IT’S TIME TO GET down to the nitty-gritty. Last month, we introduced the theory of having separate income and cost of goods accounts in QuickBooks, and explained why this was the best way of keeping track of how well your store was doing. This month, we’re going to help you actually create those accounts.

To refresh your memories, for income, your three accounts were:

- Showcase Sales;

- Special Order & Memo Sales;

- Shop Sales (Repairs).

And for cost of goods, your complementary accounts were:

- Showcase Sales Cost of Goods;

- Special Order/Memo Cost of Goods;

- Shop Cost of Goods.

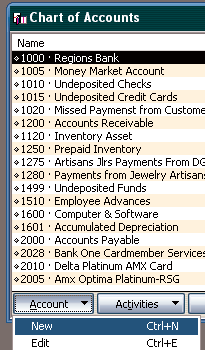

So let’s make these now. Go into QuickBooks and go to the Chart of Accounts. The easiest way to get this is by typing “Control +A.” At the bottom left of that window is a small box titled “Account.” Click that and choose “new.”(See First Figure)

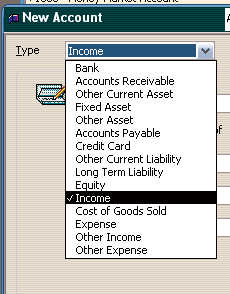

At the next window, you’ll see a menu called “Type” with the category “Bank” currently selected. Pull down the menu and change the selected category from “Bank” to “Income”. Then, in the “Name” box type “Showcase Sales”. Clicking on the “next” button saves the account you just created. Now that you’ve saved it, start with the next account. (See Second Figure)

Advertisement

Notice that the next window that comes up will automatically come up as an Income Account. Name the next account “Special Order/Memo Sales”. Click “next”, and do the same process for Shop Sales — or you can call it “Repair Sales”.

Now it’s time to create your “Cost of Sales” accounts. After clicking “next”, change the account type from “Income” to “Cost of Goods Sold”. Then, create a new category for “Showcase Cost of Goods”, click next, and create another for “Special Order & Memo COG”. Click next.

Now it’s time to create your “Cost of Sales” accounts. After clicking “next”, change the account type from “Income” to “Cost of Goods Sold”. Then, create a new category for “Showcase Cost of Goods”, click next, and create another for “Special Order & Memo COG”. Click next.

Now, it’s time to do our “Shop Cost of Goods”. In this case, we will continue to add sub-accounts under our Shop Costs. After you have created the “Shop Cost of Goods” and clicked “next”, do the following:

Type the name of the first cost of the shop, which is Jewelers Wages. Then right below the name is a small box titled “Subaccount”. Click the box and then the drop down arrow next to it will reveal the “Shop Cost of Goods” category. Choose it. Click “next” and then add the following sub-accounts one by one:

- Jewelers Wages

- Jewelers Matching Taxes

- Jewelers Benefits

- Findings/Gold/Mounting

- Small Shop Stones

- Gas & Oxygen

- Shop Tools

What you have just entered is sub-accounts that cover all the different costs of having a shop. And in the future, instead of choosing “Payroll Expenses” when you have to account for the paycheck of your jeweler, you choose “Shop Cost of Goods Sold: Jeweler’s Wages”

Then when you put all your shop sales in the income area, and all of your shop costs in the costs of goods area, you’ll finally know whether your shop is profitable or not.

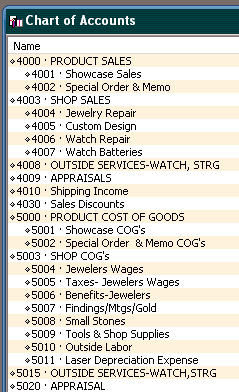

Once finished, your Chart of Accounts should look something like this (See Third Figure).

Once finished, your Chart of Accounts should look something like this (See Third Figure).

Advertisement

Next month, we’ll start to show you how to enter your sales into these accounts by using our Point-of-Sale program data and a simple journal entry. (If you don’t own a Point of Sale program, my “QuickBooks for Jewelers” program shows you how to use QuickBooks without a jewelry-specific point-of-sale program, but the simple fact is you’ll run your business better with one than without one. ) QuickBooks on its own is a poor inventory management program. Remember: we aren’t using QuickBooks for inventory management here, we’re using it for money management.

In the meantime, you can start using the “Shop Cost of Goods” we just created. But don’t start using the other income and cost of goods categories yet. Because we’ll have more to teach you on these next month.

Here’s a teaser for you. When you bring inventory into your jewelry store the bill or check is not for “Cost of Goods”. It’s an “Inventory Asset”.

Jewelry is an asset and stays that way until the day it sells. Then, and only then, does it magically transform itself into “Cost of Goods”.

More next month.

This story is from the March 2005 edition of INSTORE.