IN A COMPREHENSIVE consumer study, The Plumb Club Industry and Market Insights 2021 reveals numerous opportunities for the jewelry industry when it comes to lab-grown diamonds.

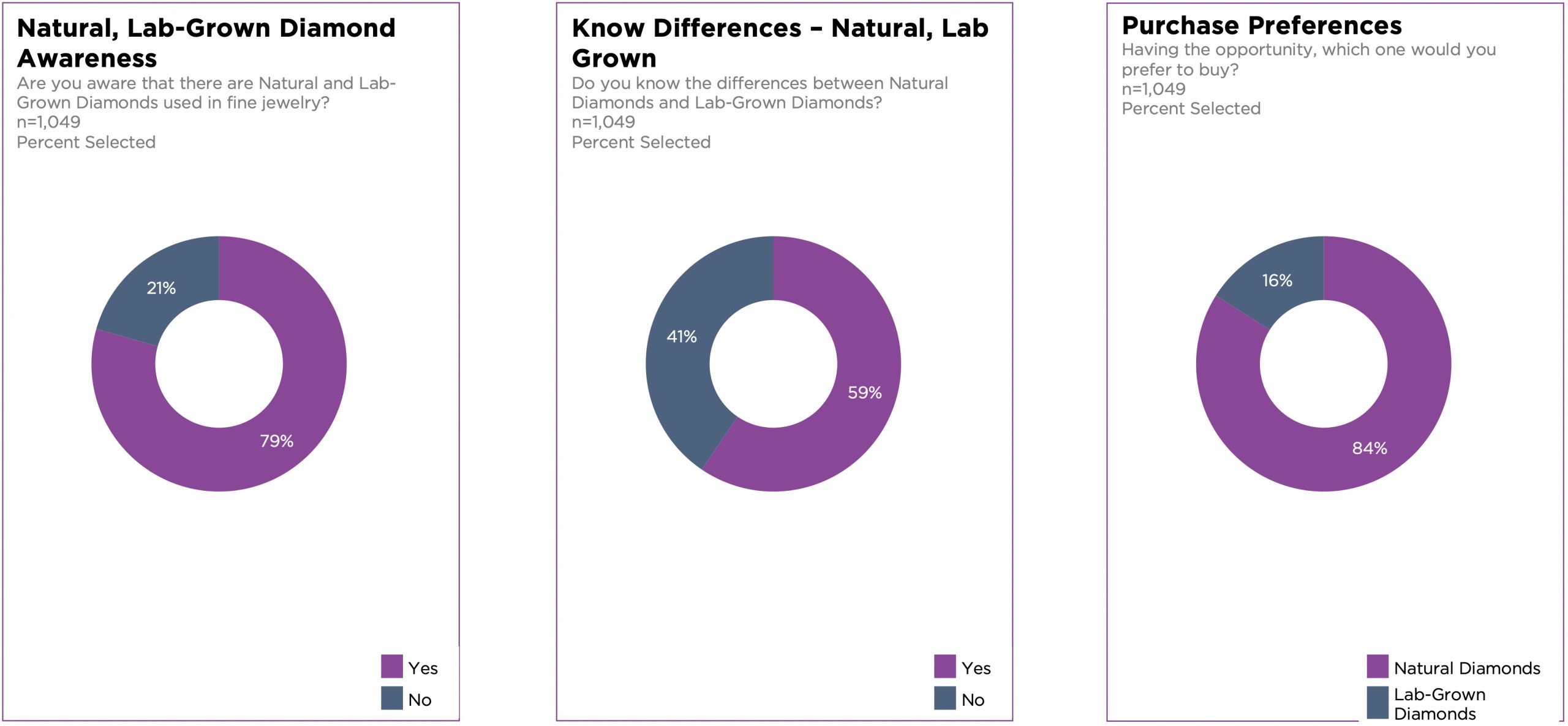

When presented with the opportunity to buy a diamond, 84% of consumers responded that they would prefer to buy natural diamonds, while 16% said that they would prefer a lab-grown diamond. However, deeper probing indicated that there may be several reasons for this disparity.

Reinforcing the need for the industry to educate the public, 21% of consumers were not aware of lab-grown diamonds. Although 79% said that they were aware of lab-grown diamonds and their use in fine jewelry, 41% admitted to not knowing the differences between natural and lab-grown.

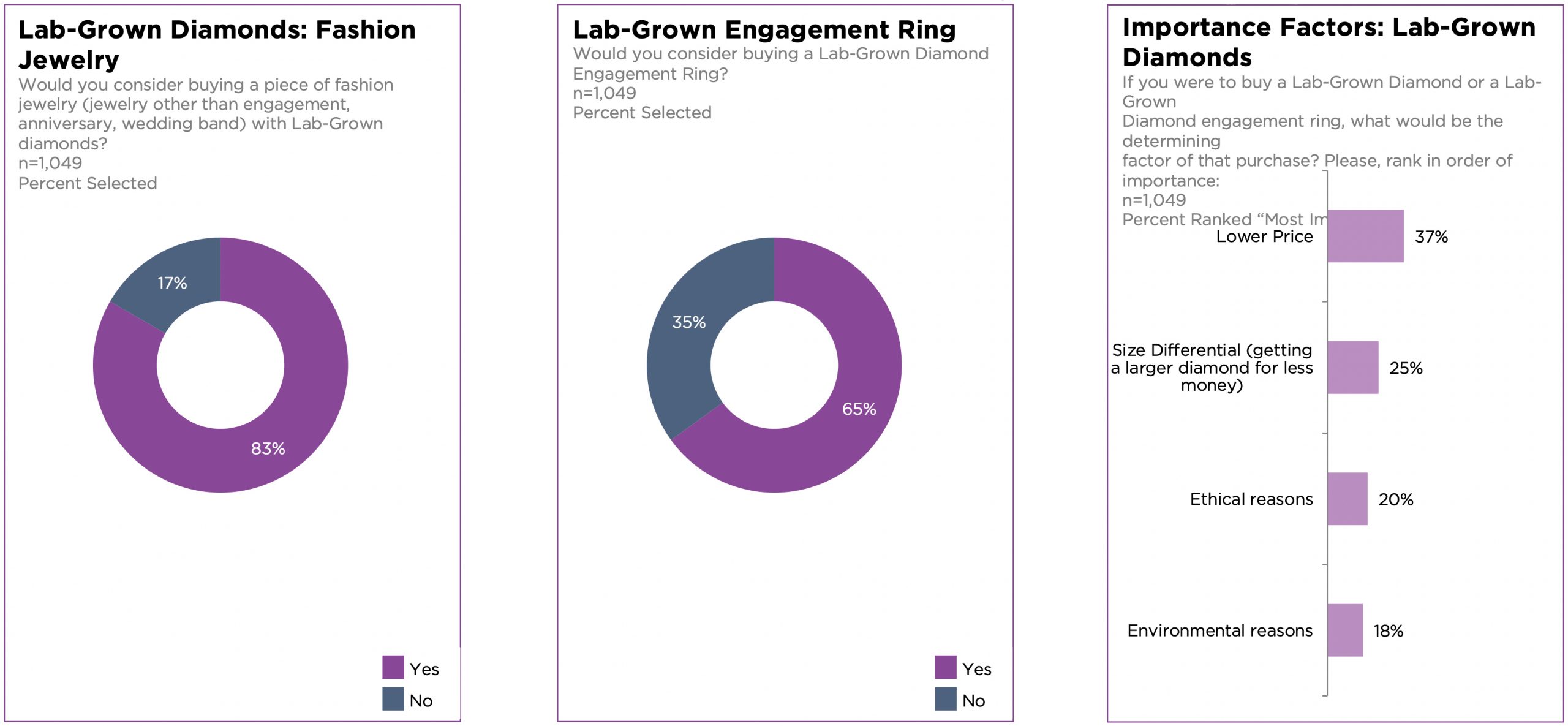

What a consumer is intending to purchase plays a role in the consideration of natural or lab-grown diamonds. From a category perspective, 83% of consumers said that they would consider buying a piece of fashion jewelry (jewelry other than engagement rings, wedding bands or anniversary rings) that contained lab-grown diamonds. When discussing the engagement ring, however, the number drops to 65% of consumers who would consider buying a lab-grown diamond.

For both fashion jewelry and engagement rings, the key factors for purchasing a lab-grown diamond piece appear to be lower price (37%), differential in size for the money (25%), ethical reasons (20%) and environmental reasons (18%).

Advertisement

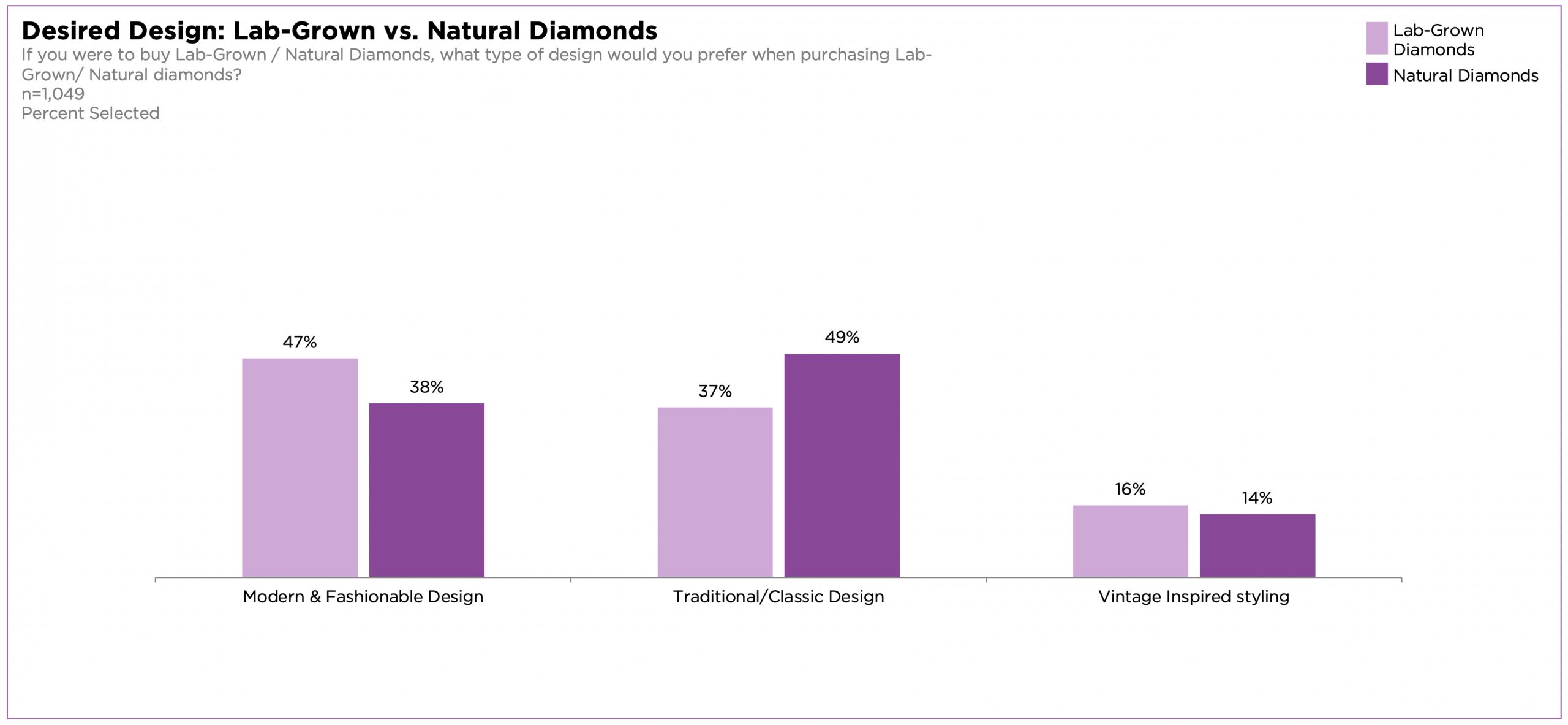

The styling of a piece of jewelry also seems to be indicative of preference. When consumers were asked, “If you were to buy a lab-grown/natural diamond, what type of design would you prefer?”, the breakdowns are as follows:

- 47% said that if they were buying lab-grown, they would prefer a modern and fashionable design (compared to 38% who said they would prefer that type of design when buying a natural diamond).

- 49% said if they were buying natural diamonds, they would prefer more traditional and classic styling, as opposed to 37% who preferred that style when buying lab-grown diamonds.

- When it comes buying lab-grown or natural diamonds in a vintage styling, the numbers are more evenly split (16% for lab-grown diamonds, 14% for natural diamonds).

The findings above were part of an expansive multi-focused study initiated by The Plumb Club, a coalition of 45 best-in-class suppliers to the jewelry and watch industry. The study was conducted in the first half of 2021 with a sampling of 1,049 men and women from ages 25-60 with a focus on 10 test markets across the US. It was done with the help of Paola Deluca, The Futurist and Qualtrics.

Additional information from this expansive research will be shared over the next number of weeks. Any retailer wishing more information on The Plumb Club Industry & Market Insights 2021 should contact a Plumb Club Member. For a full list of The Plumb Club Members visit here or email info@plumbclub.com

Advertisement