ROLL UP YOUR sleeves and let’s get to work. In January, I explained how to get started planning your annual budget, either on pad and paper or far more easily using QuickBooks software. You may remember that I left you hanging, with all your numbers in the red. This month, I’ll tell you how to change that, using a sample September budget.

The negative numbers represent how much you need to make to break even. You can see that September’s net loss is ($10.734.65). You need that much Gross Profit (Sales — Cost of Goods = Gross Profit) and you’d have enough money to break even.

If you were to keystone everything (gross profit of 50 percent) you’d need to sell $21,469.30 to break even. But you need to make some net profit, and 6 percent would be nice. So you use my formula and add 16 percent to our expenses. $10,734.65 + 16% ($1717.54) = $12,452.19. Double that number to reach the sales you need: $24,904.38.

The $24,904.38 needs to be divided up among the staff and owner. If the owner makes 40 percent of the sales and there are two full-timers on the floor, then you take the 60 percent remaining and divide it up — 30% + 30% to the two full-timers. Sales should be divided up by percentages. If you had a full-timer and a part-timer, you’d still divide up the remainder, but divide it based on how many hours they work.

You still have to fine-tune your budget. Many of you don’t have a 50 percent gross profit margin; most folks have 44 percent to 47 percent.

Advertisement

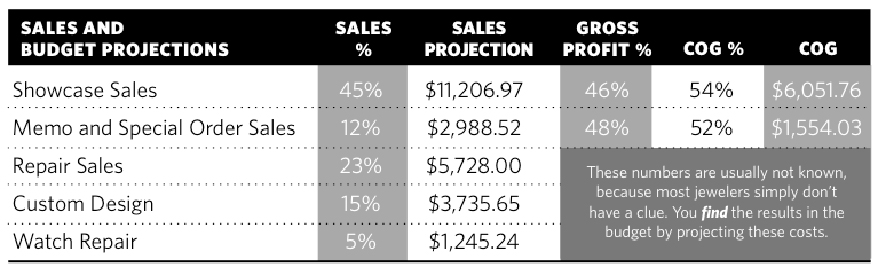

Additionally, you want to break down sales into income departments. In this example, all sales were figured at $24,904.38. But in reality you must divide it between departments: Showcase Sales, Memo and Special Order Sales, Repair Sales, Custom Design and Watch Repair. You’d divide up the $24,904.38 into these smaller income departments and the Cost of Goods for the first two only.

After plugging in these numbers, you then need to plug in the Cost of Goods for the shop: jewelers’ wages and taxes; findings, small stones, metals; shop tools, buffing compounds; laser lease payments. You’ll probably need to adjust payroll now. You should move the jewelers’ pay and taxes out of payroll expense and plug them into Shop Cost of Goods. Now you can finally see how the shop is doing.

To find out our sales and cost of goods for each of these departments you first find our sales by department by percentage. Then find the Gross Profit and Cost of Goods and enter those.

So you go back to our budget and plug in the Showcase Sales, Memo and Special Order Sales and Cost of Goods from this chart. The shop’s cost of goods is plugged in by what your jewelers earn and typically what you spend monthly for the supplies for the shop.

Here’s the scary part

You just might find out the shop is losing money!

If you found out on the Budget Overview totals that expected sales were $10,708.89 (it adds up) and your cost for the shop is $7,856.00, you wouldn’t be too happy, would you? Heck no. At 50 percent margin (keystone), a Cost of Goods of $7,856.00 should bring in double or $15,712.00, not $10,708.89.

Advertisement

The moment of truth is here: You need to raise your prices, partner.

Go back to the Budget Overview and see how our net profits are looking. You might have some bad months; we all have a few. But look at the year totals. If they’re not good you’ll need to do something:

Cut expenses

Increase margins. Think about a larger markup on items under $400, add a few extra bucks to every loose diamond sale, buy more diamonds off the street, find lower priced vendors, make some of your own products for higher markups, raise shop prices.

Increase sales for some months. This is marketing and closing ratios. If the month is $24,904.38, maybe you’ll need to go to $29,500.00 at our 46 percent margin to make it a profitable month. Yep, you’ll just have to sell more stuff. Imagine that!

Doing it right will help put more money in your pocket and, of course, it will make next year’s budget a breeze. This might be the only time you’ve known how you stood and what it takes to make a successful business. It certainly takes a lot more than “Open the door and they will come.”

Now that you’ve got your budget all set up, print the Budget Overview and place it on the wall of your office or in a three-ring binder. You should post the income totals each month for your sales goals for the staff to see.

Advertisement

Each month you should make sure to run a profit-and-loss statement that compares your budget against how you really did this month. In QuickBooks, go to Reports > Budgets & Financials > Budget vs. Actual and hit Next, Next, Finished.

Now you’ll have in one column the actual P&L for the month with the budget amounts next to it and then a third column showing how much you’re over or under in dollars and percentages from your plan.

Doing it right will help put more money in your pocket and, of course, it will make next year’s budget a breeze.

Have a profitable year!

This story is from the February 2007 edition of INSTORE.