July monthly sales data from our store comparisons has shown a decline in sales activity for the month compared to last year with a corresponding drop in our rolling 12-month sales also being evident.

Twelve-month year-on-year data for July was down 0.49 percent on June’s result with total sales of $1,589,470, down from June’s average store sales figure of $1,597,325. This represents the sixth straight month our rolling 12-month sales figure has declined, with this period having shown a total decline of 2.5 percent over the period in question. This would annualize to a sales drop of 5 percent for the year should the trend continue.

This represents the first six-month period of decline since April to October 2016, when the rolling 12-month sales showed a drop of 2.9 percent.

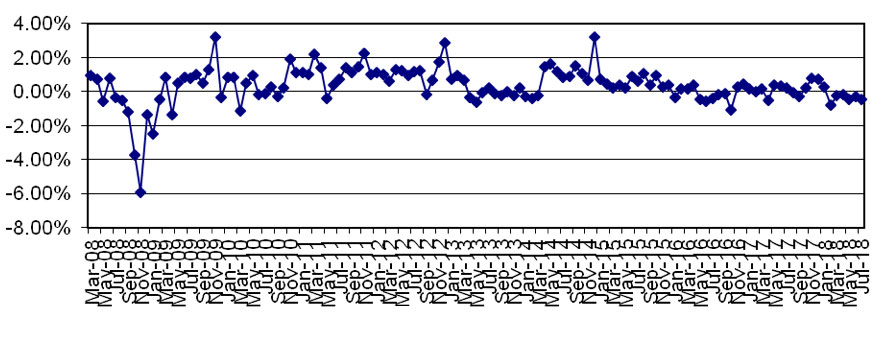

Monthly Percentage Change in Sales – YTD Sales Data

The trend line above shows that the monthly change in sales percentage has been running much closer to zero over the last two to three years following the initial heavy declines during the recession and strong growth coming out of it. That’s indicating that increases have been modest and declines haven’t been major when they have happened. What will be interesting to see, however, is next month’s result. A decline will be the seventh straight month that year-on-year sales dropped, and that is a figure we haven’t seen since the recession. Whether it is an indicator of a sustained period of sales decline will be the question.

Advertisement

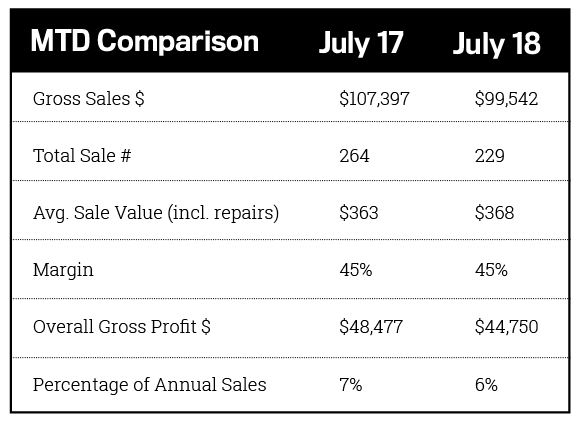

A quick comparison of monthly sales for July shows where the trend is coming from.

As the numbers show, July monthly sales saw a drop of just under $8,000 from $107,397 to $99,542. Unit sales were down 13.2 percent on last year’s number of items sold, with average retail sale increasing by 1.37 percent to partially offset the drop. Margins held firm at 45 percent, with gross profit dropping from $48,477 to $44,750, a fall of 7.68 percent.

So where is the decline coming from? Overall diamond sales continue to be healthy, with the fall coming across other departments, particularly silver, but this will vary on a store-by-store basis. It’s important to analyze your own numbers and see how they compare to this trend.

Grab a YTD report by department for this year versus the same time last year. How do you compare in sales over the two periods? If your sales are down, which areas are dropping? Is it diamonds? Colored stones? Gold or silver? How about watches? It’s important to isolate the problem area in order to take action.

Once you’ve determined the area that needs addressing, you need to delve further. Are you losing sales volume, or is there a drop in the average value being sold? If it’s sales volume, then you will be mirroring the trend across our same store-data. This raises questions: Are these people no longer buying, or are they buying elsewhere? Have they substituted the product that has declined in sales with other jewelry products. Other products altogether? Or are they not buying at all? The economic data seems to indicate that customers are still spending, so where is their money being spent if not on jewelry?

Advertisement

It’s important to understand that your competition is not just other jewelers, but anywhere else your customers can choose to spend their money. There has been a trend toward spending money on experiences over material items in recent years, particularly among millennials, and thanks to social media it’s not hard to see why. Before the internet, many would buy products as a means of displaying their wealth or uniqueness to others. Now they can enjoy an experience (a fancy restaurant, an overseas trip) and post it to their Instagram or Facebook as a means of demonstrating their success and to garner the admiration of their friends.

The successful jeweler of the future will recognize this and ensure that shopping becomes more than just a material purchase, but an experience in itself. Packaging the buying of jewelry into an overall experience just might be a way to establish a point of difference and claw back some of the money that has moved into other areas.