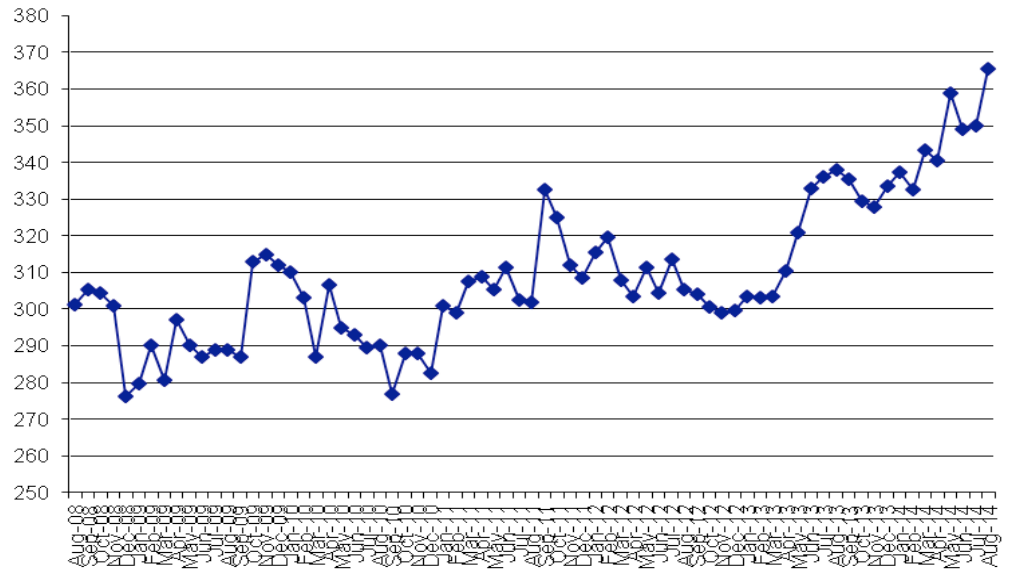

August results from across our data pool have shown the strong upward trend we have seen in the last few months continuing, with more growth in average rolling 12-month sales. As the sales data in our chart shows, the average increase in same-store sales across measured stores was 9 percent for August 2014 compared to the equivalent month last year.

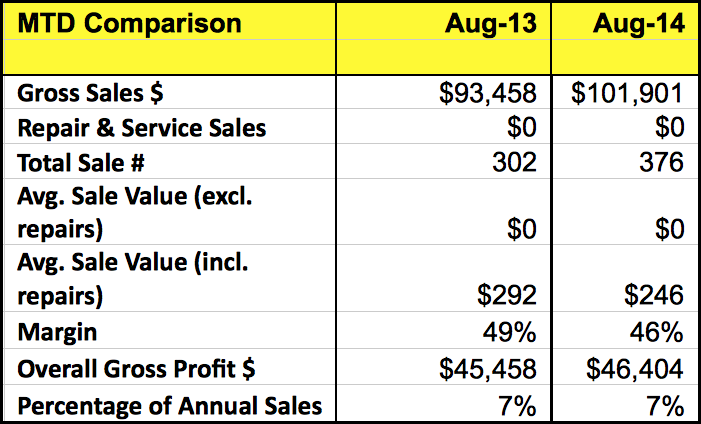

The month also saw a nice improvement in the number of items being sold, with an increase from 302 to 376, a rise of 24 percent. The average sale dropped from $292 to $246, a decrease in the average retail value of items sold of 18 percent. Unfortunately margin for this period was well down with a drop from 49 percent to 46 percent, which had a significant impact on profitability. The reasons for this are not obvious (pre-holiday season sales anyone?) but affected the bottom line with gross profit increasing by only 2 percent from $45,458 to $46,404. Given the extra staffing that may have been required to achieve these extra sales units, some stores may have effectively been down in overall profitability.

Although this month goes a little against the trend of increasing big ticket sales we are highlighting the sales of diamond rings again but this time focusing on number of units sold.

We now have some fairly good data collected over a period of time in this area and as the graph clearly shows, diamond units have been on the increase since the start of 2013 when sales were sitting around the 300 units per year level. Figures improved significantly during the first half of 2013 and have continued to grow at a fairly steady pace since with an occasional drop followed by an immediate increase.

Advertisement

The wonderful thing about diamonds is that the selling cost is often no more than for an item that’s priced at less than $100. In fact, many businesses with a high average retail sale are running with much lower staffing levels than businesses that rely on volume. For the typical jewelry store, diamonds can represent as little as 2 percent of the sales volume but contribute as much as 50 percent of total sales. A recipe like that deserves to be baked more often!

So how do your diamond sales compare? If you’re not achieving the sales level in diamonds you should be, then you need to look at why. The average U.S. store is achieving over 45 percent of its sales from diamonds. If you’re doing less than 40 percent, you need to look at how this opportunity can be improved.

Check out your competition — What are they doing right? What can you do better? It surprises me how many jewelry-store owners have never checked themselves against their competition. The only feedback they receive is from comments, good or bad, from their customers. That can be useful but it’s not an entirely reliable source of information, because customers aren’t looking at your competitors the way you should be.

Check out your inventory — Does your store say diamonds? Many jewelers are reluctant to commit fully to the diamond business. That doesn’t just mean your holding of inventory but the time and effort you put into managing that product. Do you review product regularly? Do you look to re-price items that are slow moving, or re-price up those that are fast? Do you move your displays regularly or have your diamonds always sitting in the same cabinet? Does the product look tired?

Check out your staff — When was the last time you had them mystery shopped? Do they know how to effectively close a diamond sale? They may be repeatedly making the same mistake that could be costing you sales and you may not even know about it. Do you meet with them regularly to discuss diamonds? Do you pull out diamond items to talk to about them at these meetings? This is the perfect opportunity to take action on old diamonds that haven’t moved or to show them proven sellers and new items they need to be aware of. The old management saying “you can only manage what you measure” is true. Your diamonds are looking for an excuse to hide away and slip under the radar (and are soon forgotten about by staff if they don’t sell). Pull these old pieces out, incentivize them and get them moving again.

Advertisement

For daily news, blogs and tips jewelers need, subscribe to our email bulletins here.

/* * * CONFIGURATION VARIABLES: EDIT BEFORE PASTING INTO YOUR WEBPAGE * * */

var disqus_shortname = ‘instoremag’; // required: replace example with your forum shortname

/* * * DON’T EDIT BELOW THIS LINE * * */

(function() {

var dsq = document.createElement(‘script’); dsq.type = ‘text/javascript’; dsq.async = true;

dsq.src = ‘http://’ + disqus_shortname + ‘.disqus.com/embed.js’;

(document.getElementsByTagName(‘head’)[0] || document.getElementsByTagName(‘body’)[0]).appendChild(dsq);

})();

Please enable JavaScript to view the comments powered by Disqus.

blog comments powered by