Heading out to Vegas for Jewelry Week? Here are some of the trends we are predicting you will see and that you might want to bring into your store. Some have been going strong for a few seasons, while others have been evolving for a couple of years. All are popular from the red carpet to the ready-to-wear runways to the jewelry design studios. So, why not try your luck with this trend or the others we will be showing?

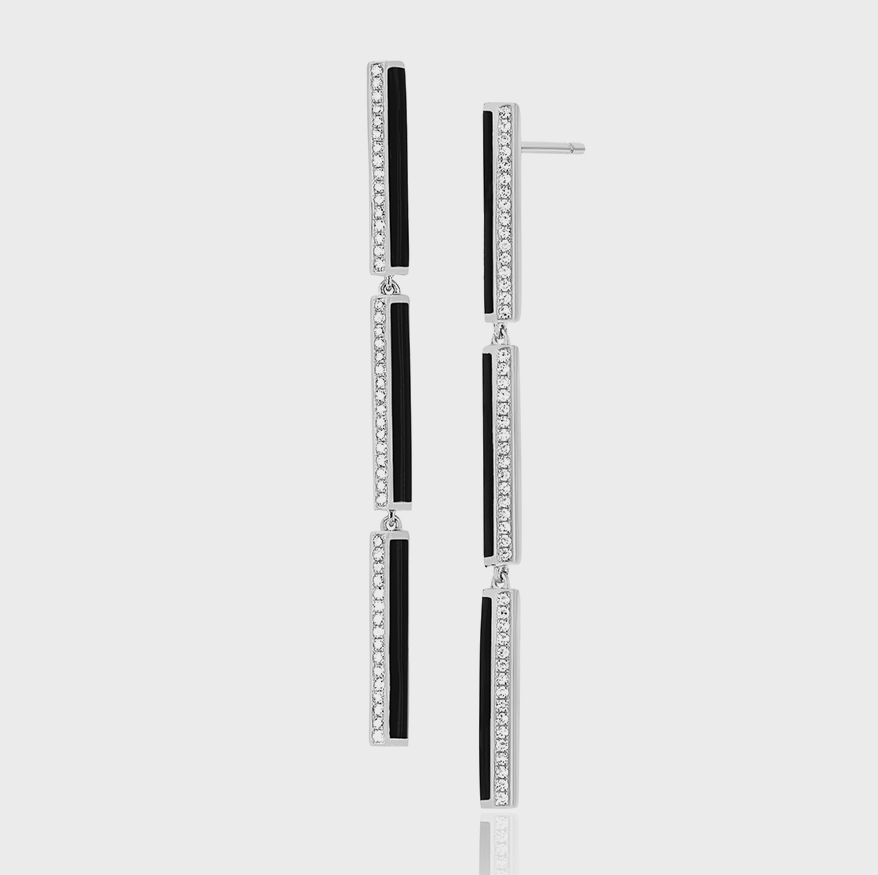

From the red carpet to the runways to the design studios, all styles of earrings continue to be strong. One style that we saw at all the big awards shows this past season as well as on the international catwalks was the long and lean look. The earrings can range from sticks of diamonds to streamlined and linear with more movement, traced with enamel and/or popped with colored stones, and can go from mid-length to shoulder-skimming.

Lili Reinhardt in Swarovski earrings at the 2019 Golden Globe Awards Photo: Shutterstock

GiGi Ferranti Gia Deco 14K stick earrings with Zambian emeralds and diamonds. gigiferranti.com. $5,200

EF Collection 14K gold diamond and enamel Stripe Bar Drop Earrings. efcollection.com. $650

Harwell Godfrey 18K gold articulated black and white diamond stick earrings in yellow gold, harwellgodfrey.com. $2,700.

Effy Pave Classica 14K White Gold Diamond Vertical Earrings, 0.35 TCW effyjewelry.com. $1,095.00