IN REFLECTION of the roller coaster ride much of the country has been lately, we adopted an amusement park theme for the 2025 Big Survey. More than 630 jewelers from 43 states and Canada seemed to enjoy the ride, sharing data, insights and terrific little anecdotes about the ups and downs of life as a jewelry-store owner or manager. Following are 10 of the top takeaways from the survey. (But don’t stop with this list. See the entire survey here – it is packed with findings that, as the man in the big hat would say, will astound and astonish you!)

1. 20% of jewelry store owners earn more than $250,000 a year

Reflecting wider economic trends, those at the top end — jewelers who reported earning more than $250,000 a year — continued to do well, with this group expanding to account for more than one in five of the survey respondents. Proportionally, these jewelers were most likely to be found running well-established stores (at least 40-years-old) from downtown addresses in small cities with a strong focus on bridal. They were also most likely to be men at 77% of that cohort, versus 61% for our overall pool. Note that 4% of our survey-takers reported earnings of $500,000-$1 million a year, while a little over one percent made more than $1 million.

2. Fewer customers are buying more

VIP customers have always been important to jewelers, and this trend is becoming more pronounced. A significant number of jewelers are witnessing increased wealth concentration among their clients, with almost half of our survey respondents reporting that their top 5% of customers account for between 20-30% of their sales. This situation reflects broader trends of economic disparity and wealth accumulation across the U.S. and is likely to continue. How to best respond if you’re seeing a similar situation in your market? Keep doing the things many of the best jewelers do: Invest in exceptional customer service and personalized experiences to build loyalty, build relationships and trust, use targeted marketing campaigns to reach different segments, and stock the high-end, customized, or exclusive pieces that appeal to affluent consumers.

3. Top competitive threat? It’s coming from online

Internet retailers just edged the “the independent jeweler around the corner” when we asked survey takers to rank their toughest competitors, followed by chain stores, big box retailers, and brands selling directly to retailers. Non-jewelry luxury retailers and TV shopping networks rounded out the list. We asked this question a little differently back in 2021, when the country was still in the depths of the pandemic, but it appears the competitive landscape has changed little. Chain stores had improved their competitive position in the last few years while the issue of brands selling directly to consumers appears to have eased.

4. The No. 1 brand among jewelers was …

Allison-Kaufman held onto the No. 1 position for a second year in a row, followed by Gabriel & Co and Stuller at No. 3, based on votes to our question: What are the three best-performing jewelry lines that you carry? As for watch brands, Citizen finished on top again, followed by Rolex and Seiko. As they do every year, watch makes dominated the list of the brands jewelers most wanted to add to their cases. And Rolex was, again, the most desired brand.

Advertisement

5. Finished goods are where jewelers are feeling the pain of tariffs.

The Trump administration’s imposition of steep tariffs on trading partners was always going to affect many jewelers given the international nature of the trade. Almost half (46%) the respondents identified finished goods as the area they were most feeling the impact, followed by diamonds (13%), non-jewelry supplies, packaging (10%), and color gemstones (3%). Just shy of one in five of the survey-takers said the tariffs had no impact.

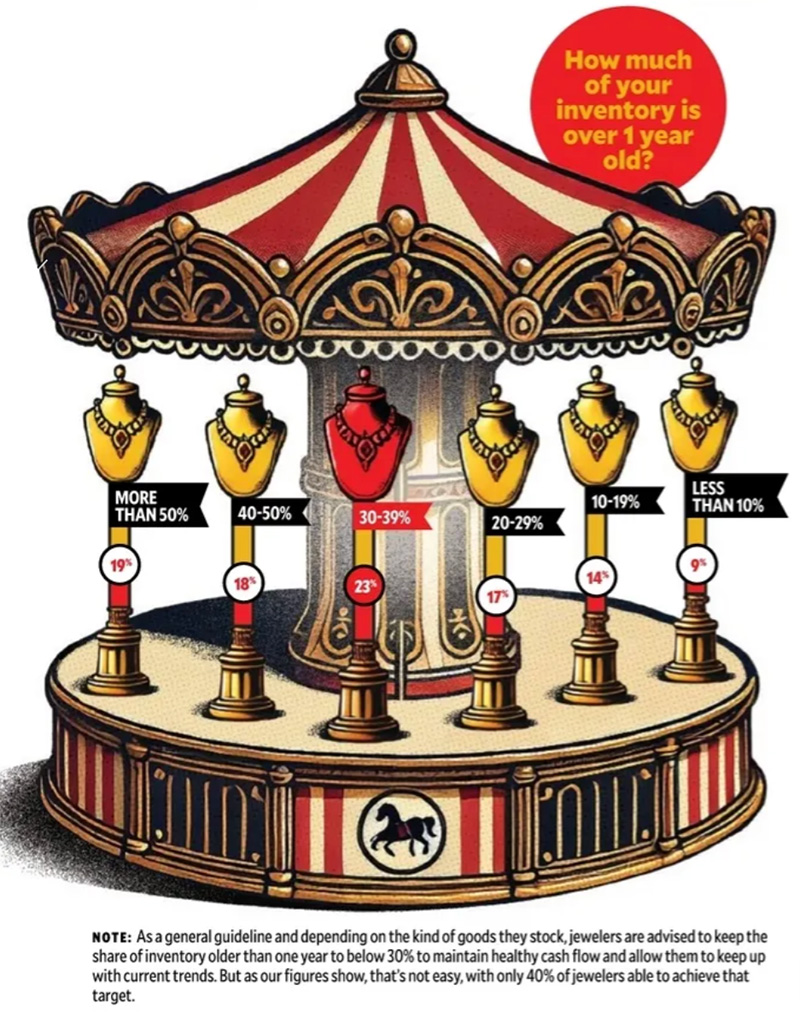

6**. Jewelers will mark down aggressively … except when they won’t**

Nearly half, or 47%, of jewelers in our survey said they mark down the price by a third or more when a piece of jewelry reaches “dog” status. However, it was clear many jewelers remain reluctant to admitting their stock had reached said “dog status”, with more than one-third (37%) disclosing 40% or more of their inventory was more than 1 year old.

7. LGD price blowback exists, but it’s actually quite rare

Only 6% of the survey-takers reported experiencing regular complaints about falling lab-grown diamond prices, a level that was unchanged from last year. Twenty percent said they receive occasional complaints (vs 13% last year), such as when clients discovered friends buying the same size stone for thousands less just a few years later. However, for the vast majority of jewelers selling LGDs, customers understood the nature of the product. Most respondents emphasized that they preempt such reactions with upfront education, explaining that lab-grown diamonds have no resale or trade-in value, prices will likely keep dropping, and they should be viewed like technology that quickly depreciates. Overall, jewelers stress that consistent disclosure, honest pricing, and managing expectations have prevented widespread backlash, though many anticipate more difficult conversations as time goes on.

8. It’s the economy… and hiring.

The No. 1 challenge facing jewelers? It was a tie: Hiring good workers and the current economic uncertainty, with those two answers accounting for 50% of the total. Staffing challenges also came out top when we asked, “What frustration most makes you want to get off the wild ride of owning a small business?”

9. Wise old heads prevail

Jewelry store ownership or management is not a young person’s game. More than half (54%) of our survey-takers were over 60. The average age was 62, while the mean – most common age – was 68.

Advertisement

10. Suspicious about AI

Tech companies are investing trillions of dollars, stock markets are on a run, futurists see a brave new world, but jewelers, they mostly remain skeptical — about AI that is. Only 22% are using one of the common large language models like ChatGPT or Gemini on a daily basis. Forty percent have yet to try them with the remaining 38% saying they use them infrequently or not for business.

What’s the Brain Squad?

If you’re the owner or top manager of a U.S. jewelry store, you’re invited to join the INSTORE Brain Squad. By taking one five-minute quiz a month, you can get a free t-shirt, be featured prominently in this magazine, and make your voice heard on key issues affecting the jewelry industry. Good deal, right? Sign up here.