THE PANDEMIC HAD a definite effect on consumer buying habits and the way they shop. Consumer attitudes and habits have shifted, and retailers who recognize and adapt to these changes will benefit from the opportunities that have arisen.

The Plumb Club, a coalition of over 50 best-in-class suppliers to the jewelry and watch industry, is celebrating its 40th anniversary this year and continuing its mission to educate the industry. To help retailers navigate and take advantage of these market changes, they once again initiated a research document and conducted a consumer study of over 2,000 consumers that identifies the most current insights and trends in jewelry purchases and motivations.

Advertisement

THE IMPACT OF INFLATION

Current consumers are more sensitive to the impact of rising costs, as well as ethical and sustainable practices. They want brands to be authentic and inclusive in their practices and messaging, and they are demanding flexibility in how and where they purchase.

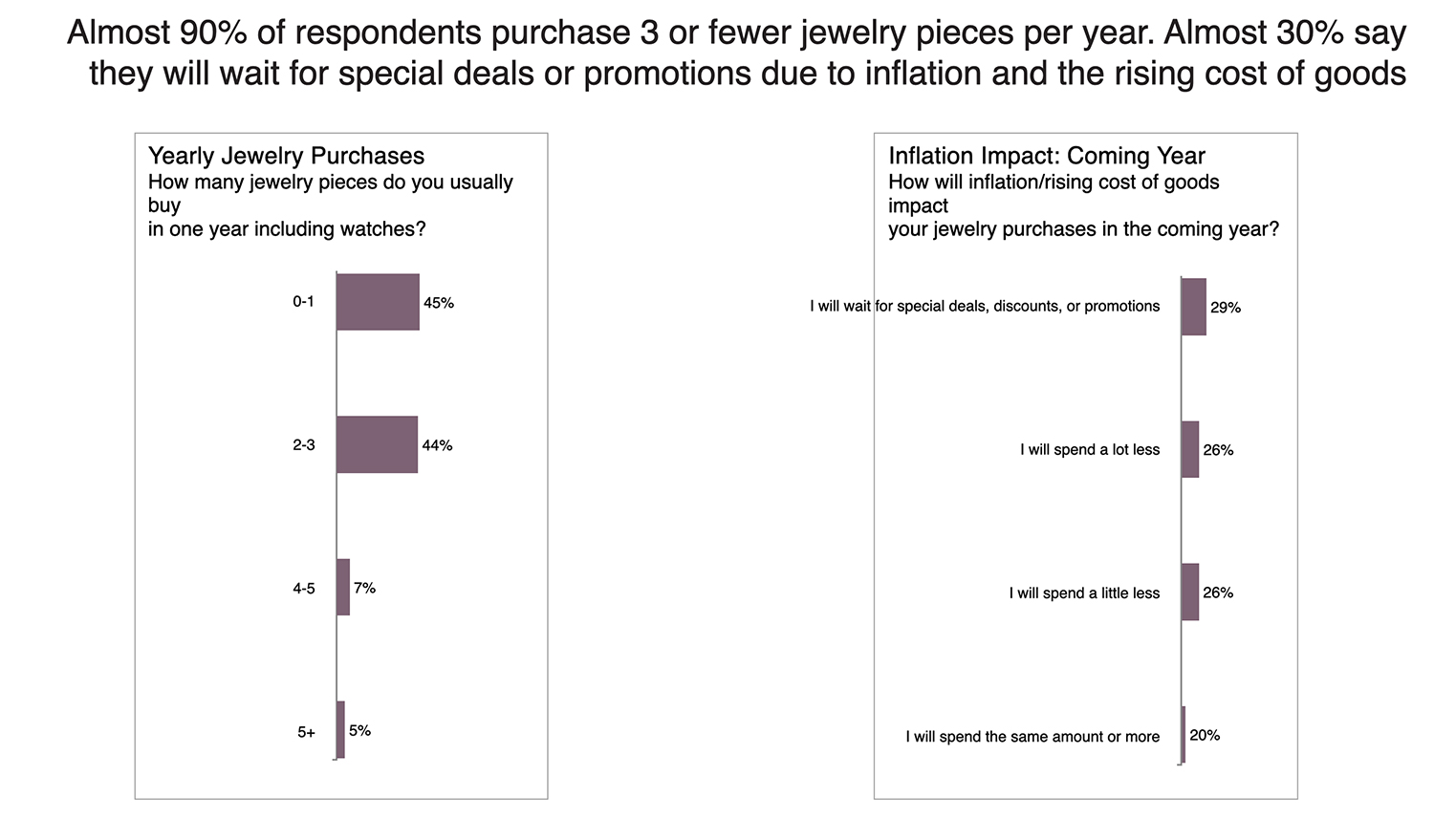

According to The Plumb Club Industry and Market Insights 2023, almost 90% of consumers surveyed purchase up to 3 pieces of jewelry and/or watches per year. For the majority, relaxation of COVID restrictions will not change their jewelry purchasing decisions. However, inflation and the rising cost of goods will cause almost 30% to wait for special deals or promotions to purchase.

FINANCING AND ONLINE BUYING

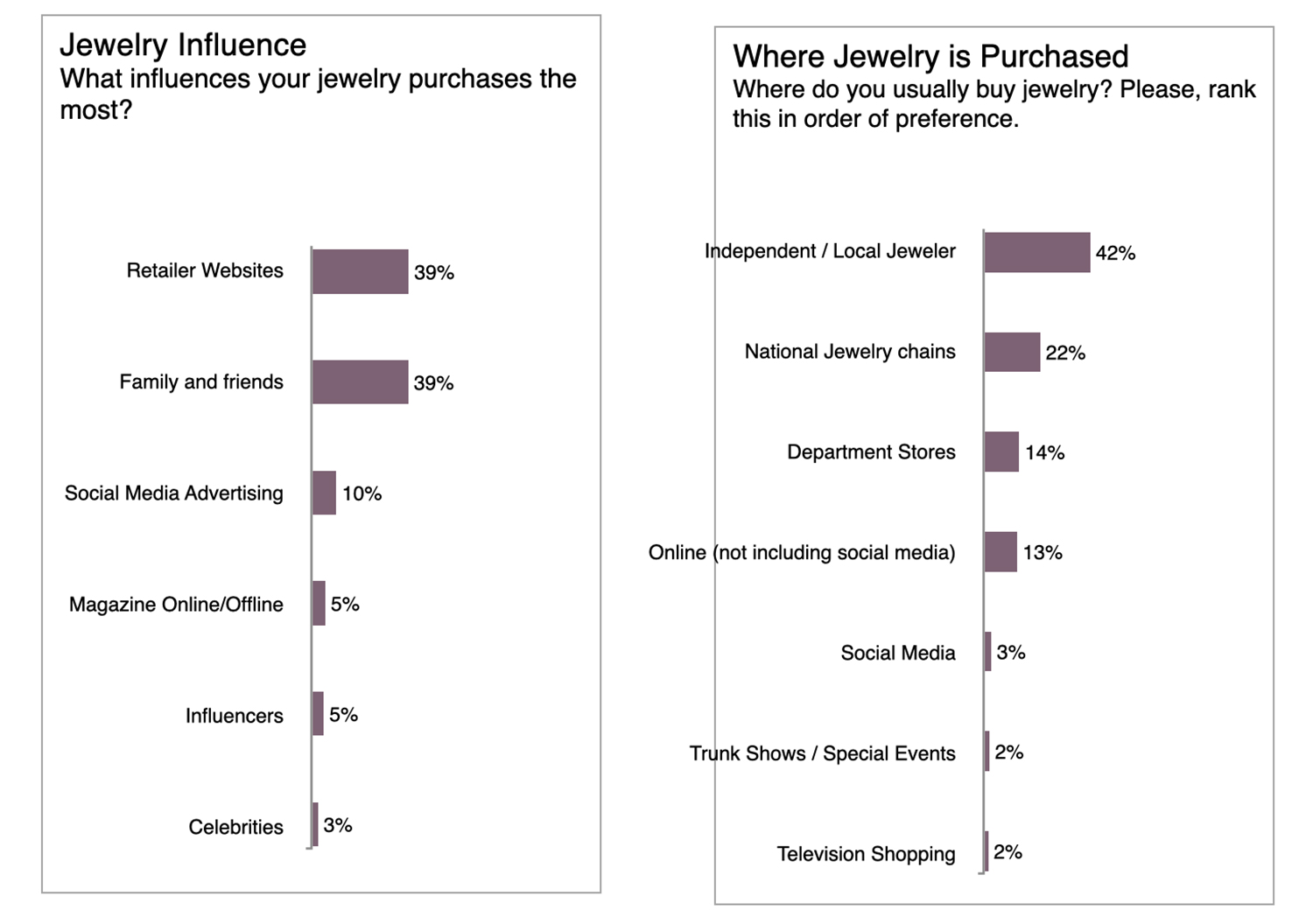

A finding that should please most retailers is the fact that a jeweler’s website is one of the most important influences of the purchase, ranking on par with the influence of family and friends. Independents and local jewelers are the primary choice for buying jewelry with 42% of respondents saying they usually buy jewelry through this channel. Further, for retailers who offer financing, 57% of consumer respondents said the availability of financing is a purchase motivator or decision influencer.

QUALITY MATTERS MOST

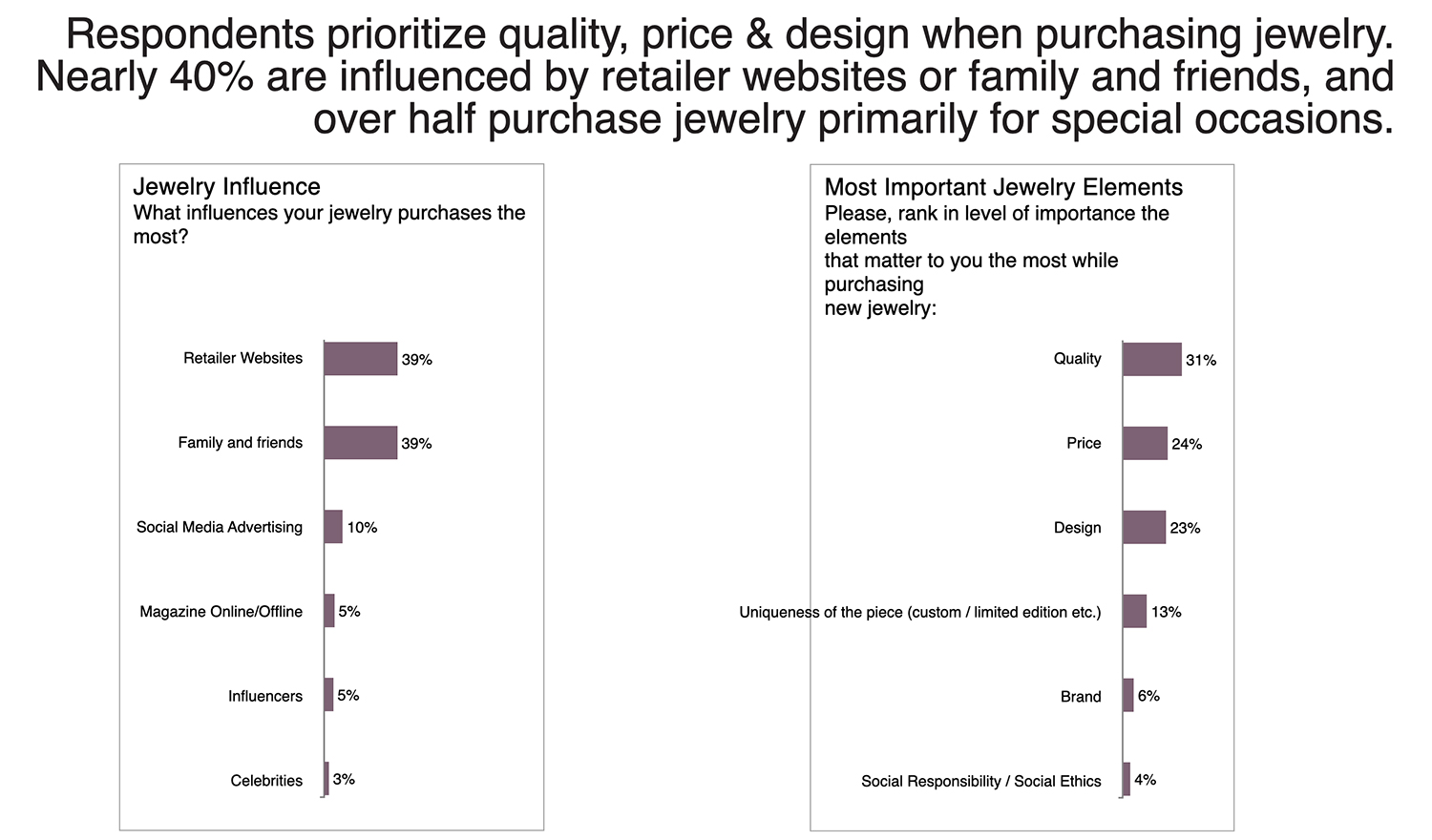

When it comes to the timing of when consumers are most interested in wanting to purchase a new piece of jewelry, special occasions are an important trigger. 54% of respondents say celebrations, such as birthdays, anniversaries or holidays, are key dates. A primary driver of the sale, however, is not necessarily the price. When asked to rank the level of importance of elements when making a purchase, quality was ranked the highest at 31% and price ranking at 24%. Design, uniqueness of piece, brand and social responsibility, were other areas of ranking.

POPULAR DIAMOND SHAPES

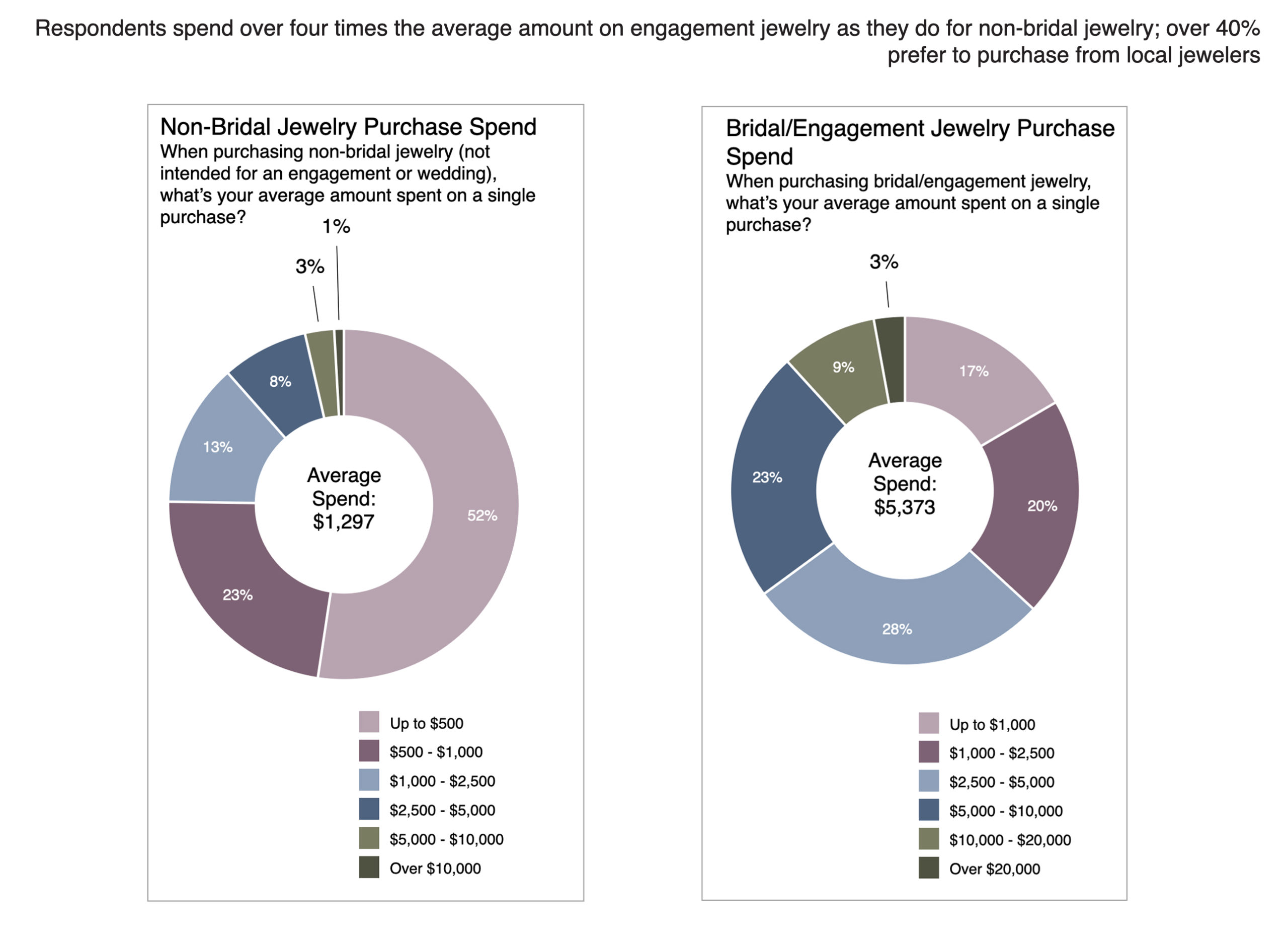

As for purchase dollars, the average consumer spend on a piece of jewelry not intended for an engagement or wedding is $1,297. Illustrating the importance of love and commitment, the average spend for an engagement ring jumps to over 4 times this amount to well over $5,000. The study also reveals that, although 10% of brides are choosing a “non-diamond” engagement ring, the most popular engagement center continues to be a diamond with 41% still choosing a classic round. Oval shapes have seen a steady increase in popularity from 2% in 2015 to 19% in 2021. Shape and setting continue to be the most important ring features.

Advertisement

Staying in tune with consumer insights is a key building block for the success of every retail business. Responding to those shifts with products and services that meet the evolving desires is the foundation on which to build a solid reputation of customer satisfaction and loyalty. The Plumb Club is pleased to provide these insights to help retailers do just that!

The insights shared here are part of a multi-faceted research study initiated by The Plumb Club with the assistance of Paola Deluca, The Futurist, and Qualtrics, a world-renowned survey and analytics firm. The study was conducted with a sampling of over 2,000 men and women from the ages of 25 – 60 with a balanced demographic and psychographic mix across the US with the goal of understanding how individuals engage with jewelry. Respondents had all attended some college or higher and had a combined household income of at least $75K/year. Additional information from this expansive research will be shared over the next several weeks. Any retailer wishing for more information on The Plumb Club Industry and Market Insights 2023 should contact their Plumb Club Member vendors. A full listing of Members can be found here.