INDEPENDENT JEWELRY STORE owners do some things better than their industry peers — customer service, product knowledge, community involvement — and some things worse, most notably in getting a decent return on their inventory (known as Gross Margin Return on Inventory, or GMROI).[/dropcap]

INDEPENDENT JEWELRY STORE owners do some things better than their industry peers — customer service, product knowledge, community involvement — and some things worse, most notably in getting a decent return on their inventory (known as Gross Margin Return on Inventory, or GMROI).[/dropcap]

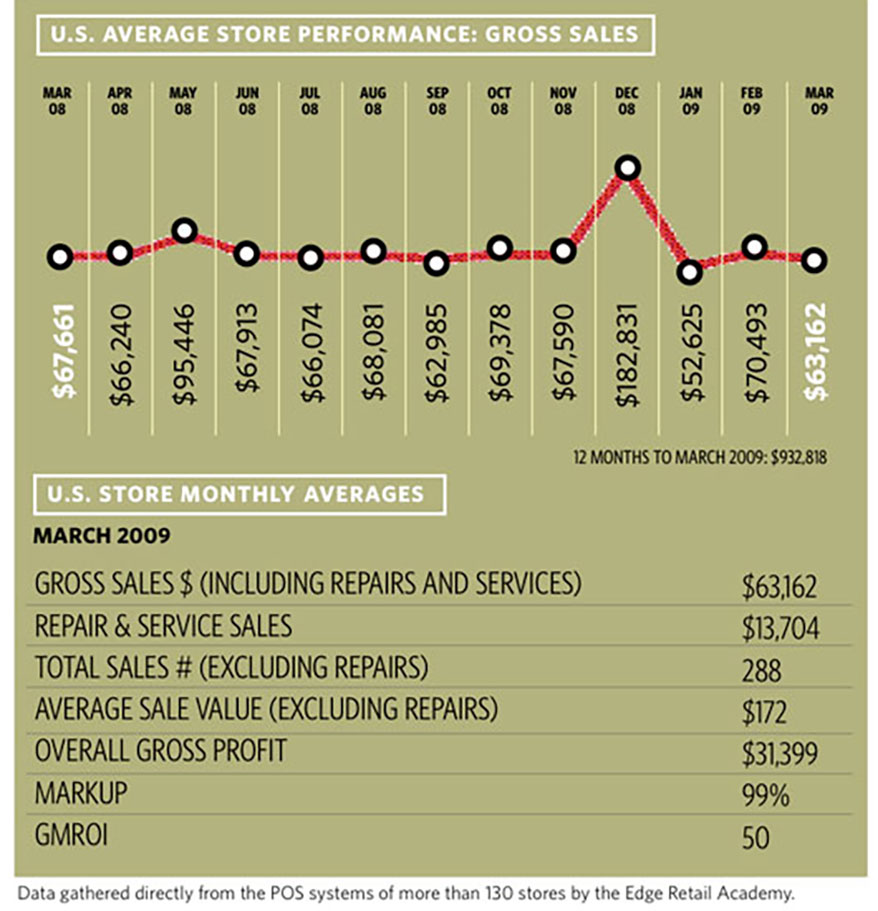

As you can see in the table, the average GMROI for the hundreds of stores in our survey from the last 12 months was 70, or a return of about 70 cents a year for every dollar invested. That’s not good.

It means too many stores are carrying too much inventory or applying too little markup.

The most successful stores are able to achieve a GMROI of 200 or more, often combining markups of 130 percent or more with a stock turn of 1.5 or better. That can mean huge differences in cash flow, profit and general store health. For example, if you are holding $500,000 of inventory and are achieving the average stockturn of 0.70, you have — by the standards of the country’s best independents — $250,000 invested that is giving you no return. That’s $250,000 you could be using to pay debt or invest.

The key to using the information we present each month in this column is to compare it to your own store’s performance and to identify opportunities. In this example, let’s say your store was doing a 0.70 stockturn — in line with the industry average, but your markup was only 90 percent compared to the average of around 100 percent.

- YOUR STORE 0.70 x 90% = 63 GMROI

- AVERAGE STORE 0.70 x 100% = 70 GMROI

Comparing your store to one achieving the industry average you would be generating an annual gross profit of $252,000 with a $400,000 stock investment ($400,000 x 0.70 x 90%). The average store with the same stockholding would be generating $280,000 in annual gross profit ($200,000 x 0.70 x 100%). The bottom-line difference? $28,000!

Advertisement

The same scenario would apply if you were achieving the industry markup but had a lower stockturn — an improvement in stockturn would generate more.

So, how to improve GMROI? Better inventory management, an awareness of the power of your best-selling products (and their margins) and a healthy markup. Many retailers believe they need a certain amount of inventory to support sales. That’s true, up to a point. But more inventory won’t automatically generate more sales. In fact, it can cost you sales if the old bloated inventory is stopping your customers from seeing your better pieces. If you have a stockturn of less than 1 then it is almost certain that you have more money tied up in inventory than you need.

This story is from the June 2009 edition of INSTORE.