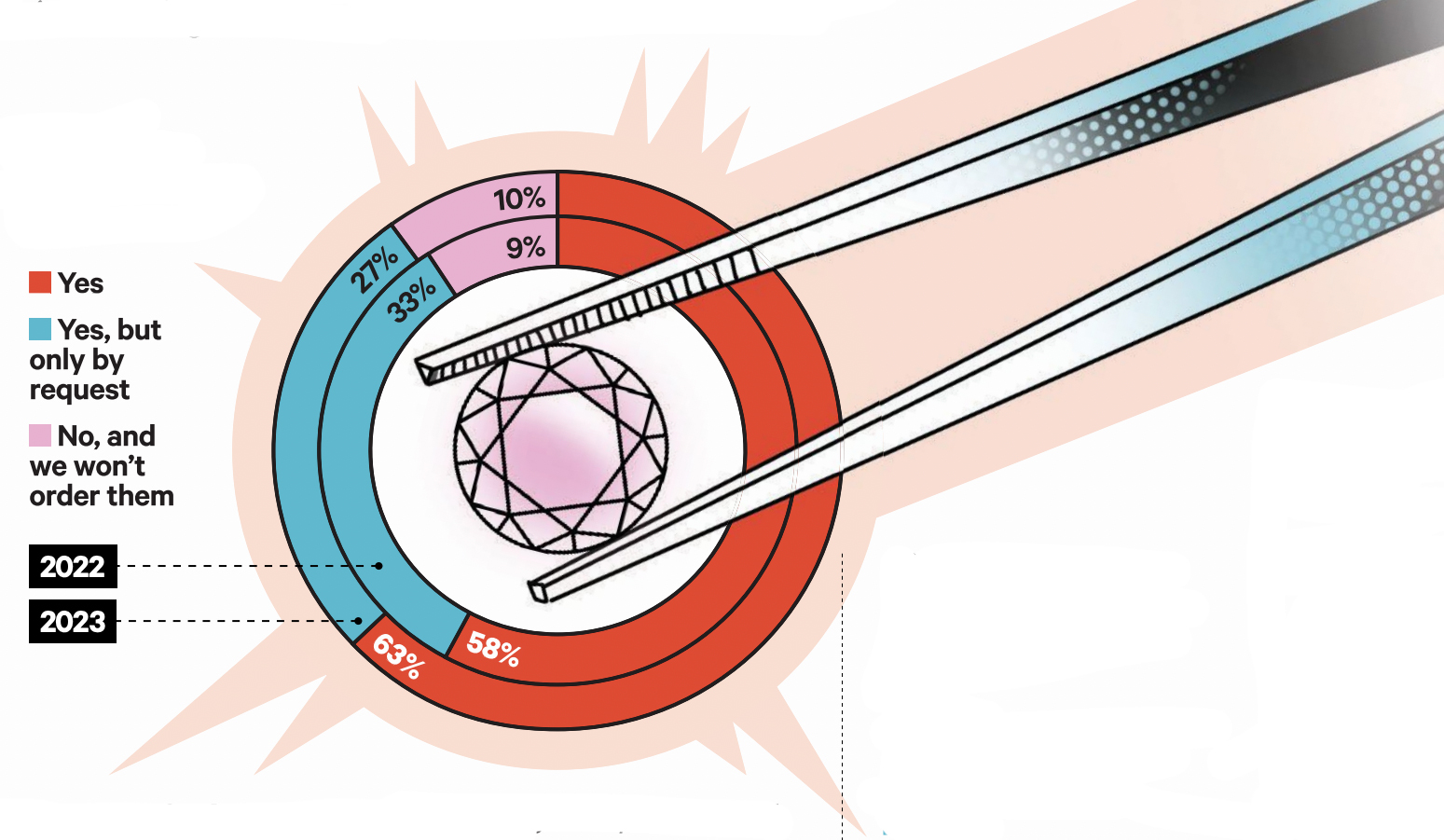

33. Do you sell lab-grown diamonds?

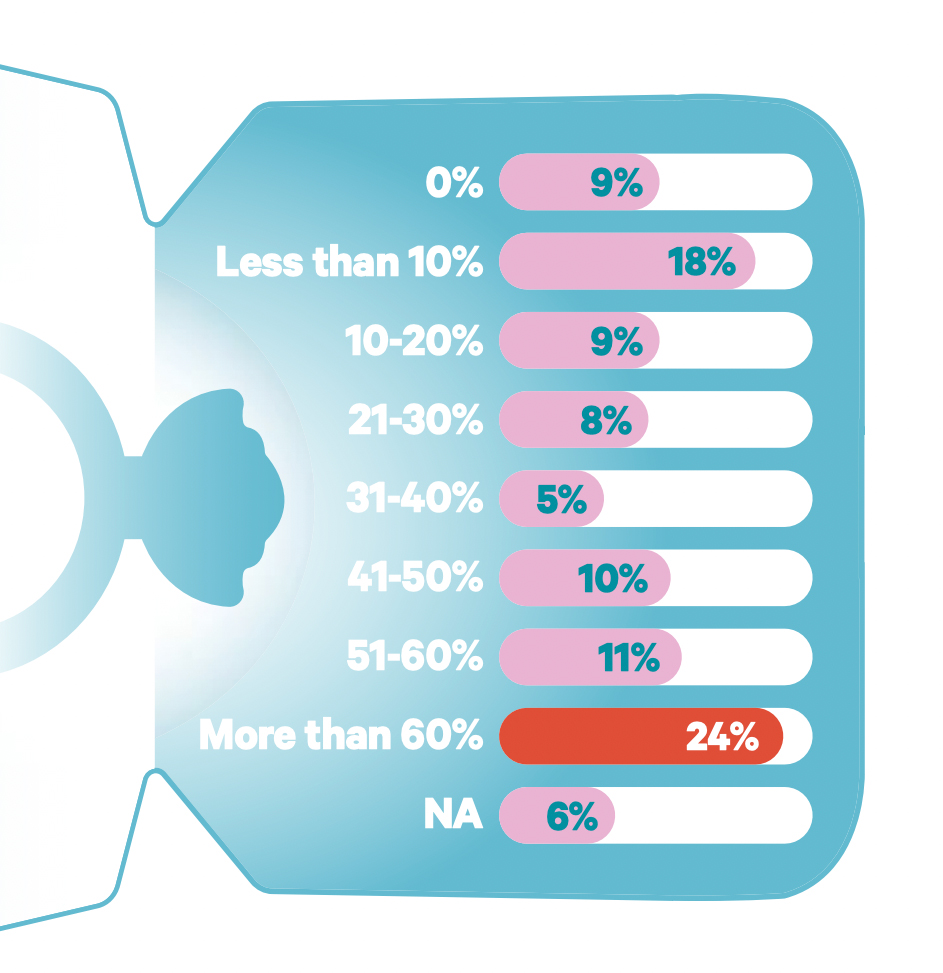

34. What is the average gross margin on the lab-grown diamonds you sell?

The figures reported by respondents to our survey ranged wildly, from as low as 10% to as high as 250%, although the most common response was 50%, with almost four in 10 reporting they averaged keystone. Such figures suggest jewelers are continuing to command better margins on lab-grown diamonds than for natural diamonds. According to Tenoris, the consultancy founded by industry analyst Edahn Golan, independent jewelers in the U.S. averaged gross margins of 48.6% on natural diamond engagement rings in 2022.

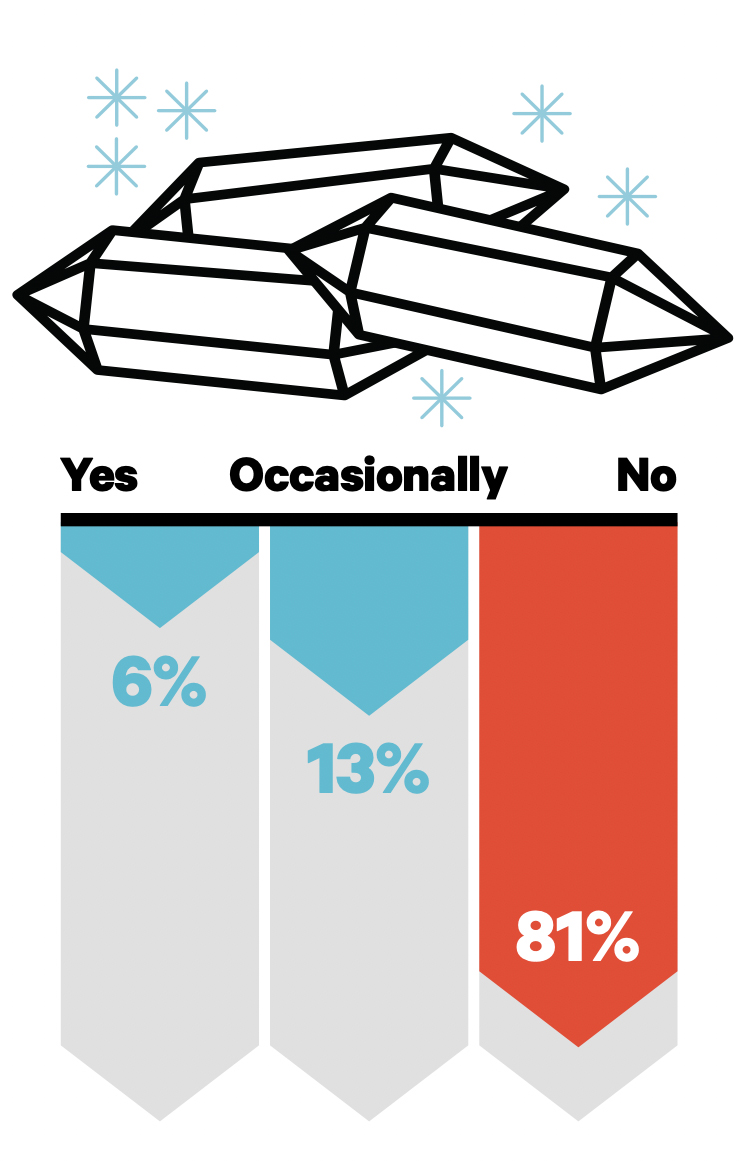

35. Of the engagement rings you sell, what percentage (by unit) have lab-grown center stones?

36. Do you give any credit on lab-grown diamonds toward a trade-in?

| Yes, it’s the same as our policy for naturally occurring diamonds |

|

8%

|

| Yes, but it’s less than for naturally occurring diamonds |

|

11%

|

| No, but we offer trade-ins for naturally occurring diamonds |

|

50%

|

| No, we don’t offer credit for any diamonds |

|

17%

|

| N/A |

|

14%

|

37. How many LGD pieces do you sell a month vs. naturally occurring diamond pieces (not dollars, but actual items)?

| 0 |

|

13%

|

| Less than 1 in 10 |

|

24%

|

| About 1 in 10 |

|

11%

|

| About 1 in 5 |

|

11%

|

| About 1 in 4 |

|

6%

|

| About 1 in 3 |

|

9%

|

| Equal number |

|

9%

|

| Sell more LGD pieces than mined diamond pieces |

|

17%

|

38. Are you seeing any blowback from past customers since labgrown diamond prices have declined?

While not many jewelry stores are reporting “blowback,” quite a few are worried about it happening in the future. Part of the reason that retailers are not encountering angry clients may have to do with the fact that the category itself is so new as a retail product. As one jeweler said, “We haven’t seen blowback yet, but I expect to in the next five years as the first of those marriages start to fail.”

Retailers also report that they make sure to tell lab-grown diamond buyers that prices have been dropping and that they don’t know when they will reach bottom. Many also explain to customers that they are investing in “love,” not future money. That said, a few have begun fielding complaints. “Some are unhappy they have lost value even though this scenario was discussed at time of purchase,” said one jeweler.

Advertisement

The answer seems to be to prepare clients for a drop in monetary value while also downplaying the idea that they’re buying an “investment.” This jeweler said it best: “We are transparent with our clients and tell them that lab-grown diamonds are no more ethically sourced than natural when we take into account power consumption and the lack of regulations. We also have been clear that it is likely that the lab-grown diamonds will hold no intrinsic value. We equate it to buying technology in the sense that if you financed a computer for 24 months, by the time you pay it off, it will likely be cheaper than when you bought it. We believe in educating our clients fully and allowing them to make the best decision for them.”