David Brown

President of The Edge Retail Academy |

|

Numbers Continue to Rise in February

Our sample data of more than 300 stores across the U.S. again shows that all looks rosy for growth for the average jeweler across the country based on February’s results.

The average store achieved sales of $116,505 for the month of February, up from $103,425 for February 2012, an increase of just over 12 percent annually. As the graph below shows, this extends the strong growth achieved between February 2011 and February 2012 when average store sales increased from $90,070. This means an overall increase in the last two years of $26,435 or just under 29 percent, a great result by anyone’s standards.

Gross profit has also trended up by 26 percent over the same period, indicating that the sales growth has not come at the expense of margin during this time. The only area showing a drop is quantity of items sold. From a figure of 615 items in 2011, sales units increased by 5 percent in February 2012 but have since dropped to only 600 units in the same month in 2013. Average sale value has jumped significantly, however, more than compensating for the loss of units. The average retail sale excluding repairs has risen from $183 in February 2011 to $202 in February 2012 and now to $281 in 2013.

Advertisement

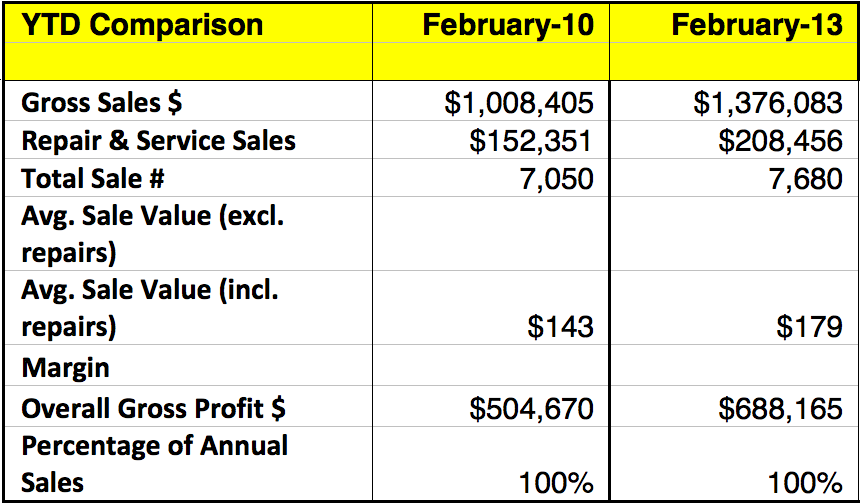

Year-to-date numbers are trending well when we look back over a three-year period to the depths of the global financial crisis.

Annualized sales in February 2010 for our sample stores sat at just over $1 million with sales of $1,008,405. Skip forward three years and the picture is much more impressive. Annual sales have reached $1,376,083 – an overall rise of 36 percent. Repairs and services have contributed their share as well, with growth just on 37 percent. This raises an interesting fact as it is often assumed that repairs can be counter-cyclical: when business is quiet, repairs pick up and slow back down when consumers return to a buying frame of mind. This data clearly suggest that repairs can be price sensitive too.

Although the figures above indicate that the number of units sold slowed down a little in February, the longer-term trend still appears solid. Units sold have increased annually from 7,050 per annum in 2010 to 7,680 per annum for 2013 February YTD. This represents an increase of just under 9 percent for the period. It will be interesting to see where this trend takes us in the future. Are we seeing a reduction in cheaper items bought and a return to fewer sales but more big tickets as we had before the great recession? We will be keeping an eye on this data over the next few months to see if it is the case. Silver appears to be maintaining its sales volume at present but will this continue?

It’s important you’re prepared for the opportunity to sell bigger ticket items. So what can you do to help with this?

- Look at the average retail value of your inventory. As a rule of thumb, if you’re looking to achieve an average retail sale of $200 you would need to carry product that is, on average, around 20-30 percent higher in price, or $240 to $260. That’s because you will always achieve a higher volume of sales in the cheaper product lines, so you’re average “offering” will need to be higher to balance this out. It’s hard to make a $1,000 sale if there is nothing in the store, but it’s also hard to average $1,000 every sale if the dearest item you have is $1,000.

- Role play with your staff. After a couple of years of cheaper-priced sales, your staff may need a re-education on how to promote bigger ticket items. Make sure they haven’t forgotten how it’s done, or become lazy and are just presenting beads to each customer.

- Put your best staff in the best positions. There’s nothing wrong with showing a preference for which staff serve in which areas. Diamond sales are not for the faint of heart and it’s not the environment for new or below-average sales people to be found. You can’t let those big-ticket items walk because the wrong person is doing the job.

David Brown is president of the Edge Retail Academy, an organization devoted to the ongoing measurement and growth of jewelry store performance and profitability. For further information about the Academy’s management mentoring and industry benchmarking reports contact inquiries@edgeretailacademy.com or Phone toll free (877) 5698657

Advertisement

|