Sales at the average U.S. jeweler continued on their merry way in April with an increase of 0.36 percent on a rolling 12-month basis. April 2014 sales of $103,418 were up by $5,498 to $108,916, an increase of 5.31 percent on the equivalent month from the year before.

As the graph below shows, the continued rise in average U.S. store sales figures has been unabated for the last 12 months; if this were a hill, most of us would have had to sit down for a rest by now!

The shape of the sales graph very closely mirrors the increase in the Dow Jones average over the same period, not all together surprising given both sets of data could be seen to represent the performance of the economy as a whole.

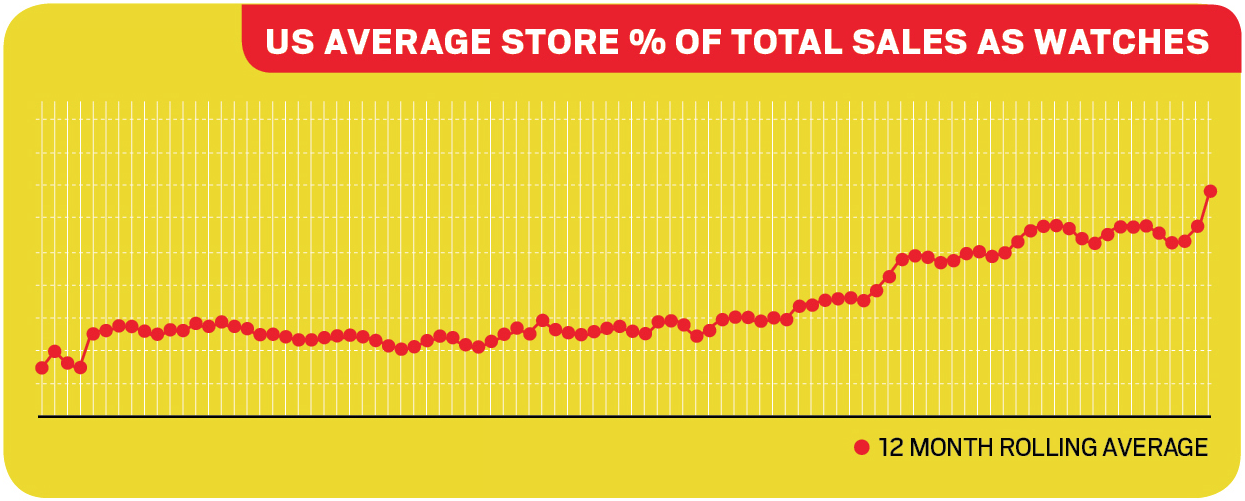

Most months we tend to focus mainly on jewelry when sifting through our data but we’ve picked up an interesting trend in watch sales over the last 12 months. Sales of watches have steadily been increasing and as the graph below shows this has resulted in a larger contribution from watches of the percentage of storewide sales.

As the 12-month trend line shows, watches have gone from accounting for around 3 percent of storewide sales back in 2008 to around 9 percent in 2015. This is on the back of an increase of over 40 percent in storewide annual sales figures during this timeframe, so the real impact in dollar terms of watches will be closer to a four-fold increase.

Advertisement

What’s driving these increased sales? An interesting trend can be seen is when we compare larger versus smaller stores.

Comparing the data makes for interesting reading. The effect of watch sales on larger stores is quite noticeable and reflects a difference in terms of the contribution watch sales make between larger and smaller stores, which we have spoken about before. The dollar difference is huge with larger stores achieving nearly $350,000 a year more in watch sales, or almost 13 times as many dollars!

The difference isn’t so noticeable in units though, with 224 units compared to 82. It’s the average sale that makes the biggest difference and clearly there is a market in high-end watches that the larger stores are cashing in on that the smaller stores are missing out on. The watch market has become something of a commodity at the bottom end but clearly top-end brands are alive and well. Margins are not as attractive but the stockturn makes for good reading.

So where do watches sit in your business? Is it an area that you’ve developed or has the competition got too tight? Are you fighting it out for the low hundred-dollar sales or has your store embraced the higher-end market? You may have made some assumptions about the future of watches for you but these numbers may have you rethinking the equation.

he difference between the sales of the over $1 million stores and those doing less in our sample is $1.9 million per annum ($2.6 million is the average for annual sales at larger stores and $700,000 is the average for the smaller ones). That $350,000 of this difference, or just over 16 percent, comes from watch sales shows that size isn’t the only factor explaining why bigger stores do better in timepieces.

Advertisement

For daily news, blogs and tips jewelers need, subscribe to our email bulletins here.

/* * * CONFIGURATION VARIABLES: EDIT BEFORE PASTING INTO YOUR WEBPAGE * * */

var disqus_shortname = ‘instoremag’; // required: replace example with your forum shortname

/* * * DON’T EDIT BELOW THIS LINE * * */

(function() {

var dsq = document.createElement(‘script’); dsq.type = ‘text/javascript’; dsq.async = true;

dsq.src = ‘http://’ + disqus_shortname + ‘.disqus.com/embed.js’;

(document.getElementsByTagName(‘head’)[0] || document.getElementsByTagName(‘body’)[0]).appendChild(dsq);

})();

Please enable JavaScript to view the comments powered by Disqus.

blog comments powered by