(Press Release) NEW YORK — Diamond market sentiment was positive in June after the Las Vegas shows demonstrated robust U.S. jewelry demand. Suppliers held polished prices firm amid shortages in some categories and as high rough prices squeezed manufacturing profit margins.

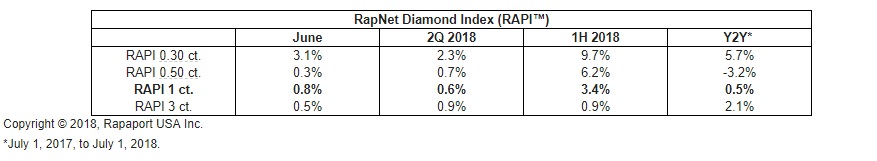

The RapNet Diamond Index (RAPI) for 1-carat diamonds increased 0.8 percent in June. Prices strengthened in the second quarter, continuing the positive momentum seen since January. RAPI for 1-carat rose 3.4 percent in the first half of 2018 and was up 0.5 percent from a year ago on July 1.

Stable US and Chinese demand is supporting the market. Larger brands and innovative independents working to improve the buying experience in-store and online are gaining market share. Jewelers that are unable to change the way they engage with customers are losing out.

Retailers require less inventory from polished suppliers due to increased efficiency and are relying more on memo. There is a shift to using technology in-store, giving jewelers access to a larger virtual inventory that lets them provide customized service to millennial consumers. Savvy diamantaires are allowing jewelers to tap into their stock online, providing high-resolution images and detailed provenance of their supply from mine to market.Manufacturers and dealers are aligning their inventory with retailers’ needs, resulting in slightly lower stock levels than this time last year. The number of diamonds listed on RapNet fell 4 percent year-on-year to 1.34 million stones as of July 1.

Mining companies are also supplying less rough, selling lower volumes at higher average prices. De Beers’ rough sales fell 1.5 percent to $2.89 billion in the first half, according to Rapaport calculations, with prices up an estimated 3 percent to 4 percent.

Trading is expected to slow in July and August as dealers in New York, Belgium and Israel take their annual vacations. There is optimism for the second half as jewelers and diamantaires adjust to a changing marketplace.

Advertisement