David Brown

President of The Edge Retail Academy |

|

A slight slowdown in sales caused by election uncertainty was the prevailing theme in October. But in the background, another interesting trend was playing out – the small but steady decline in share of overall sales contributed by silver. This isn’t entirely unexpected or unwelcome but it does suggest you’ll need to start polishing your sales staff’s diamond product knowledge.

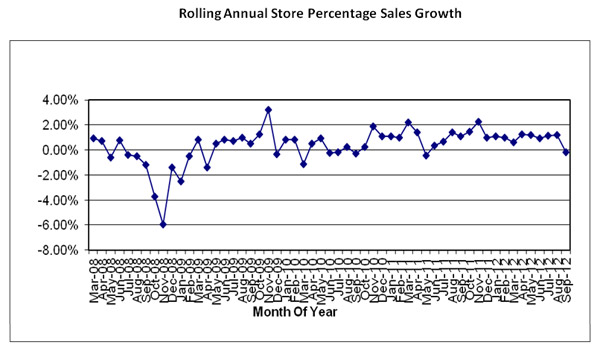

Store sales growth showed the first signs of declining in September after almost 18 months of continuous increases on a rolling 12-month basis. September’s figures showed a drop in sales of 0.18 percent per annum from the preceding month. This is the equivalent of a million dollar store achieving $1,800 less in sales for September 2012 compared to September 2011. This would be a 2.16 percent decline in annual sales if it were to continue over a 12-month period (12 x 0.18 percent) or the equivalent of $21,600 less in sales over the year. The last drop in annual sales growth occurred in May of 2011 when sales slipped by 0.42 percent from the preceding month

Is this cause for concern? Sales figures fluctuate, and to have had almost 18 months of unbroken growth has been an encouraging sign, so in isolation these figures mean very little. The question is…will it continue?

Given the usual election uncertainty that can happen every four years, this situation may only be temporary, but it could also mean a slowdown in October figures as well. If we see any change in the political landscape, things may take a more permanent turn, but curiously it is the uncertainty that causes consumers to hesitate in these circumstances rather than any fears caused by the result. It is quite likely that stability will return regardless of whether a Republican or Democratic president is elected. It proves the theory that retail spend is more a by-product of confidence rather than the actions of any political party.

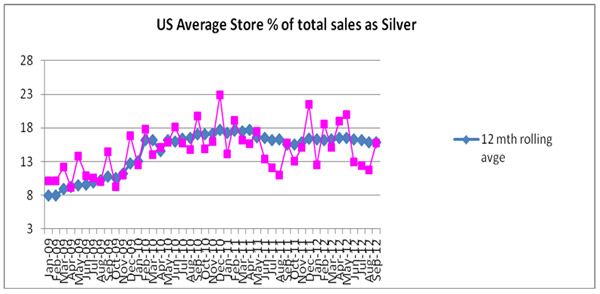

This month we are focusing on silver, which had been something of a lifeline for many jewelers during the economic slowdown. As the graph below shows, the sales contribution from silver has slowed somewhat during the last few months.

Advertisement

This isn’t so much a reflection on silver (although an increasing price may have contributed) but is more of a reflection of the public’s willingness to spend more on their jewelry purchases – and hence we have seen a stronger performance from diamonds. Certainly the contribution from silver as a percentage of overall sales has dropped from its previous level.

From a high of 18 percent, silver now contributes around 15 percent to the average store, still well up from 8 percent in 2009.The important thing for stores is to adjust to this new environment (or should I say a return to the old environment!). Many stores have significantly increased their holdings of silver inventory and, in some cases, taken on additional staff to deal with the increased number of transactions that selling silver can lead to (particularly in the bead market, which can makeit an extremely time-consuming item to sell). This has been an effective means of regaining revenue in the last few years but may require some adjustment in approach if customers are returning to bigger ticket items and silver sales continue to fall off (as these are average figures, some stores have seen a more significant movement away from silver).

Training can be the biggest issue. Many stores who have hired inexperienced staff in the last three years and may have found that these employees sold little other than bead product. Presented with increased interest from consumers in diamonds, these same sales associates are often under-equipped with the knowledge required to sell diamonds.

This was highlighted to me by a jeweler recently who joked that he sold so much bead product that if he was asked by someone to see his diamond earrings he’d need a signpost and directions to help him find any in his store! Like all comments made in jest there is an element of truth to it and I have no doubt that many jewelers are losing diamond sales because their staff are not adequately prepared to sell them.

Advertisement

A good test is to get three diamond items from your cabinet and at your next morning meeting ask your staff members to tell you what they know about them, and try to sell you. If there is hesitation, then the knowledge base needs to be improved.

Regular diamond training is the answer. Aside from the external resources that are available you can often find good diamond expertise amongst your older staff members or yourself. Harnessing it is the secret! You need to arrange a set time each week when sales staff can be rostered for training. Not having a set time will mean it won’t happen.

If you struggle to achieve this with internal resources then seek outside help. The small cost of additional training can often be recouped on the first ring sold! Don’t skimp on this important investment in both your staff and your business; the returns can be better than any money in the bank!

ABOUT THE AUTHOR: David Brown is president of the Edge Retail Academy, an organization devoted to the measurement and growth of jewelry-store performance and profitability. For further information about the Academy’s management mentoring and industry benchmarking reports, contact inquiries@edgeretailacademy.com or phone toll free (877) 5698657