IF YOU’RE JOINING us late, last month we set up our chart of accounts, and prepared ourselves to input our sales and cost of goods into QuickBooks. Some of the jewelry point-of-sale programs will automatically export the day’s sales into QuickBooks. For those of you who don’t have this feature (and there are many), you’ll have to enter this data simply through something called a “journal entry.”

We do need to make two more charts of account. One will be a “connection” account between our sales and our checkbook. Why do we need a “connection” account? Because we will have days where we have (example) $5,000 in sales abut only have $3,500 in the till. Why would we have only $3,500 when we sold $5,000? Because someone gave us a deposit last month and paid the balance due today. In 90% of jewelry stores, sales do not equal “cash” in the till.

The other account will be to “hold” our sales tax liability.

Go to the chart of accounts and create a new account. Hit “Control + A” to see the account list and “control + N” for new account. Create an “Other Current Liability” account and name it “Customer Deposits”. Then click “next”. Do another “Other Current Liability” account, but name this one “Sales Tax Collected”. Save and close.

QuickBooks will allow you to save many different account templates, and we will save this one to make our work easier in the future.

To make a new journal entry, select the Banking menu and then choose “Make General Journal Entry”. In the account column, choose the following accounts, one by one:

Advertisement

- Account — (Type)

- Showcase Sales — Income

- Special Order & Memo Sales — Income

- Shop Sales(Repairs) — Income

- Sales Tax Collected — Other Current Liability

- Showcase Sales C.O.G. — Cost of Goods

- Special Order/Memo C.O.G. — Cost of Goods

- Inventory Asset — Asset

Then go into the memo lines to the right and type these words (as a useful reminder):

- CR: Showcase Sales;

- CR: Special Order/Memo Sales;

- CR: Repair Sales;

- CR: Sales Tax Collected;

- DB: Showcase Cost of Goods;

- DB: Special Order/Memo Cost of Goods;

- CR: Total of both COG’s.

And, on the next blank memo field, type the words “Down arrow-Customer Deposits.” It will not have an account on the left.

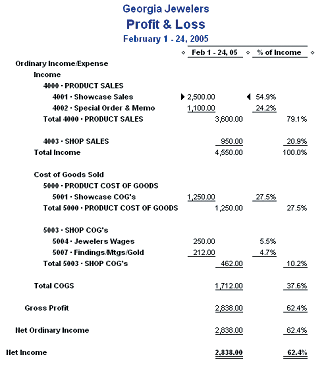

When you’re finished, the result should look like the image in the first figure.

Now let’s save this as a template. While the entry is up, click Control + M and name it “Daily Entry.” Click “OK.” You can close this if you like.

To use this saved form from any place within QuickBooks, all you need to do is hit Control + T (for Saved Transactions) or at the top, go to Banking and find, at the bottom, the item which reads “Memorized Transactions”. Double-click the item you created called “Daily Entry.”

Advertisement

To put your sale into QuickBooks from your point-of-sale program, you’ll need to run two reports from your POS software.

- Sales for the day, with cost of goods

- Sales tax collected

1. For “sales for the day,” you can enter sales daily, weekly or even just once a month if you like. You’ll probably have two different types of sales: Products and Shop.

Most POS systems will print a report of products along with their cost of goods. Either on the report or someplace else in the POS system you’ll need shop sales (repairs, custom design, watch batteries, etc). Shop sales do not have their cost of goods included in the POS system; those are entered into QuickBooks when you pay those bills.

So you’ll need:

- Sales of products that we own, with cost of goods;

- Sales of products you don’t own (special order & memo) with C.O.G.’s.;

- Sales only of the shop (Repairs & Custom Design);

2. For “sales tax collected”, You’ll find a report of the sales tax on these sales. Might even be on the same report.

This is all you need, now go to the memorized “Daily Entry” journal entry and open it — (Control + T). Make the date on the entry the same as your last day of the sales report you just ran. (E.g. For a report that covers March 14-20, the Daily Entry would be March 20.)

Advertisement

Now follow the instructions on the form. For showcase sales, the memo field reads:

- CR: Showcase Sales. This means “Type the total of showcase sales in the Credit column.” So click in the credit and type the Showcase Sales from the report. Do the same for the other sales and the sales tax collected. These numbers all go into the Credit column.

The Cost of Goods go into Debit column. Now add up the two “cost of goods” figures and put the result in the credit column on the Inventory Asset line.

What have you just done? You’ve placed your sales onto your Profit & Loss Statement, then you entered the cost of those product sales, all with a single journal entry. Then you told QuickBooks to lower your inventory amount by the cost of goods amount. (Remember: All products brought into your store sit in Inventory Asset until the day it sells, when it moves out of Inventory and into Cost of Goods. Easy rule of thumb — if it gets a SKU, it’s an inventory asset. If it doesn’t, like “findings” or “jeweler’s wages”, it’s a Cost of Goods.) That’s exactly what you did … and it took less than eight minutes!

There’s two things left to do:

- You still have the journal entry up. On the last of the memo columns on the right-hand side, it reads “Down arrow-Customer Deposits”. That reminder is there to get you to do the following: Push the down arrow key on your keyboard until a number magically appears. On that line, click in the account field in the first column and then enter your Customer Deposits. This will balance the entry and tell QuickBooks how much money we “think” we’ll collect. It will equal the sales (plus sales tax) for the period you’re covering — whether it’s daily, weekly, or monthly. Click “Save and Close.”

- Now you need to calculate the money you’ve collected. Only enter money or checks you have collected as a single entry after they are deposited in the bank. Credit cards sales are usually entered as daily totals as the credit card machine does this for you each night. Open the check register; use the date the money was sent to the bank. Tab over to the “deposit” column. Enter the total of checks and cash. Tab into the account field and type Customer Deposits. Tab into the memo field and type Checks/Cash.

This will help you during reconciliation. Then record. For Visa and MasterCard; use the date the credit card machine printed the day’s receipts. Tab over to the “deposit” column. Type the total of Visa & MasterCard deposits. Tab into the account field and type Customer Deposits. Tab into the memo field and type Visa/MasterCard. This will help you during reconciliation. Then record. Do the same for American Express (AMX) and another for Discover (Disc).

This is what you’ve done:

You made a journal entry telling QuickBooks what the total sales were in three key areas, moved the cost of the items sold out of Inventory and into Cost of Goods. Then you told QuickBooks the total sales are ready to be balanced against any money received.

Then, in step two, you’ve entered the money and “charged it” against the Customer Deposit account. This account will never be zero as you’ll always have people paying deposits on custom and special orders and picking these up. Take a look at it in Chart of Accounts.

Now you will really see how your company is doing.

Next month will be the last installment of this series and will give you some insights into how to read your new, more accurate reports.

This story is from the April 2005 edition of INSTORE.