June’s results across our sample stores again showed a healthy increase in sales compared to last year. The overall sales result of $120,622 was up on June 2014’s result of $107,130 by $13,492, or 12.6 percent. Units sold increased from 348 per store to 410 with average retail value achieved little changed (a small decrease from $273 to $269). The unit increase represents a rise of just under 18 percent on the equivalent month last year – one of the best volume increases we’ve seen. Customer numbers or units sold per customer are clearly increasing!

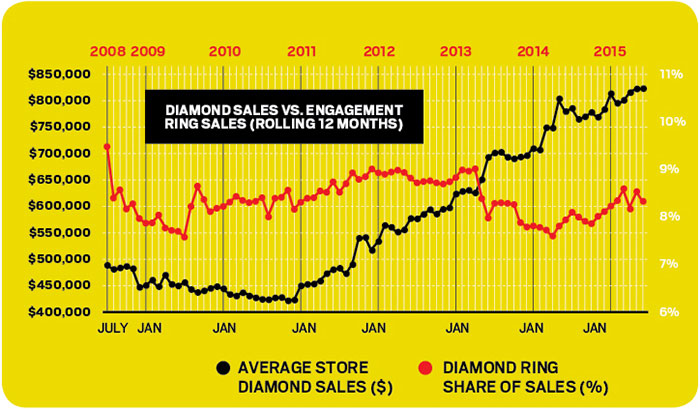

We revisit the key sales department of bridal this month with some comparative analysis of how diamond sales have been tracking across the jewelry stores we monitor.

Diamond sales have levelled off in the last three months but have continued to climb well long-term over the last few years. Since June 2014, the figures have largely tracked sideways and it will be interesting to see whether the numbers hold or continue their long-term upward trend. The average store is now achieving diamond sales in excess of $800,000 per annum, which represents around 50 percent of total store sales. When we consider it wasn’t that long ago that diamonds accounted for less than 40 percent of annual sales for some stores (and poor annual sales at that) there is no doubt this market has rediscovered its confidence. Interestingly, in the last few months diamonds have come back a little in overall percentage contribution to store sales – the category reached as high as 53 percent at one point, showing that other departments have been enjoying stronger recent growth.

So how are diamond rings tracking? As the above graph shows, the overall contribution of diamond rings to storewide sales has followed a consistent pattern over the last two years and is in fact lower than the contribution diamond rings were making during the financial crisis.

What does this mean for bridal? Clearly the growth is happening across other areas apart from rings. With around 9 percent of storewide sales coming from rings and 50 percent coming from diamond jewelry overall, that shows that other diamond departments such as bracelets, pendants and earrings have become significant factors in the diamond sales game. We don’t define the reason for purchase (e.g. earrings purchased for wearing on the wedding day as opposed to general wear) and all jewelry has a shelf life of more than one day (it would be an expensive wedding if the jewelry was thrown out along with the leftover food!)

Advertisement

The data suggests that rings have lagged behind the growth in other diamond jewelry departments and given the traditionally higher average retail sale for a ring versus say pendants, earrings and bracelets, this is an area that needs strong attention in some stores.

So how does your inventory balance up? What percentage of your diamond inventory consists of diamond rings and how does this compare in both sales and inventory holding? A store carrying 50 percent of its diamond product as rings but only achieving 20 percent of its diamond sales as ring sales is out of balance. The question needs to be asked why this happening. The first starting point is age. How old is the product in that department? Has it been neglected? Is the investment earning a return and how does its performance compare to other diamond areas?

Where is the product displayed? Are all diamond rings in the window, or does the customer have something to see when they come in-store? Are they displayed together? Is it a good location for foot traffic? Is it mixed in with other diamond jewelry?

How is it marketed? What do you do to attract bridal customers to your store? Does it work? What works for others that you could adopt yourself? Are you creating a sales funnel and building a relationship with the customer or just trying to sell at the first meeting?

Are the staff up to scratch? Have they been well enough trained in what they need to do to sell bridal? Are they involved in product selection? Do they like the product they have been given to sell? Are they incentivized to sell it? Do they know what promotions you are doing if customers come in and mention them?

These questions are a good starting point to building your bridal business and should be asked on an annual basis if you are serious about building this part of your business.

Advertisement

This article originally appeared in the September 2015 edition of INSTORE.

David Brown is president of the Edge Retail Academy. To learn how to complete a break-even analysis, contact inquiries@edgeretailacademy.com or (877) 569-8657.