Jewelers entered the holiday season on the back of another positive month in trading results. November sales rose to $127,255, up 9 percent over the same month in 2013. The main driver of the improvement was an increase in items sold, with the figure rising to 428, up 10 percent from 390 units sold in November 2013 at the typical independent jeweler.

Year to date, the average store’s rolling 12-month gross profit at the end of November was $692,525 compared to $666,626 one year ago, reflecting a 4 percent rise in gross profit. Whether the average store will be able to keep costs, principally rent and wages, under control to see this translate into a higher net profit remains to be seen.

So what are jewelers expecting for the holiday season? How do they feel about the marketplace in December and beyond? Surveys are often the best way to gain answers to such questions, but surveys tend to be a little subjective: the answer can depend on what the responder thinks you want to hear.

As the saying goes, actions speak louder than words, and as we advance through the busy December period it’s interesting to view the actions of jewelers during the busiest time of year.

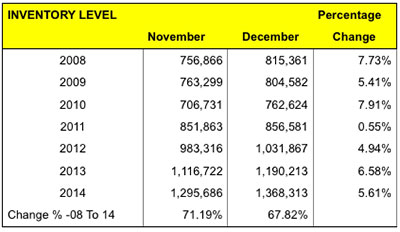

The level of inventory being carried is arguably the strongest litmus test of jewelers’ expectations. We’ve done an analysis of inventory levels over the last seven years to compare what jewelers are carrying into the holiday season, and how confident they feel about the sales coming their way.

Advertisement

As the chart shows, the average jeweler typically increases his inventory holding by around 5-7% between November and December to help cover for the busy holiday period (the exception being 2011) and this trend appears to have continued in 2014.

Of particular note, however, is the amount of inventory being held by jewelers generally. Although the increase for 2014 is no more than usual, it is coming off the back of very strong inventory levels that have been steadily growing over the last few years. As the data shows, the average inventory level being held at the end of 2014 will be approximately 70 percent higher than the equivalent period in 2008, yet sales over the equivalent period have grown by only 43 percent (the average store was achieving rolling 12-month sales in November 2008 of $1,036,893 compared to this year’s monthly total of $1,476,893).

Clearly confidence is ahead of sales and this is reflected in a faster growth rate of inventory compared to revenue, but is it overconfidence? Inventory levels tend to be directly related to cash-flow; rather than making a conscious decision to buy based on what they need, many store-owners are choosing to buy based on what they can afford.

Certainly the coming couple of months are the best time to be overstocked but the test will be how jewelers handle the leftover product once the New Year rolls in. Managing cash-flow is a crucial part of any retail business and never more so than when the cash is flowing at its strongest. The decisions made now — both in terms of purchasing product and replenishing it after the New Year will affect at least the next six months if not most of the coming year. The growth rate in inventory we have seen of around 16 percent each year for the last 3-4 years can’t continue without a corresponding increase in sales and I don’t believe anyone would predict an increase of 16 percent across the industry in the coming 12 months.

Now is a good time to look at your stock-turn and see whether the numbers are getting out of sync with your sales. Get help in this area from a If you need assistance in this area one of our team will be more than happy to help.

Advertisement

For daily news, blogs and tips jewelers need, subscribe to our email bulletins here.

/* * * CONFIGURATION VARIABLES: EDIT BEFORE PASTING INTO YOUR WEBPAGE * * */

var disqus_shortname = ‘instoremag’; // required: replace example with your forum shortname

/* * * DON’T EDIT BELOW THIS LINE * * */

(function() {

var dsq = document.createElement(‘script’); dsq.type = ‘text/javascript’; dsq.async = true;

dsq.src = ‘http://’ + disqus_shortname + ‘.disqus.com/embed.js’;

(document.getElementsByTagName(‘head’)[0] || document.getElementsByTagName(‘body’)[0]).appendChild(dsq);

})();

Please enable JavaScript to view the comments powered by Disqus.

blog comments powered by