I HAVE NOTICED a growing problem, and I’m not sure how to solve it. What kind of problem, you ask? Well, it’s a complex conundrum that extends across issues of science, economy and integrity. It’s not an easy problem to solve, but I’m hoping you can all help me out by replying to this newsletter with your thoughts and opinions. Because I’m fresh out of ideas.

The issue is, I bought a diamond. Not just any diamond, but a 1.02 lab-grown diamond from Lightbox. Without the setting, the diamond cost the jeweler approximately $400. And since I was going to be getting a tour of the AGS Laboratory, I thought, what could be more interesting than to check out the number of steps that the AGSL had to take to test each and every diamond that comes into the lab before the diamond went through the grading and light performance analysis? (Full disclosure: I am on the AGSL Advisory Committee, hence the tour.) A shoutout to the AGSL team for a great tour of their facility!

It’s no secret that the prices of lab-grown diamonds have been falling, and falling rapidly. As production has ramped up and the number of companies selling these goods increases, putting downward pressure on prices, I’ve been hearing of prices as low as 90% off the Rap list. But 90% off of what? And how much further are they going to fall?

Lab-grown diamonds have been priced based on their color, clarity and weight and then offered at some discount to natural diamonds. I have been uneasy with things manufactured in a machine being compared to their natural counterparts since they were first brought to market. Synthetic materials are different and should have been positioned this way from the get-go, in my opinion – camouflaging the composite differences between the two with fancy language like “lab-grown” and “earth-mined” does not make a proper distinction. But doing so would have made them far less expensive than they were being offered for and far less profitable for those selling these goods into the marketplace. Let’s get back to the AGSL report.

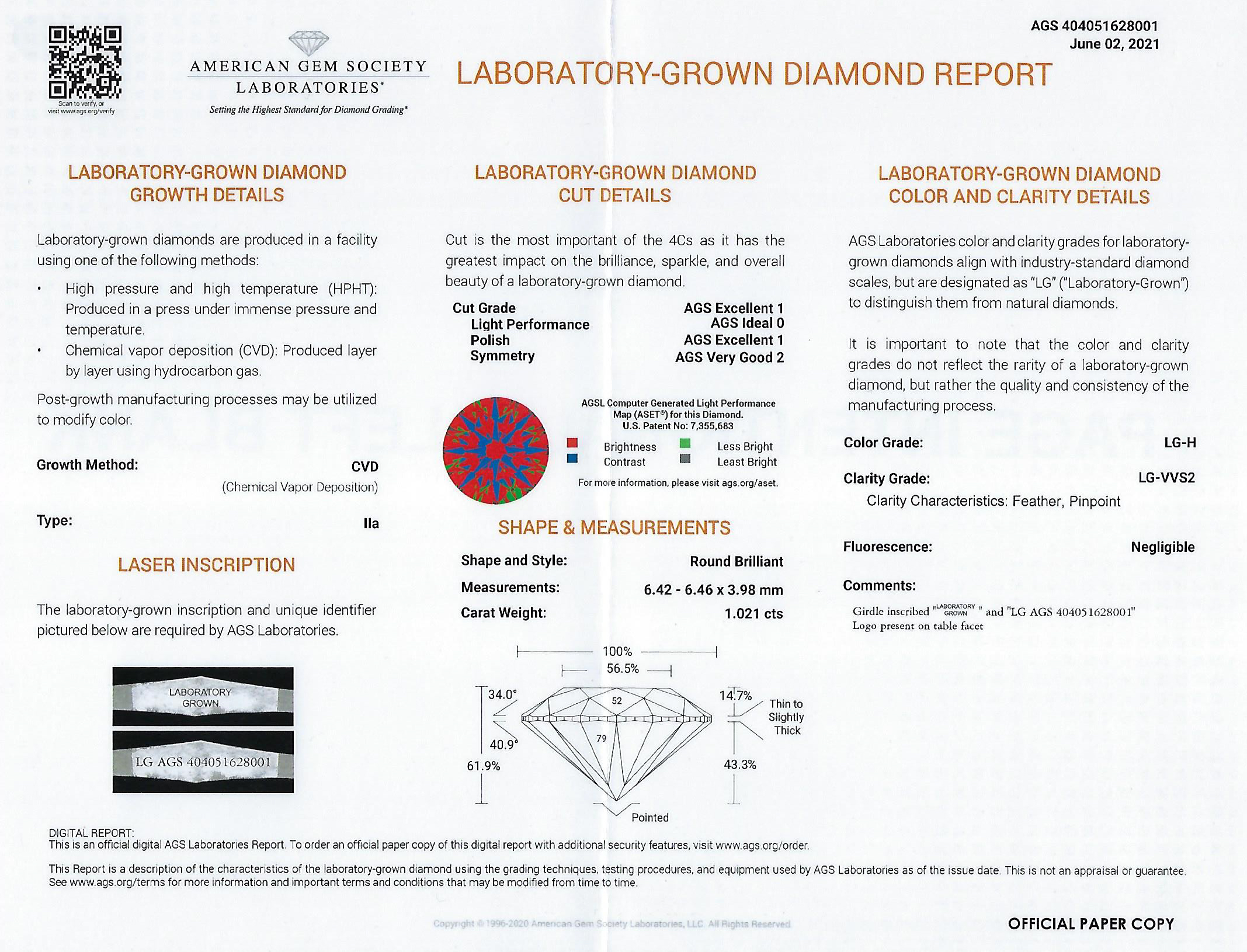

This Lightbox lab-grown diamond turned out to be a 1.02ct H / VVS2, with an AGS cut grade of 1, meaning it was near “ideal cut.” The wholesale price is approximately $400 for the stone, and it retails for $800 plus the mounting. Prior to Lightbox entering the marketplace, we were assured by other lab-grown diamond sellers that there was “no way” the goods were going to be sold for $800/ct retail, that they were brown, that Lightbox would never come to market with these goods – it was just a marketing ruse. As Lightbox expands distribution, those of you selling LG diamonds need to be thinking about your own lab-grown strategy. You can no longer claim to be unaware that these goods exist, at these prices, at this quality level.

Advertisement

I don’t know how you can square this particular 6.50mm circle. Knowing that this material exists and is being sold directly to consumers, and in an expanding number of retailer stores for $800 per carat, how does one offer the same material for two or three times the price? This is like paying $4,000 for a 1 oz gold coin that can be bought for $1,900 and then selling it for $8,000 – I don’t understand how that will ever benefit our industry, or even produce sustainable business for the sellers.

What about larger goods? What happens when Lightbox introduces 2.00 ct LG diamonds for $800/ct or $1,600 for the stone at retail, how will that compare with the other 2ct lab-grown diamonds you are selling? Go ahead and tell me that won’t happen anytime soon. Go ahead and tell me that it’s not possible to grow a crystal that will yield an 8.2mm RBC – for this price. We’ve heard this before.

Why did I bring this Lightbox LG diamond to the AGSL? At first, since I knew I was going to tour the facility anyway, I wanted to watch a diamond go through the grading process and what equipment the AGSL was using to test each diamond’s nature. And frankly I was intrigued regarding the quality of Lightbox as more of our retail clients are carrying the line. Although I always knew their goods were very high clarity and color, I wasn’t expecting a VVS2, nor an ideal cut to boot.

Another notable item is the Lightbox logo, which looks like the outline of an octahedron and is present on every one of their diamonds (just to the left of the arrow in the photo below). I wish all lab-grown diamond companies made it this easy to identify – it makes it relatively easy to identify under magnification without impacting the clarity grade and would therefore take you off the hook for testing diamonds for all time.

I expect the value of lab-grown diamonds to continue to drop, which should not be a surprise to anyone. In this article, Rob Bates suggests that IIA Technologies (the company who owns Pure Grown) launched a direct-to-consumer company that is now selling LG diamonds for less than Lightbox. Who owns LovBe? Who owns the companies who own the companies who own the companies?

Advertisement

The question, though, isn’t about value. It’s about how you can sell other lab-grown diamonds for several multiples of Lightbox’s prices. Ah, yes … the flat screen TV argument. Well, when the competition is selling its TV for $800 that you are selling for $2,000-$3,000, it may be tough to explain these differences to your customers should they do any research whatsoever. While this isn’t about pixels, it certainly can be about clarity – and most lab grown diamonds are not VVS2. As more stores start carrying Lightbox, especially in your marketplace, it will make for very uncomfortable conversations with your customers and with your existing lab-grown diamonds suppliers.

I don’t know how you square that circle. Do you?