(PRESS RELEASE) LAS VEGAS — Diamond markets are under pressure as profit margins have tightened and the trade war with China has fueled uncertainty. U.S. jewelry sales are robust, but the midstream is not profitable enough to support a sustainable supply chain.

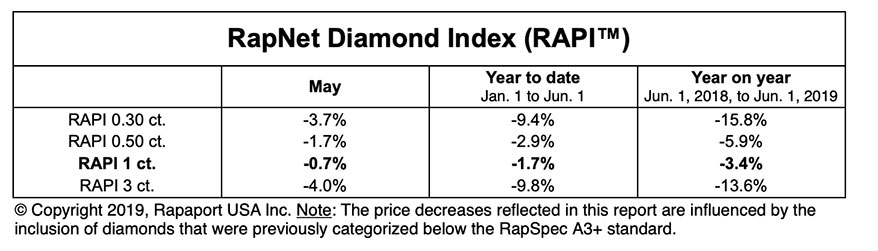

The RapNet Diamond Index (RAPI) for 1-carat diamonds fell 0.7% in May and is down 1.7% since the beginning of the year.

Diamond trading was weak at the JCK Las Vegas show. Demand is selective, with buyers avoiding inventory purchases. Jewelry retailers are taking more goods on memo. Polished suppliers are offering technology and source verification as a value-added service.

There is good demand for 0.60- to 1.99-carat, F-J, VS2-I1 diamonds. Buyers are insisting on well-cut stones. Polished below 0.50 carats is slow due to excess supply, weak Chinese demand and tight Indian liquidity.

Cutters are operating at lower capacity as they try to reduce inflated inventory. The number of diamonds on RapNet declined 2.6% to 1.5 million stones in May, but was up 16% from a year earlier on June 1.

Advertisement

Manufacturers are rejecting high-priced rough that has made polished production unprofitable. De Beers and Alrosa are carefully managing production and price levels amid this year’s slow rough demand, as outlined in the May edition of the Rapaport Research Report.

“Diamond demand is relatively good, but the middle markets are in danger of collapse,” said Martin Rapaport, chairman of the Rapaport Group. “We are reaching the point where there is insufficient liquidity to support the flow of diamonds through the supply chain. If the trade does not change its business practices and adapt to new realities, the diamond industry will suffer extreme financial and regulatory disruption. Manufacturers will stop cutting.”

To learn about the Rapaport Research Report and to subscribe, click here.