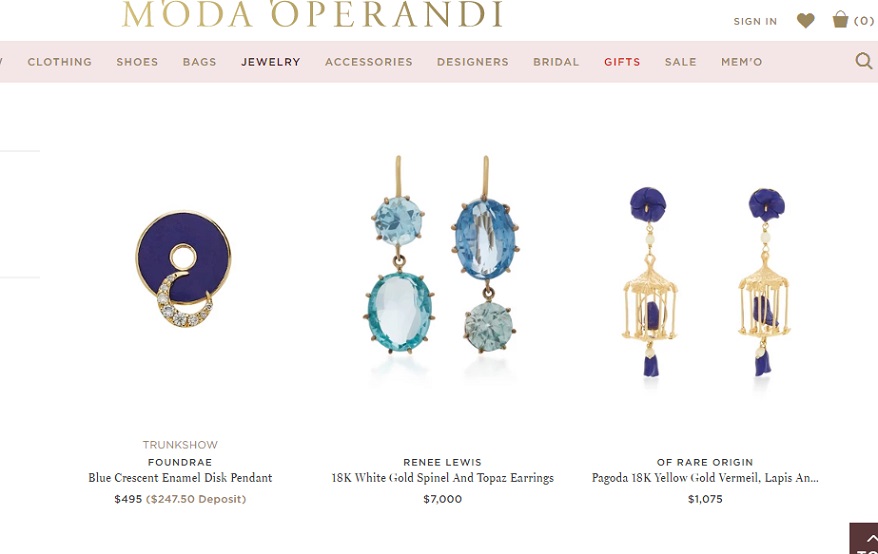

The company sells jewelry, clothing and other products.

NEW YORK — Online retailer Moda Operandi has completed a $165 million funding round.

The round was co-led by Adrian Cheng, whose family businesses include Chow Tai Fook Jewellery, New World Development, Rosewood Hotel & Resorts and K11; and Apax Digital, a new growth capital fund advised by the global private equity firm Apax Partners. Existing investors include New Enterprise Associates, LVMH and Fidelity, among others.

The company plans to use the money “to fuel continued international growth and increased development across several key business verticals,” according to a press release.

Moda Operandi, whose offerings include jewelry, describes itself as “the only place to preorder looks straight from the unedited runway collections of the world’s top designers months before they are available anywhere else.”

Launched in February 2011, the company had raised over $132 million prior to this round.

The new funding “will support the acceleration of its international business with particular focus in key markets including Asia and the Middle East,” according to the release.

Advertisement

“Expansion of Moda Operandi’s showroom concept and stylist program will aid in continued international growth as the high-touch client services complement the high-tech business approach,” the release stated.

A screenshot showing jewelry for sale at Moda Operandi.