David Brown

President of The Edge Retail Academy |

|

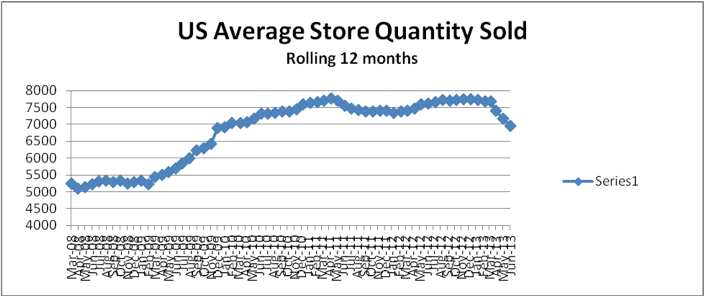

The Great Rebound Comes to an End

A period of positive growth seems to have come to an end for most jewelers based on the data from our sample groups.

After an almost continuous uninterrupted period of recovery, average store sales seem to have peaked in the last couple of months and begun to pull back from their high.

Average store rolling 12-month sales peaked at $1.384 million in March but dropped back to $1.365 at the end of July. This is a drop in sales revenue of just under $20,000 in three months, or an average monthly decline of approximately $6,600 per store.

Advertisement

This is the first time our data has shown three consecutive months of declining sales revenue since December 2008, when the economy was first caught in the grip of the financial crisis.

Percentage Change in Sales Revenue – Annual Rolling Average Per Store

So what does this mean? Are we in for another economic slowdown? Certainly economic cycles tend to indicate that the economy goes through a cycle of growth and decline every four years, and based on the timeframe it would seem the cycle would be due for this again. Given the impact of the financial crisis and the long period of time for many industries to recover, should we not, however, still be in a period of growth?

The problem with cycles is that they are never easy to predict. The only certainty in business is that we need to prepared for any eventuality that develops.

What’s been most noticeable when we dive into the figures has been the makeup of sales in recent months. There has clearly been a drop in unit sales, something that didnt happen during the Great Recession when the growth of the bead market created more unit sales but at a much lower average retail value. The years 2008-09 saw jewelers beginning to sell more smaller units as the diamond market fell away as a percentage contributor to overall sales. Most stores were getting busier but for less sales revenue (with a resulting inability to reduce much of their overheads, expecially wages since sales units were actually increasing).

This time, however, things are a little different. The number of units has dropped, indicating a fall in overall demand.

Advertisement

The percentage contribution from diamonds has been maintained, indicating that the fall has been across all departments this time, not just a drop off in top-end product. That said, the average retail sale for diamonds has come back in the last three months also.

If there is a fall in average sale to go with the drop in unit sales this will be a double hit for most jewelers. A 5 percent drop in unit sales combined with a 5 percent drop in average retail value achieved would have a compounding effect close to 10 percent.

This could be a more painful situation for jewelers to handle as it becomes difficult to concentrate efforts on two fronts, building average retail sale and quantity of units sold.

So where should you concentrate your efforts?

If the economy does slow down (and it’s early days yet) then it can be difficult to build increased customers in the short term (although you can still work on unit sales via more add-ons). The easier solution is to look to increase both at the front counter – increased average sales through selling up, and increased unit sales through add-on sales. That way if you see a reduction in foot traffic you can still be building sales through better conversion, better add-on sales, and better selling up. All three require a focus on staff and their training.

So what training are you currently doing? If the answer is none then you need to make this a priority. Sales are slipping through your fingers right now if you aren’t working on improving your staff performance — and things may get worse if sales begin to slow.

Advertisement

|