Our rolling 12-month figures took a slight dip during June, with average store sales for the year-to-date coming in at $1,597,325, down from $1,602,124 in May – a decline of $4,799 or 0.3 percent.

Total units sold for the year declined by 30 items to 4,019, with the average sale per unit holding its own at $397.

Comparing June with the same time last year, store sales for the month averaged $111,422, a drop of $4,789 from last June’s figure of $116,221.

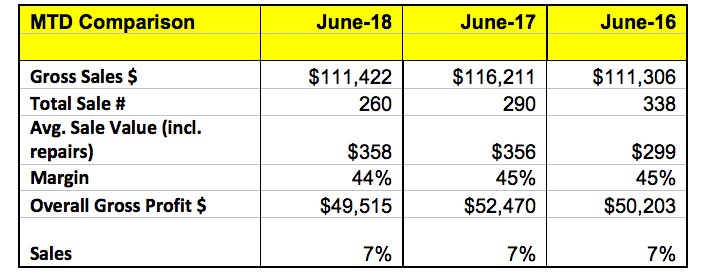

The table above shows June monthly data for the last three years. Sales figures for this June are in line with two years ago, but the trend in declining units sold is quite noticeable when viewing these monthly snapshots. Unit sales were 338 items sold in June 2016, dropping 14.2 percent to 290 in 2017. The further decline in units sold to 260 this year represents a drop of 10.3 percent on 2017. In total, unit sales have dropped just over 23 percent since 2016.

The average retail price per unit sold has increased 19.7 percent from $299 in 2016 to $358 in 2018. (Note that repair units sold are included in the average sale value but not included in the total sales numbers.)

Advertisement

Stores are continuing to battle a headwind when it comes to margin, with a drop from 45 percent for each of the last two years to 44 percent for this year. Based on sales achieved, this has stolen around $600 profit from the average bottom line of each store.

Knowing this, then, we can determine that the drop of profit from $52,470 to $49,515, a fall of $2,955 or 5.6 percent, consists of the following:

- A drop in margin: $624.

- A drop in units sold: $2,331.

Unit sales have therefore contributed 78 percent of the cause to the decline in profitability between June 2017 and June 2018 (2,331/2,955). The difference in average retail sale achieved of $2 is small enough to ignore.

So if your own store numbers look like this, what should you do? The numbers would suggest you concentrate 78 percent of your solution efforts on increasing the unit sales, and given the large impact, it seems unlikely you would bridge the gap without some sort of attempt to improve your unit sales.

However, when coming up with a solution to any business problem, there are two elements that need to be considered: the results that can be achieved and the time and effort required to get the results.

In simple terms, it’s the low-hanging-fruit theory. Do what can give you the most impact for the least amount of effort in the shortest amount of time. In this case I would recommend looking at your unit sales after you have explored your margins.

Advertisement

Let’s put it this way: Which would be easiest to do first, raise your prices or make extra sales? Before you answer this by saying you’re in a competitive market and you couldn’t possibly put your price up, let’s consider the effort required, not your customers’ (or more importantly your) perception of the impact.

You could, for example, re-price all your silver jewelry up by an average of 10 percent in the space of a few hours. Would it still sell? The truth is we won’t really know without testing it. Assuming it would, then sales would increase by 10 percent in a simplistic example, but profitability would increase even further as there are no other costs related to this price increase. In simple terms, it’s pure profit. You could afford to have some customers stop buying and still come out ahead. Is there any other activity you could undertake today that would give you a greater increase in profitability with a few hours of one-time effort?

Again, this is simplistic, and I’m not suggesting your rush out and increase the price on everything, but it is important to weigh up the return on effort as well as dollars when looking for ways to improve your business. Sometimes the best solution can be the simplest.