A STORE OWNER I spoke to recently had a burglary that totally wiped out everything in his safe. Because of his poor method for keeping track of what he bought over the counter, he got less than half of what it was insured for.

Jewelers buy two types of items over the counter: 1) gems, diamonds, watches and jewelry; and 2) meltable gold, silver and platinum.

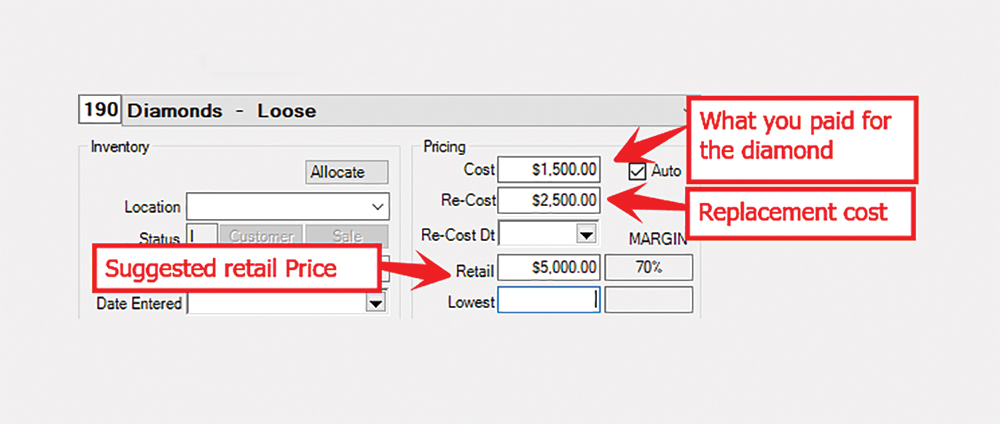

No. 1 should be placed in the showcase to be sold or wholesaled out to a dealer. If you put it in the case, then it should be entered into your point-of-sale program as inventory. For example, if you buy a diamond for $1,500, it should be entered into your point-of-sale and QuickBooks at $1,500. But the Edge platform also has a “Re-cost” box, which is meant to record what it would cost to replace this diamond in case of theft at market value. The “Re-cost” value should be the price you would have paid if you had bought it wholesale. In this case, the replacement cost might be $2,500.

For insurance, you need to keep extra paperwork on OTC buys. Leo Anglo of Vincent’s Jewelers in St. Louis, a jeweler who is an expert in this field, says, “For every OTC Item, there is a ticket detailing check number, customer last name, accounting cost, and market or replacement cost, which is transferred to the inventory system for each item. When I renew my policy, I clearly indicate that I am listing the market value.”

So, either put it into inventory this way, or sell it to a dealer for quick profit.

As for the No. 2 category above (scrap metals), you should send it into a refiner twice a year. Ask the refiner to send back your dollar value in gold coins (and any residual dollars by check).

Unless you’re living under a rock, you’ve seen how many jewelers have been robbed and burglarized recently. Your insurance will cover everything that’s documented correctly in your POS program, and yes, many jewelers might just keep their scrap in their POS program.

You know one place that you don’t see robbers and burglars burglarizing? Banks. I’d get a safety deposit box and store your gold coins there. Many insurance companies give a discount on jewelry and coins stored in safety deposit boxes. Keep it there until your big payday comes around. Now you’re covered.

For more information on store security, join the Jewelers Helping Jewelers Crime Alert Network on Facebook, and check out security articles from Leo Anglo at jewelerprofit.com/jhj-jewelers-crime-alerts.html.

Advertisement