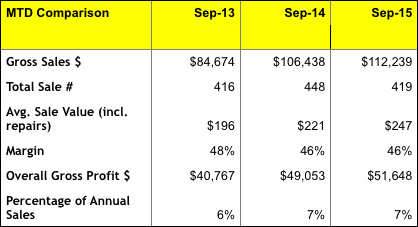

September showed continued growth for the stores in our analysis group with rolling 12-month sales up by 0.36 percent on the equivalent figures for August. This translates to growth of 4.3 percent per annum should that trend continue. Store average sales for the month were $112,239, up from $106,438 for September 2014, which translate to average annual rolling sales of $1,598,500 — just shy of $1.6 million average sale per store. When this is compared to the average 12-month sales figure of $1.28 million in September 2012 it seems clear that many stores have come a long way.

This article originally appeared in the December 2015 edition of INSTORE.

The number of units being sold has fallen from 2014 but there has been a good increase in average sale achieved compared to last year. Margin continues to be low, which is a general trend we’ve recently highlighted. September sales have increased 32 percent in the last two years but gross profit has only gone up by 26 percent. Maintaining margins would have resulted in an additional gross profit of $2,226, or an extra 4 percent in the gross profit achieved. Work that out over a 12-month period and, ignoring the higher December trading, that would be worth an additional $26,700 in annual profit just by maintaining the extra 2 percent of margin.

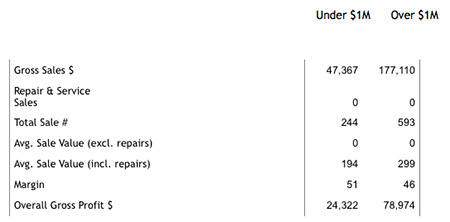

Let’s compare the results of smaller stores against larger ones, based on their sales.

Advertisement

As the data shows, the average smaller store is achieving only just over a quarter of the sales of the larger stores (bear in mind some very large stores can be distorting this figure). The typical larger store is achieving more than double the sales units at 593 versus 244, but is also achieving a 50 percent higher level of average retail item sold. Big stores don’t just sell more items they do a better job of getting the bigger sales too.

Where small stores are competitive is that they have a much better margin being achieved at 51 percent compared to 46 percent for the larger stores. The fact that repairs will be a greater percentage of the smaller stores’ numbers will no doubt be helping this figure. It’s interesting to also note that the average small store carries just under $600,000 of inventory compared to around $2.2 million for the larger stores – over three times as much.

So what can we learn from these numbers? When I delve into them in more detail across the key departments of diamonds, gold, silver and watches I expected to see a similar trend of three times the sales units and 50 percent higher margin across them – and to a large extent this was the case. There were, however, a couple of interesting variables that caught my eye.

First, when it came to watches the biggest stores far outweighed the smaller ones with $369,000 of watch sales compared to an average of just $24,000 for the smaller stores. With the average watch sale being higher at $1,800 versus $362 it makes an interesting read for those asking questions of their watch departments. Unit sales were also considerably higher at 205 watches versus 67.

The second and more interesting statistic though was silver. Larger stores sell more silver – $290,000 versus $106,000 average per store per year. There is more items sold – 4,300 versus 1,700 – but what stood out was the average sale. Larger stores achieve an average sale per item of $66 for silver versus $60 for smaller stores.

Advertisement

Now, there can be a lot of variables that explain why bigger stores make more sales – they carry more inventory, which leads to more sales units, the bigger selection means they are able to carry higher-end pieces to make a better average sale, and so on — but why should a bigger store make an extra $6 per sale from silver? That’s 10 percent more. We’re not talking high-end product here. There is no more reason why a larger store should be able to achieve a better average sale on silver than a smaller store. It doesn’t require a large investment (although larger stores do carry more than twice as much product) in order to lift your average sale.

If you’re a smaller store, then the larger competition will be beating you in many areas — but average sale for silver items should not be one of them.

David Brown is president of the Edge Retail Academy. To learn how to complete a break-even analysis, contact inquiries@edgeretailacademy.com or (877) 569-8657.