Despite some positive business data coming out over the last two or three months, the economy is showing some signs of headwinds on the back of the tariff war being conducted by the government and some overseas economies. The uncertainty is beginning to show up in storewide figures across our sample data.

Sales showed a decline of 0.45 percent in rolling 12-month data for May, the fourth such month of declines in sales figures.

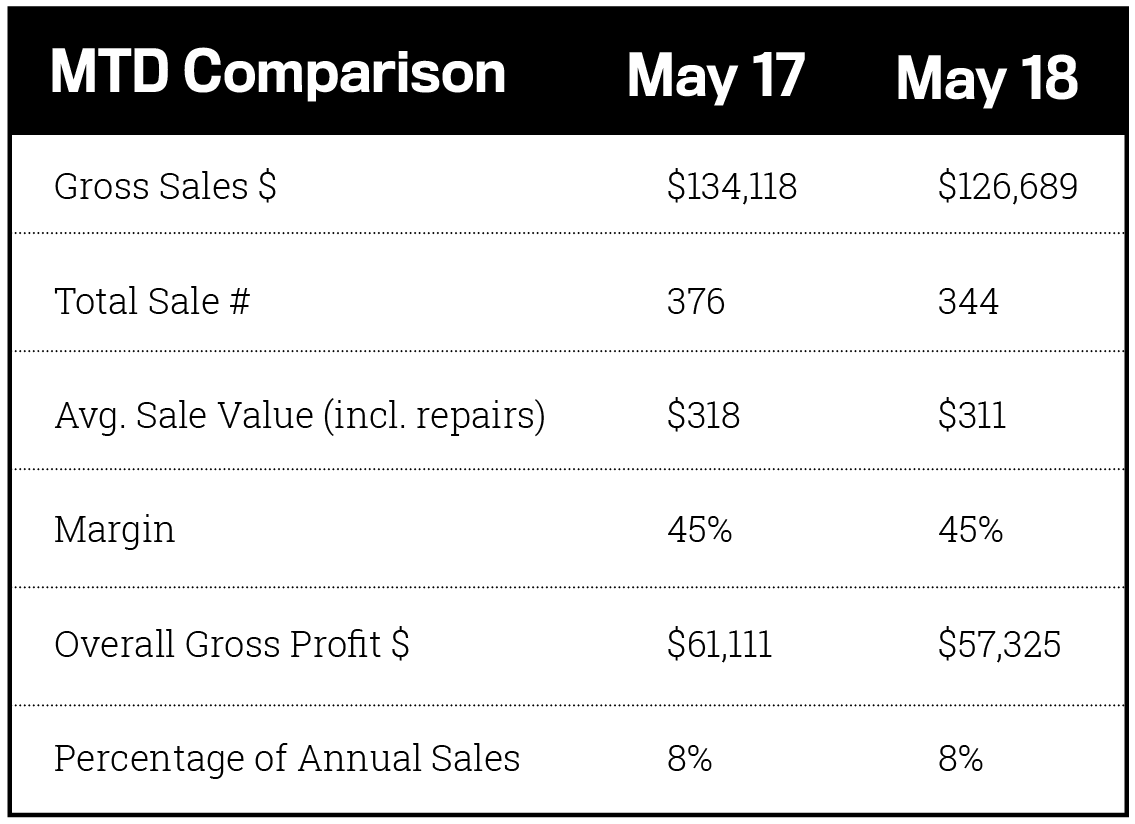

Individual monthly numbers reflect that decline.

Gross sales for May dropped 5.5 percent from last year’s monthly result. Sales units sold showed a similar trend, being down 32 units or 8.5 percent on last year’s numbers with an increase in average sale from $311 to $318, or 2.2 percent. Margin stayed on track compared to last year. This resulted in gross profit declining by $3,786, or 6.1 percent.

In these articles we’ve often spoken about the decline in gross profit margin being achieved. Preserving or growing your storewide margin doesn’t happen by chance – it is a strategy that must be followed in order to achieve results.

Advertisement

Here are some of the best proven ways to increase your storewide margin

1. Reduce discounting. Easier said than done, right? Reducing discount is about choosing what you are discounting and when you should offer it. Not all inventory items are equal. As we’ve mentioned on many occasions, as little as 10-20 percent of your product is giving you 80 percent of your sales. That means offering this item at full price is conducive to a substantial lift on the margin you will achieve. Rather than crumbling every time a customer asks for a reduction on any item, choose the ones you can do it on. Say “no.” Haven’t you had a situation where you’ve been told that’s the price and bought it anyway? Advise your customer, “Unfortunately, that’s the best price we can do on that item; however, if you’re looking for a deal, I can suggest this as an alternative.” This can have your customers choosing between a profitable sale for you or a reduction on a lesser item you want to move anyway.

2. Incentivize staff based on gross profit, not sales. Staff will focus on what is in their own best interests. If you’re more focused on gross profit than sales, your staff will become so as well, especially if you incentivize them from this perspective.

3. Put your prices up. What do others sell this item for? If you access our KPI data, you will be able to see this sort of information. If another store somewhere else is successfully selling that diamond for $200 more, why shouldn’t you?

4. Re-price fast sellers. Not only should you avoid offering discounts on your best-selling items, you should also be looking to sell them for more if they have proven they can handle the price. Again a small percentage of your products will provide most of your sales – you need to make the most from these opportunities where you can.

5. Reduce clearances. A few items on special are perfectly normal, but living constantly on sale is sending the wrong message to your customers. They will assume all prices are permanently negotiable, and this is not a position you want to put yourself in.

Advertisement

Managing your margin is an important part of your business and can yield huge returns on your bottom line. Don’t forget – every additional dollar of profit you can massage from each item will stay in your profit column without any additional costs being accrued.