Diamond market sentiment was positive in May, with the U.S. and China posting upbeat jewelry sales, Rapaport reports.

Polished diamond prices found support from a combination of supply shortages and recovering demand.

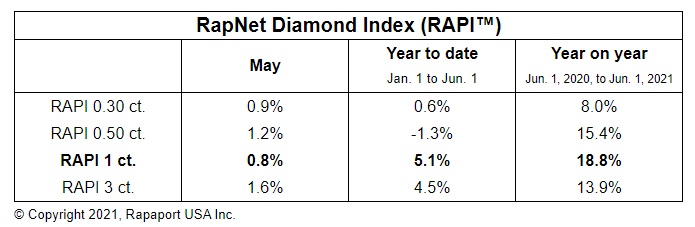

The RapNet Diamond Index for 1-carat diamonds climbed 0.8 percent last month, according to a press release. Rapaport explains that the RAPI is “the average asking price in hundred $/ct. of the 10% best-priced diamonds, for each of the top 25 quality round diamonds (D-H, IF-VS2, GIA-graded, RapSpec-A3 and better) offered for sale on RapNet.”

Advertisement

More from the release:

Rough-diamond buying proceeded at firm prices during the month. India continues to bring in large volumes of rough despite factories operating at lower capacity due to the surge in Covid-19 infections. India’s rough imports came to $1.7 billion in April, according to the latest data from the Gem & Jewellery Export Promotion Council (GJEPC). This was significantly higher than pre-pandemic levels.

Demand for 0.30- to 0.50-carat, D to H, IF to VS2 diamonds improved in May after a period of declining interest. Inventory levels in this range have fallen. The number of such stones on RapNet as of June 1 was about 23% lower than in the beginning of April. Manufacturers in India have shifted to larger sizes to maximize value while operations are limited.

Polished suppliers are filling orders. India’s polished exports grew in April even as the Gemological Institute of America (GIA) reported a one-month backlog at its labs in Mumbai and Surat. US and Chinese jewelers continue to replenish inventory. There are strong cash buyers boosting liquidity, although India is experiencing some pandemic-related payment concerns.

The trade emerged from the 2020 crisis with stronger liquidity and less reliance on banks for financing. Rapaport will explore that dynamic in the June issue of Rapaport Magazine, as well as on the Diamonds.net portal and in a series of podcasts during the month. Diamantaires are gaining confidence and keeping prices firm as orders flow in from the two largest diamond jewelry markets.

Advertisement