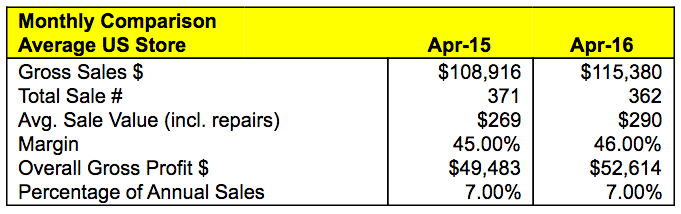

Our data for April confirms a continuing strengthening in trading conditions for most stores in our survey group. The month of April provided average store sales of $115,380 up 6.6 percent from $108,196 in same month last year. Same-store rolling numbers show annual 12-month sales of $1,630,093, rising from $1,623,630 at the end of the previous month.

David Brown

—

President of Edge Retail Academy

O

ur data for April confirms a continuing strengthening in trading conditions for most stores in our survey group. The month of April provided average store sales of $115,380 up 6.6 percent from $108,196 in same month last year. Same-store rolling numbers show annual 12-month sales of $1,630,093, rising from $1,623,630 at the end of the previous month.

Advertisement

As the numbers show, sales have increased for April compared to last year but on a lower volume of items sold. The average retail sale per item has increased, however, by 7.8 percent from $269 to $290, more than offsetting the 2.4 percent drop in number of items sold. Margin increased slightly by 1 percentage point from 45 percent to 46 percent, which boosted the monthly gross profit achieved by 6.3 percent from $49,483 to $52,614.

This month we will focus on the percentage split between different departments over the long term by comparing data from 2011 to the current figures in 2016.

The chart above shows the percentage contribution made by each of the key departments, namely diamond rings, all diamond jewelry (including rings), colored stones, gold jewelry, silver jewelry, and watches over a five-year period between April 2011 and April 2016.

The most notable figure is, of course, the increase in diamond jewelry sales from 42.75 percent to 52.35 percent, an increase of 22 percent. Given this has been achieved on increased sales figures (the average store was achieving annual sales of $1,093,632 in April 2011 against the current rolling 12-month figure of $1,623,630 – up 48 percent in total) then the increase in retail dollar terms has been even more significant.

What is surprising when first looking at these figures is how little diamond rings have actually contributed to this growth figure, increasing by just 8.8 percent from 8.45 percent of total store sales to 9.2 percent. That leaves other diamond jewelry increasing by over 25 percent in this period from 34.3 percent to 43.15 percent of total store sales. Clearly this has been the greatest area of growth for most stores. Colored stone jewelry has also enjoyed a percentage increase over this time, rising from 7.05 percent to 8.3 percent of total store sales – a gain of 17.7 percent.

Advertisement

Also noticeable is the drop in the contribution coming from both plain gold and silver jewelry. Gold has reduced on its total contribution to annual sales from 7.9 percent to 7.5 percent, and likewise silver has seen a reduction from 17.7 percent to 13.6 percent. It should be noted that these reductions, however, are on the back of that 48 percent increase in total store sales during this period – in real dollar terms both gold and silver are selling at higher levels than they were in 2011.

The two questions to ask from this information are: 1) Has your store changed its percentage contribution in line with the industry statistics? and 2) What have you done differently to reflect this fact?

If you’re good at retaining your reports then it should be easy to see how your percentage contributions compare over the two periods. Whether your business has changed or not during this time, your actions should reflect the industry as a whole. If your sales aren’t in line with where the market is heading then they need to be and if they are then are you achieving this because you’ve responded to demand or is it happening despite yourself?

Take a look at the composition of your inventory. What does it show? You should be carrying 50 percent or more of your product as diamond inventory these days to reflect these sales figures. If your diamond inventory still reflects 40 percent or less of your total inventory, which would be line with historic figures, then you might be missing this growth. What percentage are your diamond rings, colored stones, gold, watches and silver of your total inventory?

Sales start with inventory and having the right balance will see you heading in the right direction.

/p>

/* * * CONFIGURATION VARIABLES: EDIT BEFORE PASTING INTO YOUR WEBPAGE * * */

var disqus_shortname = ‘instoremag’; // required: replace example with your forum shortname

Advertisement

/* * * DON’T EDIT BELOW THIS LINE * * */

(function() {

var dsq = document.createElement(‘script’); dsq.type = ‘text/javascript’; dsq.async = true;

dsq.src = ‘http://’ + disqus_shortname + ‘.disqus.com/embed.js’;

(document.getElementsByTagName(‘head’)[0] || document.getElementsByTagName(‘body’)[0]).appendChild(dsq);

})();

Please enable JavaScript to view the comments powered by Disqus.

blog comments powered by