OUR SAME STORE DATA for October 2018 again showed a drop in sales performance across the stores being measured. Monthly sales of $102,602 were down 4.85 percent compared with the same period last year. Average sale of $399 for the month was an increase of 8.7 percent on last year’s monthly average retail value of $367. Sales volume, however, continued the decline, dropping from 262 units to 218, a drop of 16.7 percent, which has dragged the overall performance down.

Our rolling 12-month figures show a decline of 0.33 percent in the result from last month, representing the ninth straight month that numbers have fallen across the data pool. Year-to-date sales figures have now declined from $1,629,755 in January to $1,574,687 at the end of October, a drop of $55,000 in sales. Given a profit at keystone this will have reduced the average store’s bottom line, assuming all other costs stayed consistent, by over $27,000 during this period.

As the numbers above show, keystone is becoming increasingly harder to achieve, with margins consistently being below 50 percent over the last three years of data. Within these figures is also another story. When you look at the result achieved for October 2018 of 48 percent margin, the breakdown shows the smaller stores under $1 million in sales achieving 50 percent margin and those up to $3 million in sales per year achieving 46 percent. The largest stores have a margin of just 41 percent for the month.

“Well, they must be selling more high-priced diamonds at a reduced margin,” I hear you say. Certainly the bigger stores are achieving a much better average sale in diamonds, which will be contributing a squeeze to margin where there are higher ticket items. However, the best-performing stores for diamond sales, as a percentage of overall store sales, are stores doing between $1 million and $3 million, with diamonds representing 55 percent of total sales. Next are stores with less than $1 million in sales, which are making 53 percent of their sales from diamond product. The biggest stores are only seeing 46 percent of their sales coming from diamonds.

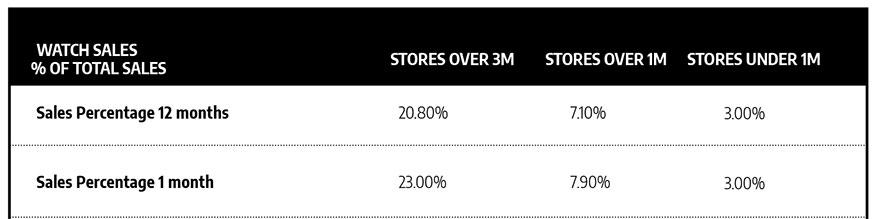

Where the biggest difference lies is in the area of watches. Here’s a look at the numbers across all stores.

Advertisement

As the chart shows, the bigger the store, the more significant the percentage of sales for watches, with the resulting impact on margins that watches can have compared to jewelry.

Although smaller stores can congratulate themselves on maintaining a better margin and doing well in diamond jewelry, this does raise the question, why are smaller stores not achieving a bigger percentage of sales in watches? Although we don’t carry ongoing data on the average sale from watches, a quick glance at October results does show an average sale for larger stores of $4,000 versus $1,200 for medium-sized stores and just $360 for smaller stores. The elite brands carried by the bigger stores are making a difference in this area.

20 percent of sales is a significant amount. Not every jeweler can carry a top-brand watch, or would want to, but it does show that the watch market is not all about discount stores and cheap knockoffs. Where do watches fit into your store strategy? Are you assuming they are a market you can’t get a larger slice of? Should you be reviewing your strategy in this area?