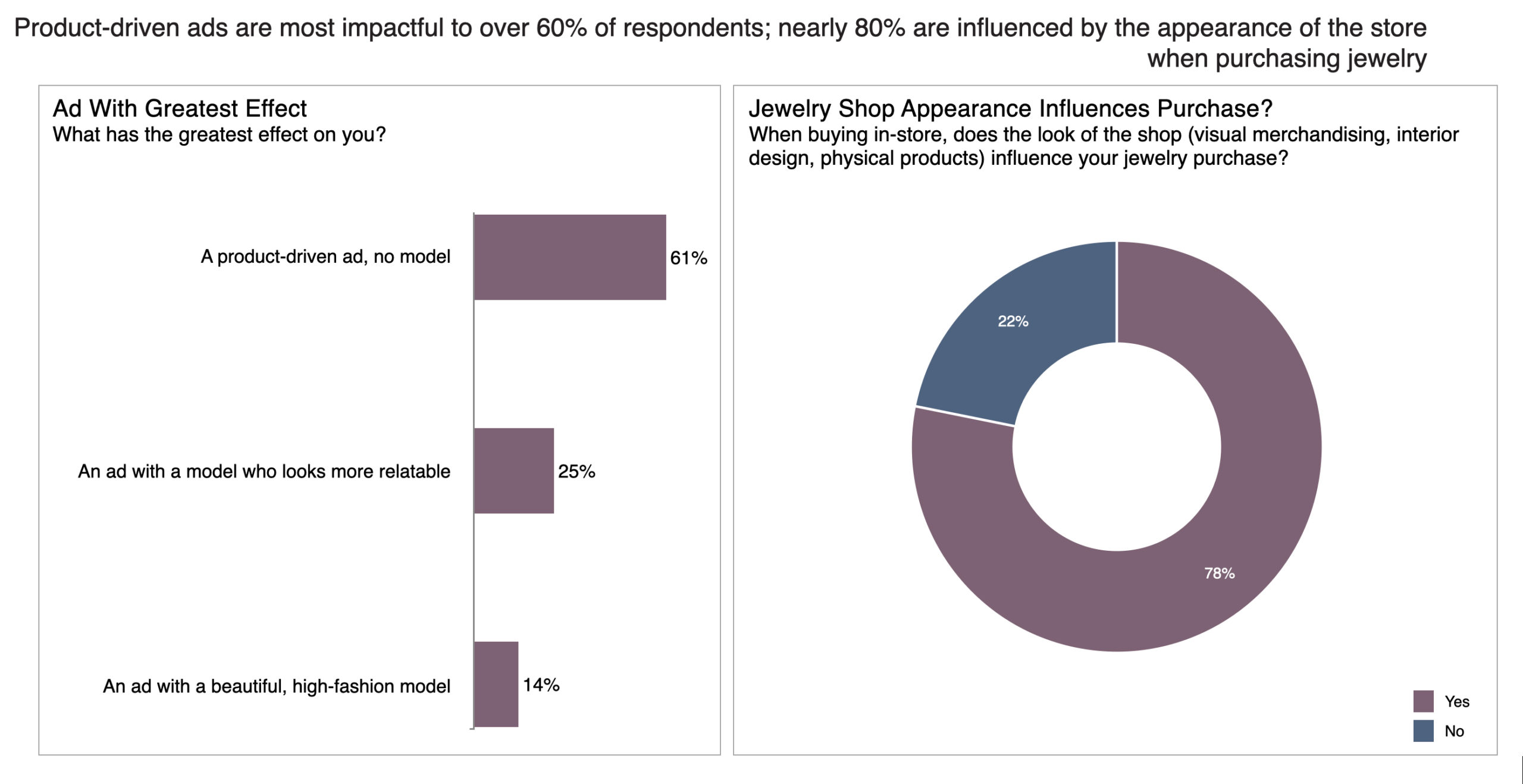

61% of consumers say that product-driven ads (no model) have the most impact on them while ads with a beautiful model have the least impact. Additionally, 78% say the look of the store influences their jewelry purchase. (graph 1 and 2 on page 57)

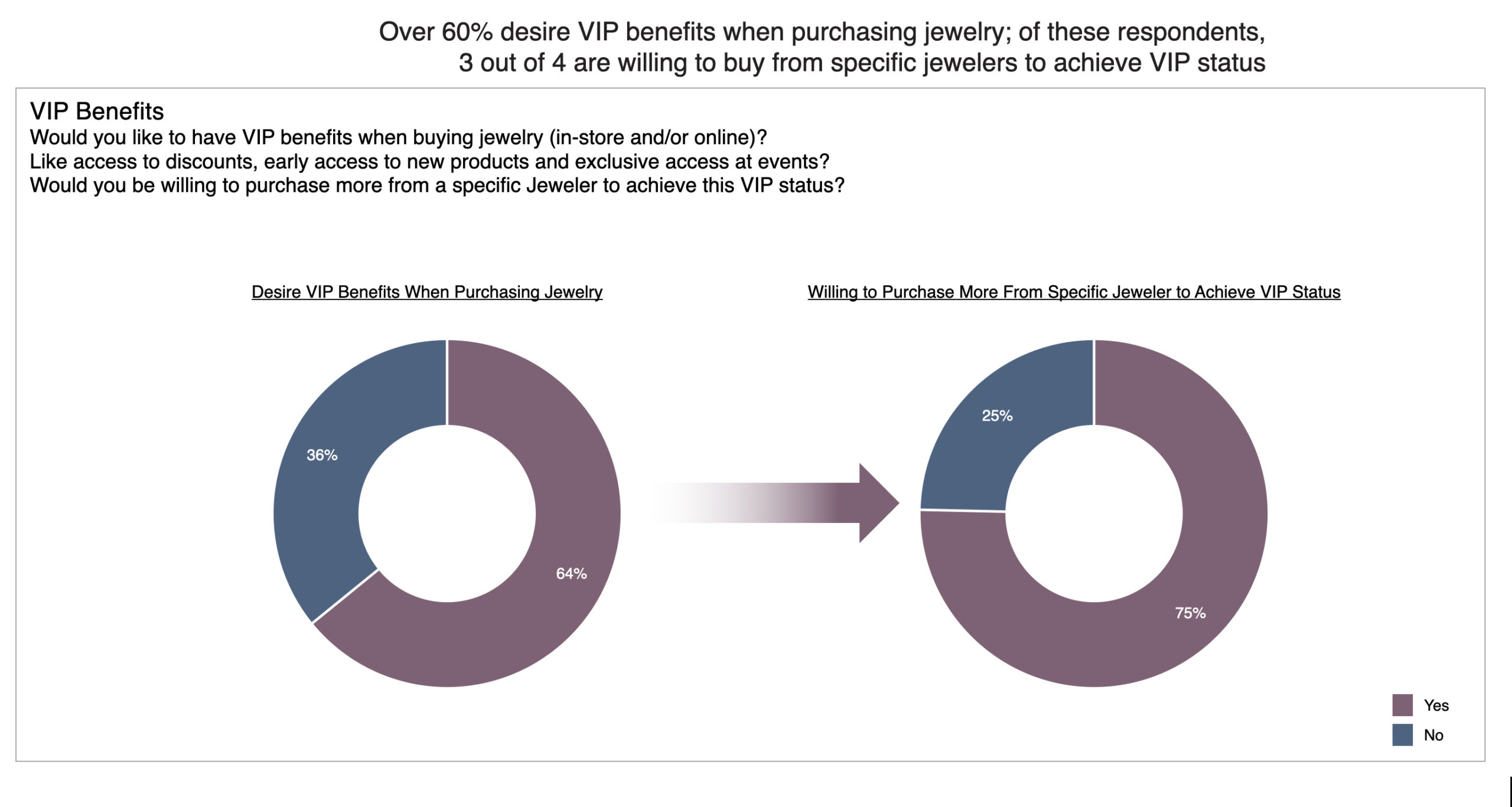

64% of consumers would like their retailer to offer VIP benefits (discounts, early access to new products, exclusive access to events) both in store and online and 75% said they would be willing to buy more from a jeweler to achieve VIP status. (graph on page 60)

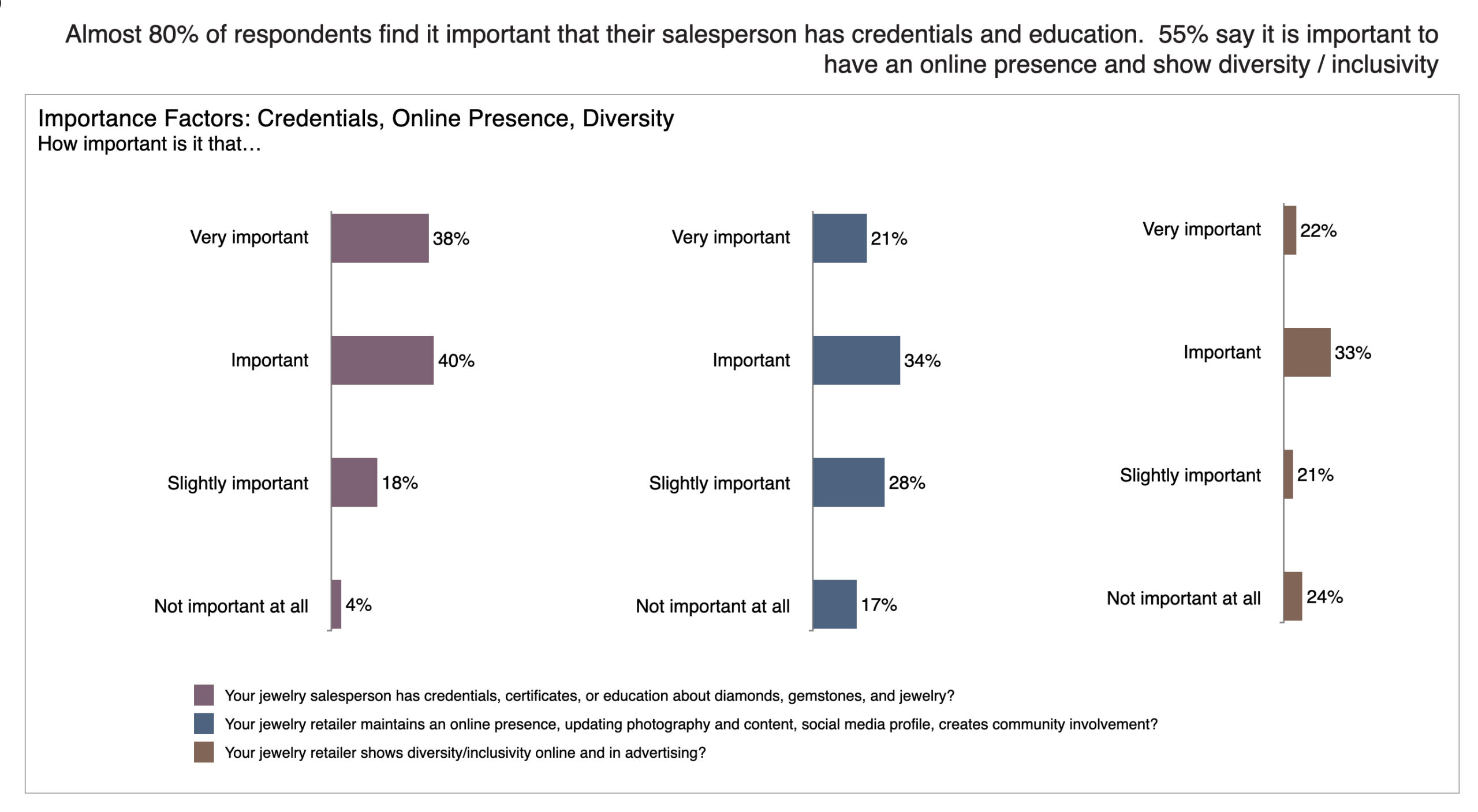

When it comes to other elements of importance, 78% of consumers feel that it is “important” or “very important” that their salesperson has credentials, certificates or education about the product, 55% feel it is “important” or “very important” a jeweler maintains an updated online and social media presence. 55% feel it is “important” or “very important” a retailer shows diversity and inclusivity. (graph on page 58)

The study was conducted with a sampling of over 2,000 men and women from the ages of 25-60 with a balanced demographic and psychographic mix across the US. Respondents had all attended some college or higher and had a combined household income of at least $75K/year.

The insights shared here in this final story of the research study, The Plumb Club Industry & Market 2023, represent only a small facet of the information contained in this expansive document. In addition, a presentation of more of these findings will be given at the JCK Las Vegas Show on Sunday, June 4 at 11am at the Showcase stage in The Venetian Expo, level 2. The presentation is entitled, “Today’s Changing Customer: Who, When and What They’re Buying!” Any retailer wishing more information on The Plumb Club Industry and Market Insights 2023, should contact their Plumb Club Member vendors or visit a member at The Plumb Club Pavilion. A full listing of Members can be found here.