(PRESS RELEASE) LAS VEGAS, NV — Diamond prices increased in February as higher rough costs forced manufacturers to raise their polished valuations. The market is being supported by US demand, but economic and geopolitical uncertainty have generated cautious sentiment in the trade.

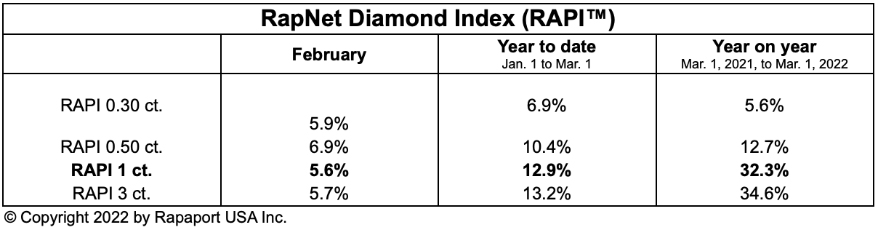

The RapNet Diamond Index (RAPI) for 1-carat diamonds gained 5.6% in February and was up 12.9% since the beginning of the year as of March 1.

High US inflation, the promise of interest-rate hikes and the lingering coronavirus pandemic are fueling doubt and weighing on consumer sentiment. Russia’s invasion of Ukraine and US sanctions on Alrosa have brought additional fragility to the market.

The sanctions, which target Alrosa’s ability to obtain credit, also saw Russian banks removed from international payment schemes. Delayed money transfers to Alrosa will likely disrupt supply from the miner — the world’s largest volume producer — and may result in rough shortages.

Scarcities were already apparent in February before the Ukraine crisis as lower production and structural changes to how rough is distributed has affected the secondary market. Rough on the dealer market and at auctions was selling at high double-digit premiums compared to De Beers’ January prices. Demand was robust at the February sight where De Beers raised prices for smaller goods an estimated 5%. Auction prices softened later in the month.

Rough-market trends drove expectations for higher polished prices. Some polished suppliers were hesitant to sell as they anticipated inventory valuations would rise further. Buyers became more restrained toward the end of February due to concerns about rising prices along with economic factors affecting consumer confidence. Initial reports from China signaled a more prudent consumer environment during the Lunar New Year.

Momentum has continued for the diamond industry in 2022 following the strong growth experienced last year. However, the market is fragile due to the volatile supply situation and weakening consumer sentiment. The lack of clarity about the market is adding caution.

Advertisement