How much is too much?

April saw a small 0.54 percent decline in the rolling 12-month sales data of our same-store comparatives.

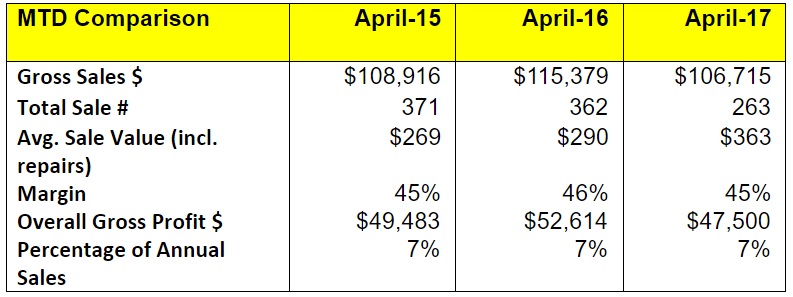

Monthly sales dropped from $115,379 in April 2016 to $106,715 for the equivalent month this year, a month-on-month drop of 7.5 percent. Sales quantity dropped almost 100 units from 362 to 263 with average sale continuing to make up the difference with an increase from $290 to $363, an improvement of 25 percent. Gross profit showed a decline from $52,614 to $47,500, which at 9.7 percent represents a greater fall than the drop in sales and this shows up in the contraction in markup from 46 to 45 percent.

The results for 2017, while down, are close to 2015’s figures although the trend of lower sales units and higher average retail is the biggest difference across the three-year period. 2017 sales represent a decline of just 2 percent with gross profit down by 4 percent on the 2015 results.

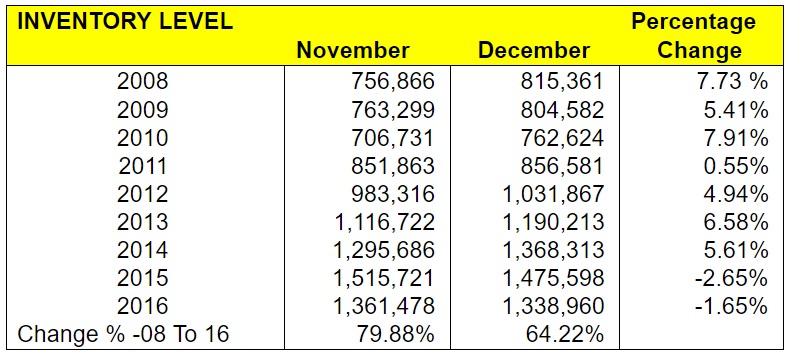

The rebound in sales since the bottom of the Great Recession has been matched by a corresponding increase in inventory levels held by the average store. From December 2008 to December 2016 same-store sales increased 63 percent, matching the corresponding increase in inventory over this time. It’s interesting when comparing the trend for inventory held in November and December over this period that the last two years have shown the first two examples of more inventory being on hand at the end of November than there was at the end of December. This may be a reflection of the increased confidence that retailers have had in building up their product selection ahead of the holiday sales season.

Advertisement

So how much inventory should a store owner carry? Often there is a focus around gaining the optimum return on investment. The ROI on money invested in inventory can be affected by both the markup achieved and the stock turn that results. Store A may have a markup of 100 percent and two stock turns per annum giving an ROI of 200 percent. Store B may achieve a markup of 100 percent and a stock turn of 1.5 times a year giving an ROI of 150 percent on funds invested in inventory. On the face of it, Store A appears to be doing better but the ROI shows only part of the story.

Let’s assume Store B has a higher level of inventory and is facing a declining ROI on every $10,000 extra they invest in product. If the next $10,000 invested in inventory achieves an ROI of just 130 percent on funds invested, does this mean it’s a bad investment?

At first, it may seem so and there could be an argument for Store B being overstocked, but the real question is what alternative return can Store B get by investing those funds elsewhere? If the alternative is a paltry 2.0 percent at the bank then investing in more inventory may be a smart move.

The ideal situation is to get a positive return on every dollar invested in inventory that is greater than the alternative returns available elsewhere. If you can achieve the same profitability with less inventory then you need to reduce your stockholding. If each additional dollar invested yields a positive return on investment that is greater than the alternatives then you should consider investing in more inventory.

Your ROI and stock turn are valuable numbers to know but should not be viewed in isolation.

DAVID BROWN is president of the Edge Retail Academy, an organization devoted to the ongoing measurement and growth of jewelry store performance and profitability. For further information about the Academy’s management mentoring and industry benchmarking reports contact inquiries@edgeretailacademy.com or phone toll free (877) 569-8657.

Advertisement

This article is an online extra for INSTORE Online.