LESS THAN A decade ago, Mark Mitchener, owner of Mitchener Farrand Jewelers in Oklahoma City, was an avowed skeptic when it came to selling lab-grown diamonds in his store.

I’m kind of a purist and I’ve never sold anything other than natural,” Mitchener says. “I never sold laser inscribed, clarity enhanced. I never sold moissanite. My grandfather was in the diamond business, and I really am passionate about diamonds. I have seven different patents for diamond cuts.”

Reluctantly, though, in 2015, he began advertising that lab-grown diamonds were available. Sales grew steadily to the point that in 2021, lab-grown diamonds surpassed mined.

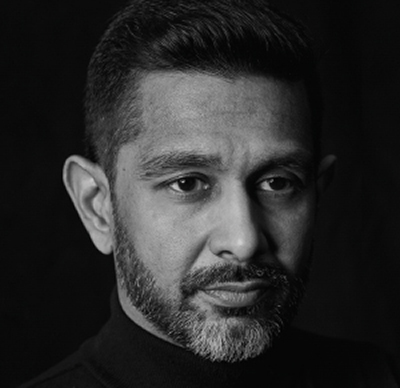

He wasn’t the only skeptic. Amish Shah of ALTR Created Diamonds, for example, said he was surrounded by skeptics, who laughed at him in 2006 when he tried to sell lab-grown diamonds. But by 2016, ALTR diamonds were being graded by Gem

Amish Shah of ALTR Created Diamonds

Amish Shah of ALTR Created Diamonds

Certification and Assurance Lab (GCAL), and today, ALTR’s best-selling diamond has surpassed 2 carats.

“The journey has been amazing,” Shah says. “Everybody thought this was a discount product. We took the position that a product is never discounted. How you sell it determines its value. A retail footprint is always a platform and what the retailers offer is the experience. The purchase price is only a percentage of the transaction.”

Shah says that consumer acceptance of lab-grown has been well established. “In 2016, the question was, ‘Why lab-grown?’ Today, the question is, ‘Why earth-mined?’”

Zulu Ghevriya, CEO and creative director of Smiling Rocks, says U.S. consumers were the first in the world to wholeheartedly accept lab grown diamonds, a phenomenon that has driven retailers’ interest in the segment. “In the last three years there has been a 360-degree change in retailers’ interest in lab grown,” he says. “Seventy-five to 80 percent of American retailers are somehow testing it in their retail stores.”

Lab-grown diamonds, he says, represent an $80 billion industry that will run parallel to the mined diamond industry. Interest is growing, too, in Europe and in China.

Mark Mitchener with co-worker Lily.

But some independent retailers don’t want to make the leap, citing tradition, romance and symbolism. Alan Rodriguez, owner of Julz by Alan Rodriguez in Canton, OH, says customers do inquire about lab-grown diamonds, but the majority of those inquiries lead to the purchase of a natural diamond after he explains why he does not sell the lab-grown variety. “I have a difficult time entering that arena,” he says. “When I think of a natural diamond, there is something that suggests forever. There’s something very romantic, something very committing. I want everyone to believe in that commitment, and so I tell the staff as long as I can pay my bills and I can have a satisfactory quality of life, I’m going to stay with natural diamonds.”

Gabrielle Grazi is VP of retail strategy and partnerships for the Natural Diamond Council, whose seven mining company members represent 75 percent of the world’s rough diamond production. Grazi says lab-grown diamonds have their place in the jewelry market.

Advertisement

The NDC’s position continues to be that lab-grown diamonds are not a luxury product. But the group has made an effort in recent years to reinforce positive aspects of natural diamonds and the good that NDC members do in mining communities, rather than being defensive about the lab-grown business. Recent marketing campaigns emphasize how companies support their mining communities with education, wildlife protection and health care. The “Thank you, by the Way,” campaign, which reaches out to retailers with boxes of marketing materials, is designed to provide education for retailers and their customers about those talking points.

“It (lab-grown) is a category that’s going to exist,” Grazi says. “We’re taking the high road. All you can do is educate the consumer about both.”

The buzz around lab-grown diamonds has sparked a years-long heated debate while reawakening the industry, says Avi Levy, president of International Gemological Institute of North America. “I think we got a little stale over the years, and this gave us something to look forward to, adapt to, be creative for, and pushed up the natural diamond guys’ game. It’s helping the industry get re-energized.”

Cora Lee Colaizzi, marketing director and senior merchandiser for Quality Gold, agrees. “Lab-grown diamonds are the biggest thing our industry has had to talk about in the last several years,” she says. “The product appears in pop culture and on the runway. Customers will have heard of them and will walk through the door with questions.”

Alan Rodriguez in his Canton, OH, store, Julz by Alan Rodriguez

In 2018, the Federal Trade Commission ruled that a diamond is a diamond whether it is grown in a lab or comes out of the ground. They are now graded and accompanied by reports from certifying laboratories and have blossomed into a multi-billion dollar business. In 2018, De Beers introduced their own lab-grown diamonds under the Lightbox label, throwing shock waves into the industry when they priced them at just $800 a carat. Last year, Lightbox began selling loose lab-grown diamonds as well, online and in stores, and introduced a “finest” colorless category at $1,500 a carat.

As technology improves, putting 2-carat diamonds in reach of more budgets has driven aspirational diamond purchases, both lab and mined. And couples who couldn’t afford a diamond at all now may be able to, leading to a democratization of diamonds, says George Prout, president of Revelation Lab Grown Diamonds.

“The Truth is, Size Matters”

In March, MVI Marketing surveyed 754 U.S. consumers, ages 20 to 35, with household income greater than $50,000. After the quality, size and price equation between natural and lab-grown diamonds was explained, 44 percent said they would purchase a lab-grown diamond, 32 percent preferred a mined diamond and 22 percent weren’t sure. Seventy-two percent said they already were at least aware of the existence of lab-grown diamonds.

“The truth is, size matters,” says Liz Chatelain of MVI Marketing. “If you can get a bigger diamond and it’s a real diamond, that really matters.” When the lab-grown is 30 percent bigger, most consumers, and especially the younger consumers who make up the bridal market, opt for the larger stone. “All engagement rings are going to get bigger,” she says. “They’re picking bigger stones and also increasing their budgets.”

Ghevriya says Smiling Rocks routinely has 2 to 5 carat lab-grown diamonds available in D, E and F colors, and they have produced diamonds up to 10 carats. Fancy shapes are increasingly in demand, particularly oval and emerald cuts.

Virtual Diamond Boutique reports that in both 2021 and 2022, 1.5 to 3.0 carats have represented more than half of all searches for lab-grown diamonds, while this size accounted for only 35 percent of searches for mined diamonds.

In mined diamonds, VDB still sees very dominant round diamond search behavior (65 percent). But in lab grown diamonds, round diamonds are less than 50 percent of search. As for shape, ovals account for more than 10 percent of search in mined diamonds, but 18 percent of search for lab grown, indicating there’s increasing growth potential for fancy shapes in lab grown.

Mitchener, who initially imagined the lab-grown option would appeal only to young people, has discovered that in his market they are popular with all ages. “I love selling diamonds. Period. Diamonds that come from the earth and diamonds above the earth. It’s exciting, to tell you the truth. It’s amazing how well they do.”

In fact, Prout says Gen X and baby boomer women experiencing FOMO (fear of missing out) may turn out to be one of the biggest demographics for continued growth as they see more lab-grown diamonds in finished jewelry, from eternity bands to studs and statement necklaces.

Galinteriors created this prototype shop-in-shop for Revelation Lab Grown Diamonds, which will be introduced at the company’s Plumb Club booths during JCK Las Vegas. President George Prout says it’s helpful to differentiate lab-grown and natural diamonds when selling them in a store, both for those customers who want to see them, and for those who only want to see mined diamonds.

Mitchener shops for lab-grown much like he does for mined diamonds, looking for the best color and brilliance, polish and symmetry. “I buy the most beautiful diamonds there are. I’m comfortable with what I buy, and so I will take them back and exchange them.

“Ice from a freezer is still ice, which is what we’re saying about lab-grown diamonds. We’re just there to help you. We give you the information so you as a consumer can process it.”

Mitchener, a customer of GN Diamond, handles lab-grown diamond exchanges in the same way he handles natural diamonds. Customers can exchange center-stone diamonds for anything in his showcase; if they want to upgrade the diamond, he offers credit for the amount they paid. “I have no idea what the value will be over time,” Mitchener says. “I do know this: Since I’ve been selling them, they’ve gone up. As more and more people got on board with it, I thought the value would come down, but that hasn’t happened.”

Asaf Herskovitz, CEO of GN Diamond, was initially opposed to lab-grown diamonds. “We’re more of a purist,” he says. Since that time, GN Diamond has become one of the largest lab-grown distributors for retail jewelers, partnering with small family businesses. “We don’t sell to e-commerce or the chains,” Herskovitz says. “We speak to thousands of independents every day, and we hear that not only is there so much demand for lab, but that they are starting to carry it for particular sizes that would not be in the clients’ budget for natural diamonds.

“Just like us, a lot of retailers did not want to present it when the customer was asking for it and were willing to send their clients to a competitor. I believe they are changing their minds now. It’s exciting to see a segment that is growing as fast as this is.”

Prout, of Revelation Lab Grown Diamonds, is on a mission, he says, to educate retailers about lab-grown diamonds and to help them take advantage of the extraordinary opportunity they represent. “It’s been raining money since everybody reopened in 2020, and our vertical has disproportionately benefited,” he says. “The lifeboat to get through the next contraction may very well be lab. My anecdotal experience with stores that embraced labs last year is the number sold as center stone engagement rings will exceed 50 percent. It’s incredible. There is a huge shift.”

Prout cautions that dozens of companies selling loose lab-grown diamonds will eventually be unable to make money and will begin to sell direct to consumer. “What’s the landscape going to look like in 18 to 24 months? All of these people will have to find a different way to make a profit and they will become internet retailers.”

He recommends retailers develop a solid relationship with suppliers that are also growers and manufacturers of finished jewelry. “Demand is bigger than supply right now, but when supply grows, that’s when it will be very beneficial to have partnered with the right supplier.”

Prout says that though evolution in the marketplace will move some sellers into a B2C configuration, that won’t be the case on the mounted jewelry side because shoppers will want to go to the store and try it on. “As jewelers discover people love lab-grown diamonds in mounted jewelry, that’s where the real potential is,” he says. “The sell-through figures will be shocking.”

What’s the Truth About Sourcing?

Although many consumers are driven by the desire to supersize their diamonds, in some markets the motivation may extend to sourcing concerns.

“They really want to know that it wasn’t mined, that’s their main thing,” says David Iler of Alchemy Jewelers in Portland, OR, of his own customers. Iler has sold lab-grown diamonds along with lab-created colored gemstones from

Chatham since he opened his store in 2005. His shoppers have done their research and know what they want. But he does find it strange that customers don’t ask much, if anything, about how and where the lab-created gems were grown.

Prout says that although details of sourcing may not be a huge talking point in lab-grown circles right now, once everyone is selling lab-grown, such key differentiators as third-party certification of responsible business practices will drive market share.

Jenn and Andy Koehn of Koehn & Koehn Jewelers in West Bend, WI.

Jenn and Andy Koehn of Koehn & Koehn Jewelers in West Bend, WI.

Eighty nine percent of respondents to the MVI survey said they would pay a premium for fine jewelry that was produced with minimal environmental or social impact. Eighty-six percent said they would pay a premium for traceability of the jewelry’s components (such as diamonds, colored gemstones, metal, and pearls) back to the country of origin.

Levy says lab-grown diamonds should not be described as “sustainable” without proof. Enormous energy is required to produce them, and the vast majority of growers burn fossil fuels. A handful, however, have developed sustainable operations, documented by third-party auditors. One source of third-party verification is SCS Global, which certifies 14,000 different products, from fish and lumber to lab-grown diamonds. “What is true is what you can prove at retail,”

Chatelain says. Another third-party verification source is Positive Luxury’s The Butterfly Mark, Prout says, awarded to luxury brands showing clear commitment to sustainability throughout all areas of business.

Kate Peterson of Performance Concepts says honesty is essential. “These aren’t labs; they are factories,” she says. “The term ‘lab’ implies a few things. A pristine environment. One little scientist tinkering with one little machine. We have to start thinking about the messages we’re sending to the consumers and that what you say today and tomorrow must match up.”

Chatelain says there will be two segments of this sector. One is the retailers who have certificates, who know where the product comes from and can talk intelligently about it. “And the other kind of retailer who talks about price, price, price and if a consumer asks questions, they’ll just say, ‘It doesn’t come out of the Earth and so it has to be better.’”

Advertisement

How to Sell Lab-Grown Diamonds

Prout says the absolute worst way to sell lab-grown diamonds is to tear down natural diamonds.

“I don’t want to teach the staff to sell against mined,” he says. “The mined diamond business is what has positioned all of us with this incredible societal imperative to buy a diamond. The way to position lab-grown is as a step up.”

Prout says a bride doesn’t want an engagement ring because it is cheaper, necessarily, but it’s enticing to hear that she can have a bigger, higher-grade diamond for just a thousand dollars more. Emphasize the features and benefits and don’t assume that they appeal only to younger millennials and Gen Zs. “Every single woman who walks in a jewelry store should try on a 2-carat and maybe even a 3-carat,” he says.

While symbolism is often cited as a sales driver for natural diamonds, Andy Koehn, owner of Koehn & Koehn Jewelers in West Bend, WI, says symbolism is in the eye of the beholder. “I tell people to go with their gut because whether it’s natural or lab-grown, it is a symbol, and it is between the two people and whatever they want to communicate out to the world. I have my personal belief of what I would do, but this is so up to you. Don’t let my bias influence you.”

Finished jewelry, such as these lab-grown diamond pieces by Smiling Rocks, show tremendous potential for retail growth, experts say.

Some companies are creating new ways to express symbolism and romance through marketing concepts.

Monica McDaniel, communications director of Chatham Created Gems & Diamonds, says that one of the taglines they use to support retailers is “True Love Grows.” Chatham’s authenticity and grading reports include the growth year of that diamond. “We can offer them a diamond that grew the year that they met,” she says. “It’s about the importance of connecting that emotion to jewelry, whether it’s a diamond or a colored gemstone. The value for jewelry goes far beyond the monetary volume.”

That’s a message Chatham wants to instill in its retail partners, as well.

Smiling Rocks Lab Grown Diamonds puts its branding focus on philanthropic engagement, giving 3 percent of the proceeds of finished jewelry and 1 percent of the proceeds of loose diamonds to high-profile global causes that include 4 Oceans, an organization dedicated to pulling trash from the ocean as well as a portfolio of charities that support education, animal welfare and the environment. “End consumers are looking for brands that stand behind causes,” says

Ghevriya. The company is also working toward membership in Positive Luxury for Butterfly Mark certification. “We are building a community that believes in this,” Ghevriya says.

Chatham has been growing gemstones since Carroll Chatham perfected the process to grow emeralds in 1938.

The Lightbox Effect: Where is the Price Going?

When De Beers debuted Lightbox Created Diamonds at $800 a carat, it was a shock for many in the industry. But the Lightbox price hasn’t affected Chatham. “If anything, I think it solidified lab-grown diamonds as a choice by using the terminology of diamond, because companies like De Beers had until that point always referred to them as synthetic,” McDaniel says. “We consider synthetic a misnomer; it confuses the customer. But now, with Lightbox, they were using the right terminology, so it almost helped.”

“I think just like mined diamonds fluctuate, you’re going to see that with lab-grown diamonds,” McDaniel says. “It’s part of the nature of the beast. It’s always a risk, but there is value in a lab-grown diamond.”

Ron Caine, owner of Rocky Mountain House and Caines Jewelers in Alberta, Canada, says he doesn’t put much stock in the resale value argument against lab-grown diamonds. “If I sell a natural diamond for $10,000 and later buy it back for $5,000, the client has lost $5,000,” he says. “If I sell them a lab-grown for $5,000 and won’t buy it back, the client has lost $5,000. Same result, but the client is $5,000 ahead (cash in pocket) at the end of the lab-grown scenario. In my opinion, the greater problem is the idea of selling jewelry as an investment. It’s not. It’s a symbol commemorating a special event in their lives, not a retirement vehicle.”

Jackie Johnson of Crabtree Consulting

Jackie Johnson of Crabtree Consulting

David Iler of Alchemy Jewelers says prices have not yet come down as much as he thought they might. “Lightbox advertising must not be working, because if it were working, it would have undermined the industry,” he says. “People who want lab-grown want it for two reasons: One, that it’s not mined, and two, because it’s affordable. But if people have unlimited budgets, I think they still will want natural diamonds.”

Kate Peterson believes retailers are leaving money on the table when they present mined and lab-grown diamonds as exactly the same product. The price and value of lab-grown diamonds will inevitably fall, she says, while the customer likely expects lab-grown diamonds to behave exactly like other jewelry items have in the past that they’ve purchased from their trusted retailer.

Peterson cautions, “When there’s no limit to production at all, there’s no bottom to the price. Right now, if 80 percent of your bridal is in lab-grown, is it because your salespeople are saying ‘Do you want natural or lab-grown?’ even if 30 or 40 percent of them would have bought natural? If you are selling it accurately, then tell them it will be selling for less at some time in the future.”

She said retailers don’t believe they’re shortchanging themselves because they are making better margins for now. On the other hand, a $2,000 mined diamond will produce almost the same margin as a $1,000 or $1,500 lab-grown diamond. Peterson said that while wholesale prices are dropping relatively quickly, retailers are still trying to make the same margins.

Modify the sales script to fit your store brand and keep in mind that it’s important to really listen to customers, she says.

“Position it as a product that has tremendous value for the customer who has that level of interest. Understand that if the customer is 100 percent interested, you have an obligation to explain what the product is, pros and cons. It’s not OK to say we really don’t know what’s going to happen with the price because you know that every day, new growers are coming aboard and technology is getting better. They will get less expensive to produce and less expensive to buy. But it can still be a good choice within the customer’s budget.”

Herskovitz of GN Diamond says that although technology is improving, it’s still costly to produce lab-grown diamonds, and he believes the price has stabilized. “The difference between CZ and moissanite and lab-grown is that with lab-grown, you still need to buy the rough and then cut and polish it. There are carrying costs. Energy costs are going up. I believe this thing has bottomed. I think the prices will get firmer. And I don’t think it takes away from the natural.”

Prout says that although the trajectory of future pricing is unclear, two important events are likely to impact the model. “First, the way we compare prices in terms of a percentage discount on Rap is an artifact of the way mined is priced, and makes no logical sense in the world of lab. I suspect we’ll see lab prices detach from Rap, so that instead, we’ll be talking about the price of an F VS stone as a comparative.

Advertisement

“Second, the fact that when you plot price against stone size you get an exponential curve also defies logic, so I’ll speculate that over time, prices as stones get larger will become increasingly linear, which in turn will make lab-grown diamonds in the 3 to 5 carat range even more accessible to consumers.”

Jackie Johnson of Megan Crabtree Consulting was the branded jewelry buyer for all 15 Robbins Brothers locations, one of the first retailers to carry lab-grown diamonds over a decade ago. “In the early stages, there were a lot of poor goods coming through, and now the way they’ve advanced technology, it’s getting bigger and better,” she says.

Johnson says lab-grown is in its settling stages. “You can build a house and have the best contractors, but it really depends on the foundation. Do I think prices will continue to drop and lab-growns will get bigger and better? Probably, but it’s more important to be educating the consumer on the product that you are selling.”