The year ended well for most jewelers, according to our industry KPI results. December’s average sales performance came in at $371,019, up from a December 2016 result of $359,919 – an increase of just over 3 percent. This lifted the rolling 12-month average from $1,614,820 in November to $1,625,921, a 0.69 percent increase for the month (or the equivalent of annualized growth of 8.28 percent). This represented the third straight month of monthly sales growth compared to the equivalent 2016 month.

Unit sales for the month showed a drop of around 10 percent coming in at an even 1,000 units per store, on average, with average sales continuing to grow — up 12.8 percent from $296 per customer to $334 per customer.

Margins held firm at 47 percent with an increase in gross profit of 3.5 percent from $169,685 to $175,665. Of particular significance is the impact the holiday season has on total yearly sales. December 2016 represented 22 percent of full-year sales for the average store, with 2017 increasing to 23 percent.

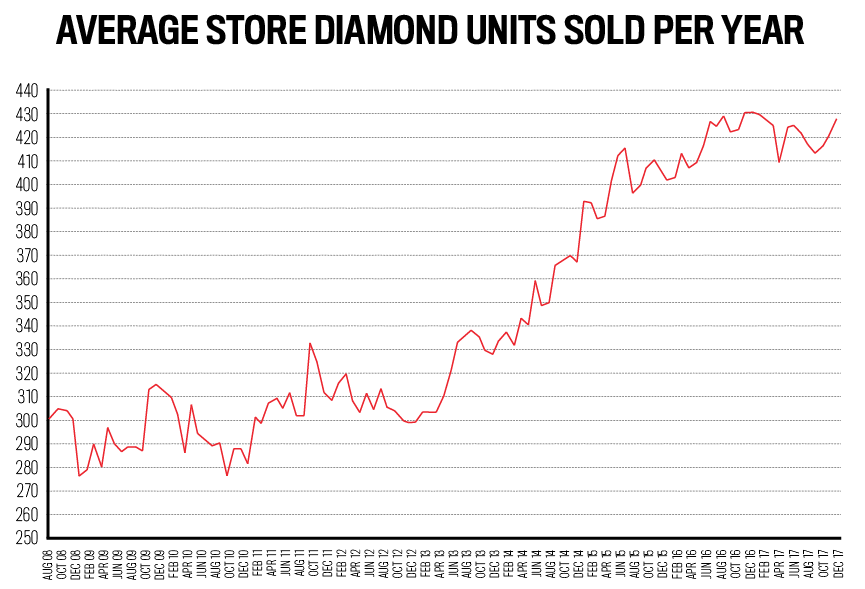

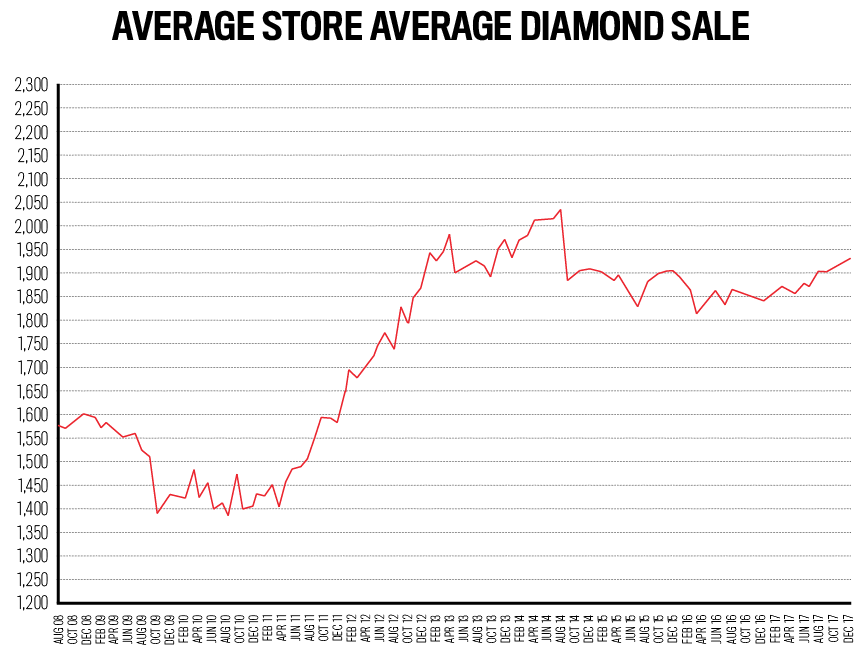

We’ve emphasized several times the recent trend in reduced sales unit volume but increased average sale being achieved. Nowhere has this been more apparent than in the growth in diamonds being sold.

This area has been a contributor of double growth in recent years – an increase both in the number of diamond units sold and also the average value of what has been sold.

Advertisement

Of particular note is the leveling off in results that is happening in this area. Average diamond sale values peaked in 2013 and 2014 with unit sales beginning to level off in 2017. It may be that stores who have depended on sales growth from diamonds could have to look for other means of continuing this level of growth during 2018.

Advertisement

So what are the options? Growth doesn’t have to be dependent on any particular product – it can be more about the opportunity that an existing customer can give you to leverage further sales. The easiest sale to make is to a customer standing in front of you who has just said “Yes.” One of the key measures we have emphasized to customers to measure as part of their KPIs is items per sale – how many pieces of jewelry are involved in each transaction.

Too often we congratulate ourselves on getting a customer across the line without viewing it as a step in the sales process. “Yes” can be seen as the end of the sale, but it can also be seen as the beginning. We frequently speak about buying signals that customers provide you such as “Do you take credit cards?” but “I’ll take that” is also a buying signal and there is no reason to assume that the customer won’t want to spend more.

It’s not just about the holiday season. December is a great time to get foot traffic through your door. But let’s not forget: By the law of averages, one in every six people will have a birthday in the first two months of the year. Why should your customer have to go to the trouble or shopping again in the next few weeks when they can solve the birthday dilemma now? Likewise the one in six who buy for a birthday in November or December can save themselves the hassle of returning for Christmas shopping when the crowds are everywhere by picking up their holiday gift at the same time. This effectively means that between November and the end of February, you have a four-month window where one-third of gift buyers will also need to find another gift very soon. Do you need a better opportunity than that to turn the first “Yes” into a second sale?

That’s just one approach to increasing your average units per transaction – simply asking for an extra sale from customers at any time of year, whether it’s a gift or for themselves, will achieve results, but this requires training with your staff and the building of a habit. We all know how effective McDonald’s “fries with that” approach is, but are you doing this in your own business?

If not, you could be leaving money on the table.