(PRESS RELEASE) LAS VEGAS, NV — Diamond market sentiment weakened in March as concerns rose about the impact of Russian sanctions, US inflation and China’s Covid-19 restrictions. Prices softened, particularly for goods below 0.30 carats.

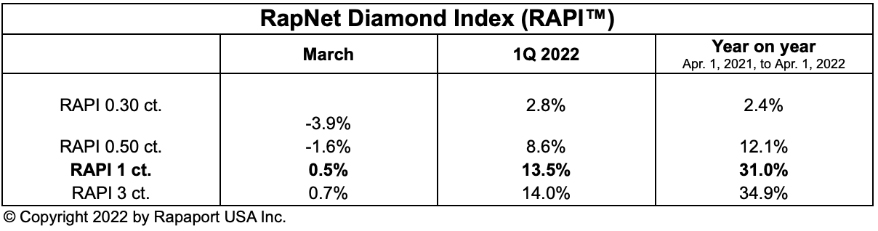

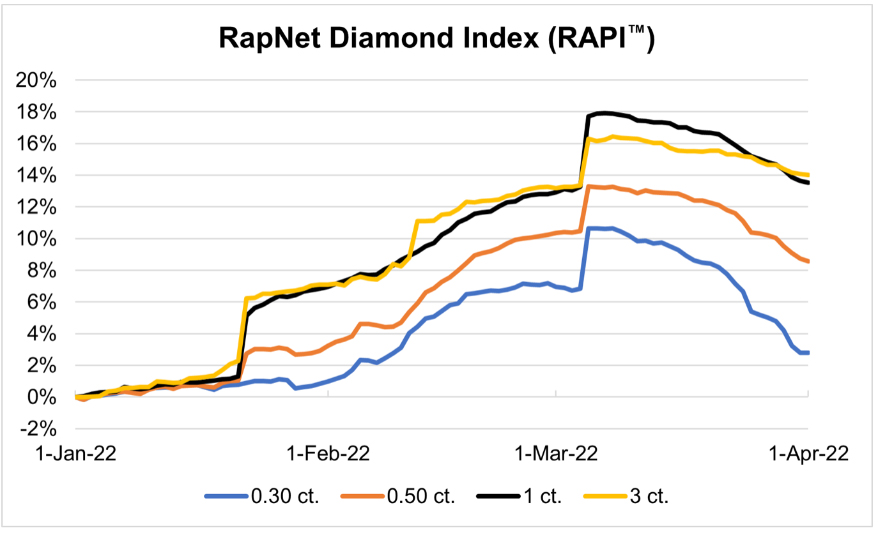

The RapNet Diamond Index (RAPI) for 1-carat diamonds rose 0.5% in March and 13.5% through the first quarter. The index for 0.30-carat goods fell 3.9% during the month.

All RAPI size categories declined from the second week of March onward. This ended a three-month period of consistent, sharp increases that ultimately proved unsustainable in the volatile geopolitical and economic environment.

The March decreases fueled uncertainty. Buyers were waiting for further price drops; suppliers were willing to negotiate in order to raise liquidity and offload less-desirable goods.

Polished inventory levels held steady overall but rose in weaker categories as sales of those items slackened. The decline in polished demand left rough dealers and manufacturers cautious. Factories continued producing polished from the large volume of rough they’d bought in January and February.

Advertisement

The US government has enacted sanctions on Russian diamonds and payment systems, affecting trade with Alrosa — the largest rough producer by volume. However, it remains legal to manufacture Russian rough in other centers and import the polished to the US. Major US retailers and European high-end jewelry brands have enforced their own ethical bans and told suppliers to avoid Russian goods altogether.

Demand for primary rough supply from Alrosa and De Beers was stable during March despite the sanctions on the former. The miners’ sales offered better value than auctions. Rough traders exercised restraint as prices fell on the secondary market.

High inflation led the US Federal Reserve to raise interest rates for the first time in over three years. Both measures typically reduce consumer demand because of their dampening effect on disposable income. Retail jewelers are therefore buying less amid the renewed uncertainty. They’re carefully managing inventory as the outlook dims for the second half of 2022.