This six-part series reveals the findings of the survey, including motivations for jewelry purchase, impact of the pandemic, effects of social media and online tech, style preferences, lab-grown diamonds, and category/appearance preferences. The study reached 1,049 online respondents in the United States aged 25-60, college educated with $75K+ income, with the goal of understanding how individuals engage with jewelry.

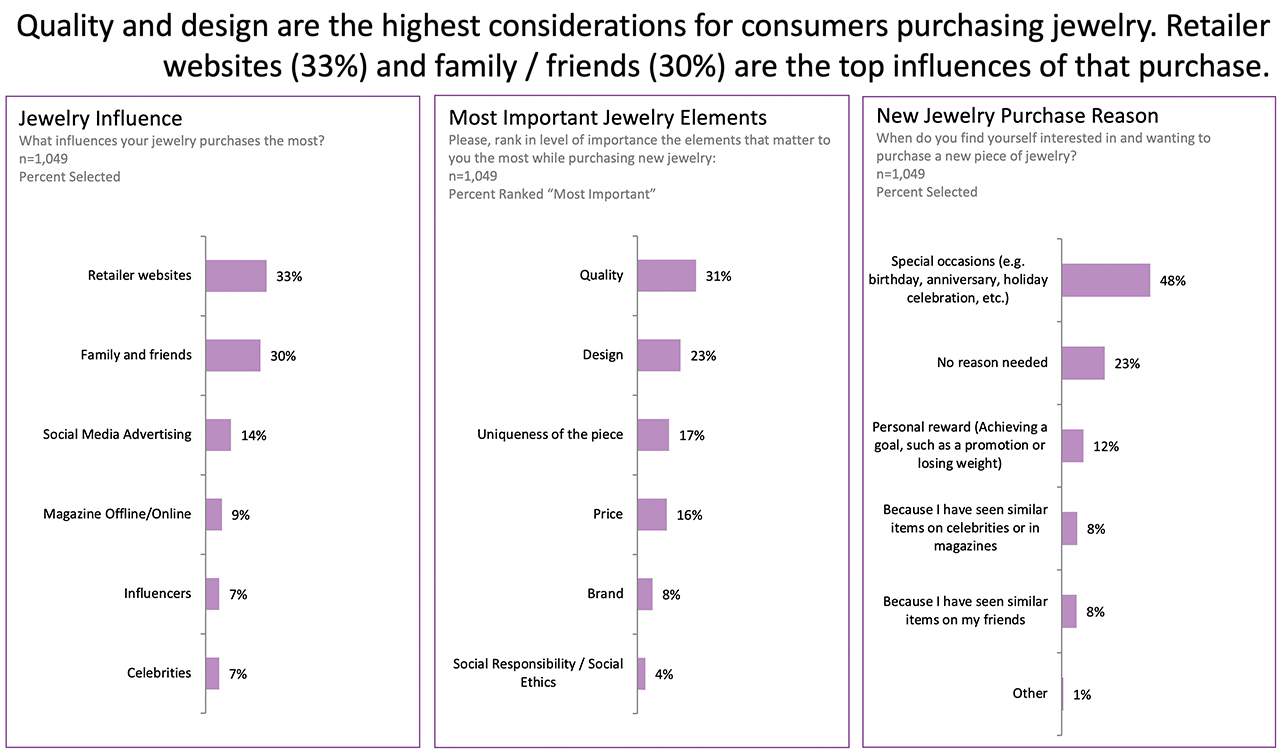

In one of the most comprehensive consumer studies ever conducted on jewelry-related topics, participants revealed the top considerations for jewelry purchases, with one-third of participants (33%) naming retailer websites as the No. 1 influence. This underscores the value of a retailer’s online presence. “Family and friends” were second highest at 30%, and social media advertising was third at 14%.

These findings are only part of a multi-focused research study initiated by The Plumb Club, a coalition of 45 best-in-class suppliers to the jewelry and watch industry, with the help of Paola Deluca, The Futurist and Qualtrics. The study was conducted with a sampling of 1,049 men and women, from the ages of 25 – 60 with a focus on 10 “test markets” across the US. Respondents had all attended some college or higher, had a combined household income of at least $75K/year and claimed to have either purchased jewelry in the past year and/or were intending to purchase jewelry in the upcoming year.

Advertisement

Other notable findings from the research, in terms of considerations for jewelry purchases, included:

- 48% of consumers were most interested in purchasing jewelry to commemorate a special occasion. 23% said “no reason needed,” while 12% said a personal reward was their prime motivator. A combined total of 52% not needing an event to purchase jewelry, highlights the growth of the self-purchase category.

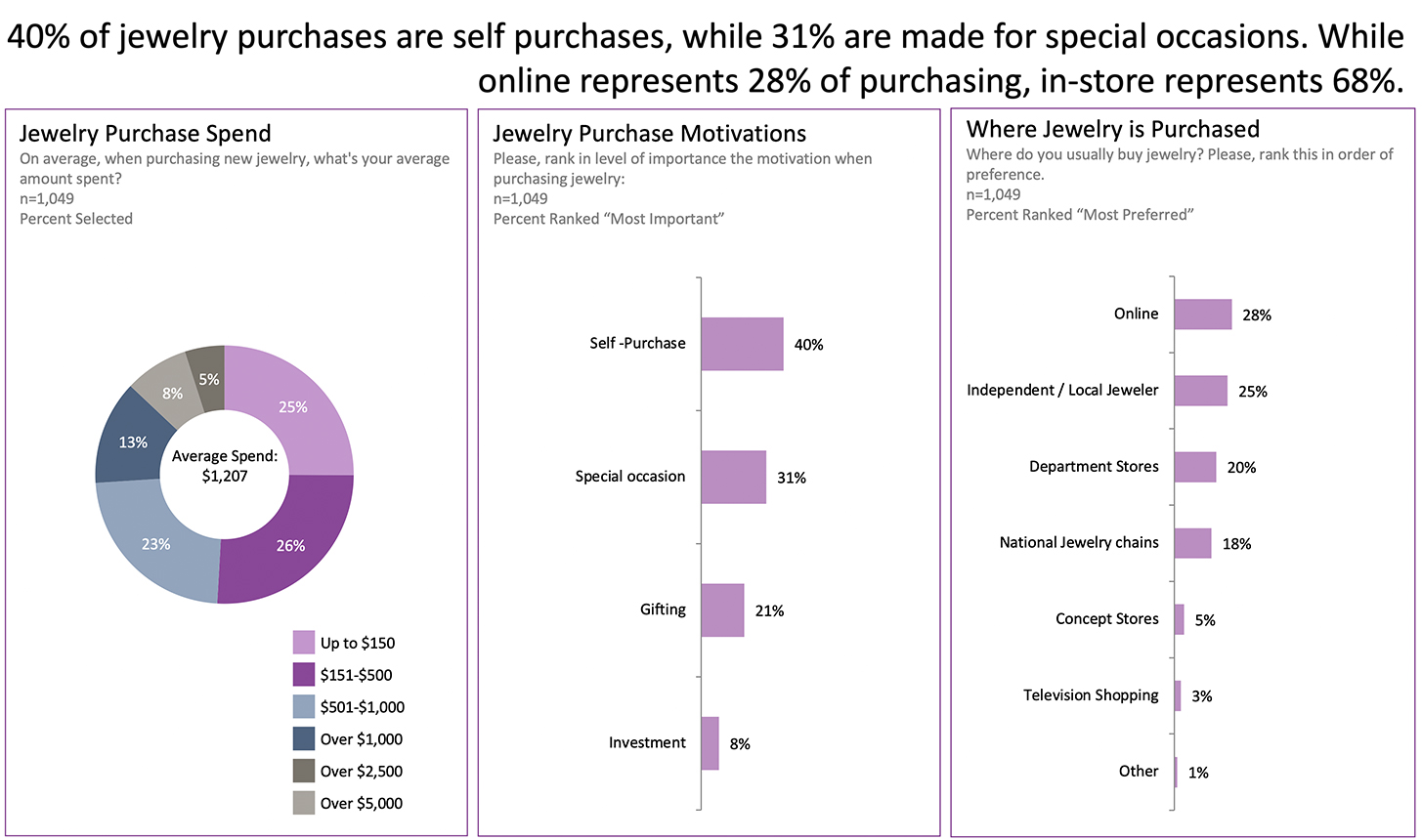

- When asked to rank “jewelry purchase motivations” in level of importance, self-purchase was No. 1 at 40%, with special occasion coming in second at 31%.

- $1,207 is the average spent on a new jewelry purchase, according to the survey. This average spend is significantly higher than research done only 2 years prior (Edahn Golan 2019). 57% of those surveyed said the availability of financing would influence their decision. The availability of retail financing may account for an average higher spend.

- 51% of those surveyed said they would only spend up to $500 on average when purchasing new jewelry. Although the percentages get smaller as the price point gets higher, 26% say they would spend from $1,000 to over $5,000 on a piece of jewelry.

- When asked where they usually buy jewelry, although 28% of participants said online, the majority, 63% still prefer to purchase in store at an independent, department store or national chain. 25% single out the independent or local jeweler. The good news – traditional brick-and-mortar retail appears to have many more years of life.

- Participants were asked to rank, on a scale from 1 to 10 (with 10 being most important), how important it is to them that their jewelry is responsibly sourced, sustainable and ethical. 20% ranked this consideration a 10. The average ranking was 6.5, which seems to indicate a growing awareness among consumers for socially responsible jewelry purchasing.

- 72% said they would be willing to pay more for a piece of jewelry that was sustainably sourced. 26% said they would pay “a great deal” more.

- “Quality” (31%), “Design” (23%) and “Uniqueness” (17%) are still the most important factors for a consumer looking for jewelry. The “price” of a piece ranks below all of these factors with only 16% viewing it as the most important factor.

Additional information from this expansive research will be shared over the next number of weeks. Any retailer wishing more information on The Plumb Club Industry & Market Insights 2021 should contact a Plumb Club Member. For a full list of The Plumb Club Members visit here or email info@plumbclub.com.

MORE STORIES IN THIS PACKAGE