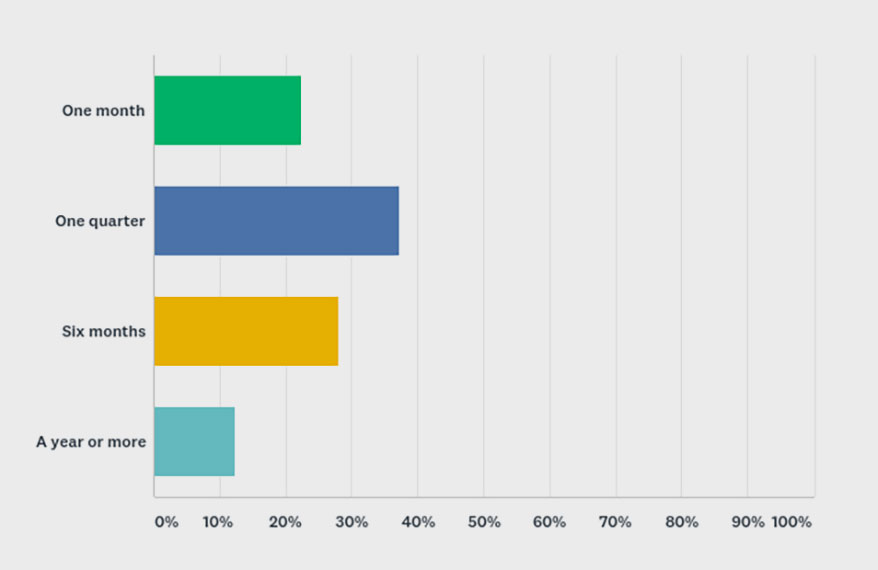

WHEN ASKED HOW long their businesses could survive if the current retail climate remains the same, only 42 percent of jewelry retailers surveyed said they could make it six months or more. One in five jewelers surveyed said they would not make it a month before the existence of their business was threatened.

Even so, retailers are seeking ways to make money and lessons they can learn. Denise Oros of Linnea Jewelers (La Grange, IL) compared the current situation to the early days of The Great Recession: “The economic downturn of 2008-2009 taught a lot of us very valuable lessons on living lean. I never thought I would have to revisit the economy at those times. We lost a lot of good jewelers who were overstretched with merchandise, memos, and loans. The ruthless lessons garnered during that hardship taught many of us that we needed more rainy day money saved up and encouraged the average jeweler — not just the pawn shops — to buy gold! We survived!”

However, she went on to express anxiety over what lessons will be learned from the current challenge: “Will it be how the government assists small businesses? Will it be how to liquidate? Will it be a vast understanding of unemployment and HR policies in times of crisis? Will it be how to do all business online and by private appointment via FaceTime? What is the next step we need to be aware of for future survival?”

Other retailers are smartly searching for business loans to help them weather the economic storm. “Are there any lenders out there that can help with payroll and general expenses during this coronavirus outbreak?” asked Owen Sweet of Owen Sweet Design (St. Pete Beach, FL). Likewise, Ellie Thompson of Ellie Thompson + Co. (Chicago, IL) wrote, “I’m keeping an eye out for an SBA loan. I’m hoping there is a streamlined process — I have a new store without years of financials. I’d love more info on how SBA loans work.”

The rapid descent of jewelry sales is what has many store owners so concerned. “Business was the best it has been in a very long time and goes to next to nothing in a week. Very depressing and a worry what will happen next,” said Kent Jester of Klasse Jewelers (Florence, KY).

Advertisement

Perhaps Gary Astrein of Astrein’s (Birmingham, MI) put it best, writing, “All things must pass, but at what price?”