1. Given the disruption of the last six months, what percentage of your inventory is now over one year old?

| Less than 10% |

|

5%

|

| 10 to 20% |

|

8%

|

| 21 to 30% |

|

18%

|

| 31 to 40% |

|

22%

|

| 41 to 50% |

|

14%

|

| More than 50% |

|

33%

|

COMMENT: Consultant David Geller likens aging inventory to people slowly gaining weight. They think “I’m OK,” but being overweight hurts all aspects of one’s health. “Having too much year-old inventory causes debt, and jewelers focus on the problems it brings (like being sick) rather than being proactive about it,” he says. The SBA loans gave jewelers a lifeline, but those bloated inventory levels will need to be addressed soon, he warns.

Advertisement

2. What were your total sales in 2019? (If you have more than one store, tell us the average per store).

| Less than $100,000 |

|

5%

|

| $100,000-$249,999 |

|

12%

|

| $250,000 to $499,999 |

|

18%

|

| $500,000 to $999,999 |

|

24%

|

| $1 million to $1,499,999 |

|

15%

|

| $1.5 million to $2,999,999 |

|

15%

|

| $3 million to $5 million |

|

6%

|

| More than $5 million |

|

5%

|

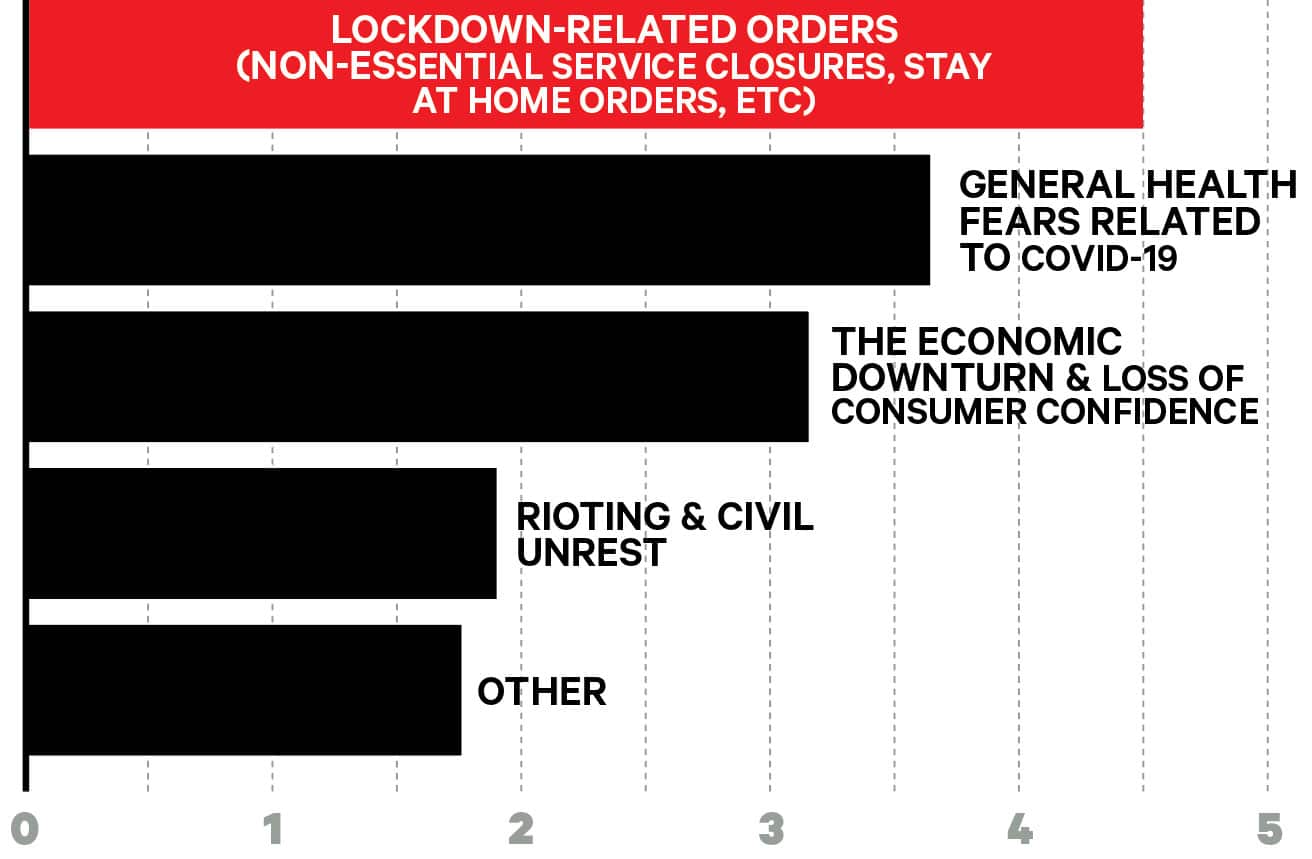

3. What’s had the biggest impact on your financial performance this year? (The results reflect a weighted average with “5” being the maximum score.)

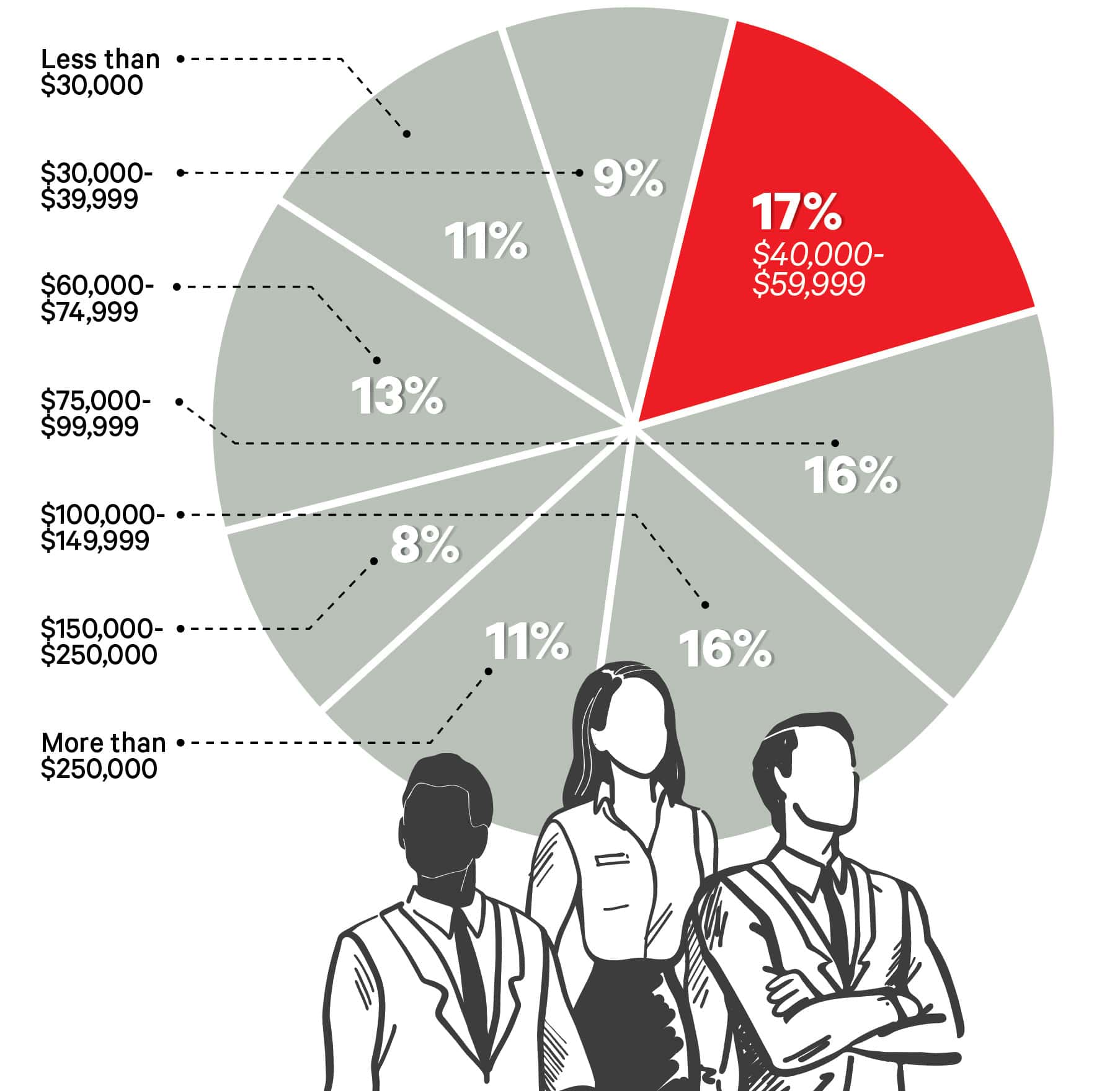

4. As a store owner, what did you earn (salary + share of profit) in 2019?

- 78% of the jewelers making over $150,000 a year were men, even though men accounted for 61% of respondents.

- At the lower end, women were over-represented, accounting for 49% of those earning less than $40,000.

- There was a clear link between a focus on bridal and how much a jeweler made: For the lowest-earning jewelers, only 5% said bridal was their strong point. For those in the middle, 16-24% said bridal allowed them to stand out. At the top, 35% said bridal provided their edge.

- 68% of the jewelers earning over $150,000 were 60 or older.

Advertisement

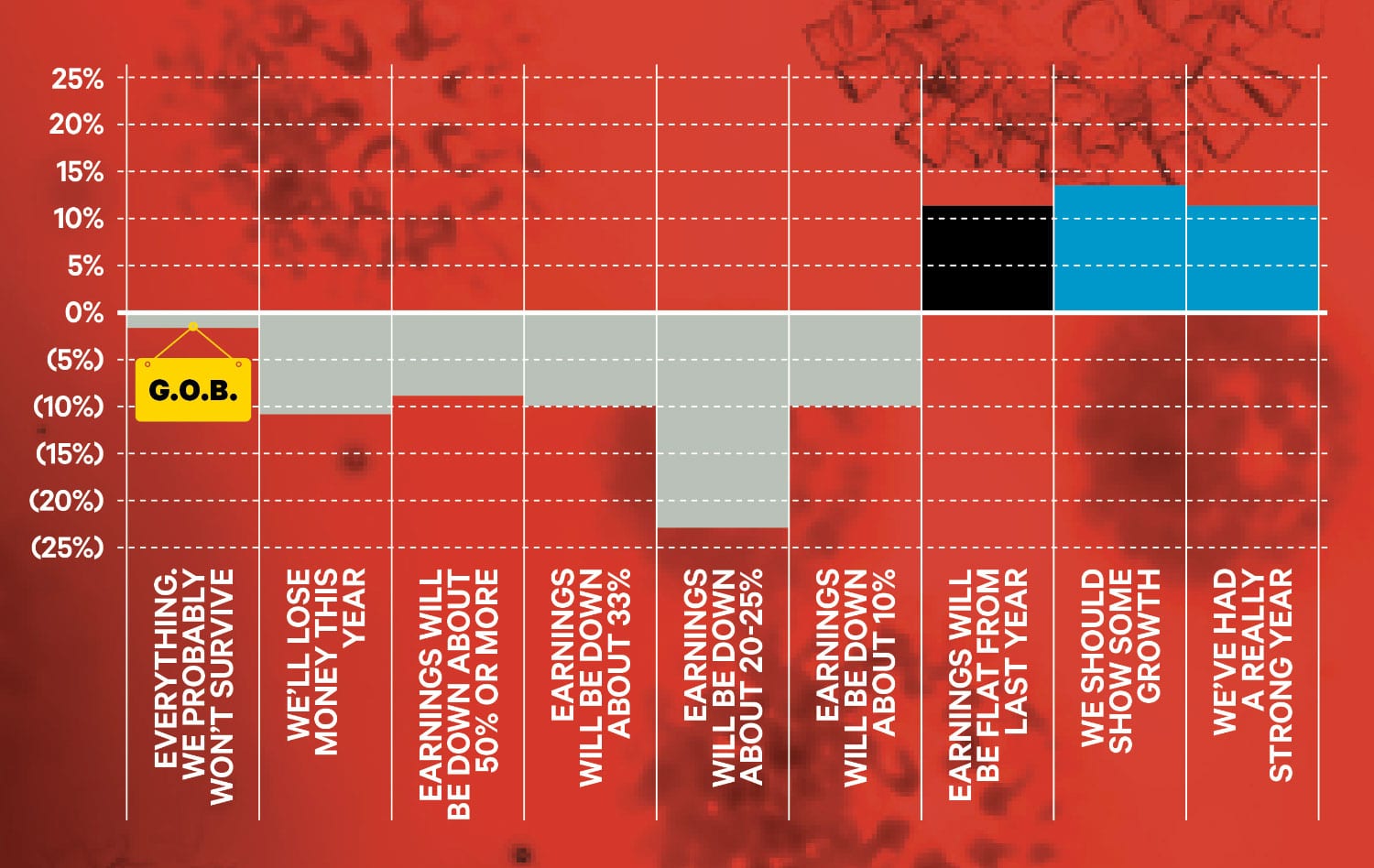

5. What do you estimate COVID-19 will cost you financially in 2020?

6. Has the surge in the price of gold been good for you?

| Yes |

|

24%

|

| No |

|

27%

|

No net impact

|

|

46%

|

Advertisement

7. Has your gold buying off the street increased significantly this year?

| Yes |

|

30%

|

| No |

|

48%

|

| We don’t buy gold off the street |

|

22%

|

8. Have changes to tariffs affected the cost of anything you buy for the store?

| Yes, significantly |

|

8%

|

| Yes, minimally |

|

38%

|

| No |

|

54%

|

COMMENT: Boxes, wrapping materials and display elements were the main products affected by the increased tariffs on Chinese-made goods. There have also been new compliance issues and increased red tape. “I am done with paying tariffs for my packaging goods,” said one jeweler. “Shifting to American-made goods but not a lot of dramatic savings. That’s been disappointing.”

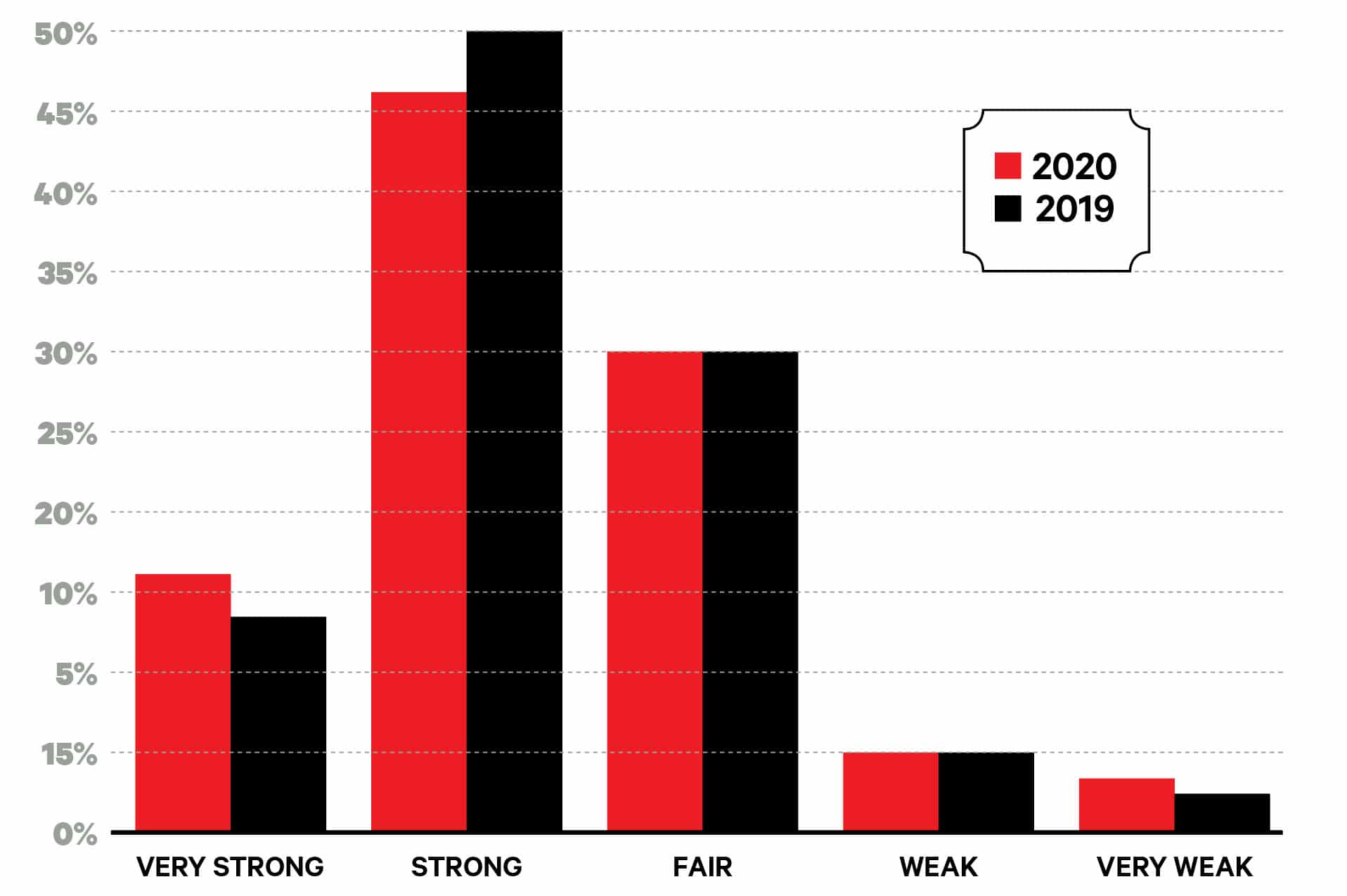

9. How would you assess the strength of your business right now?

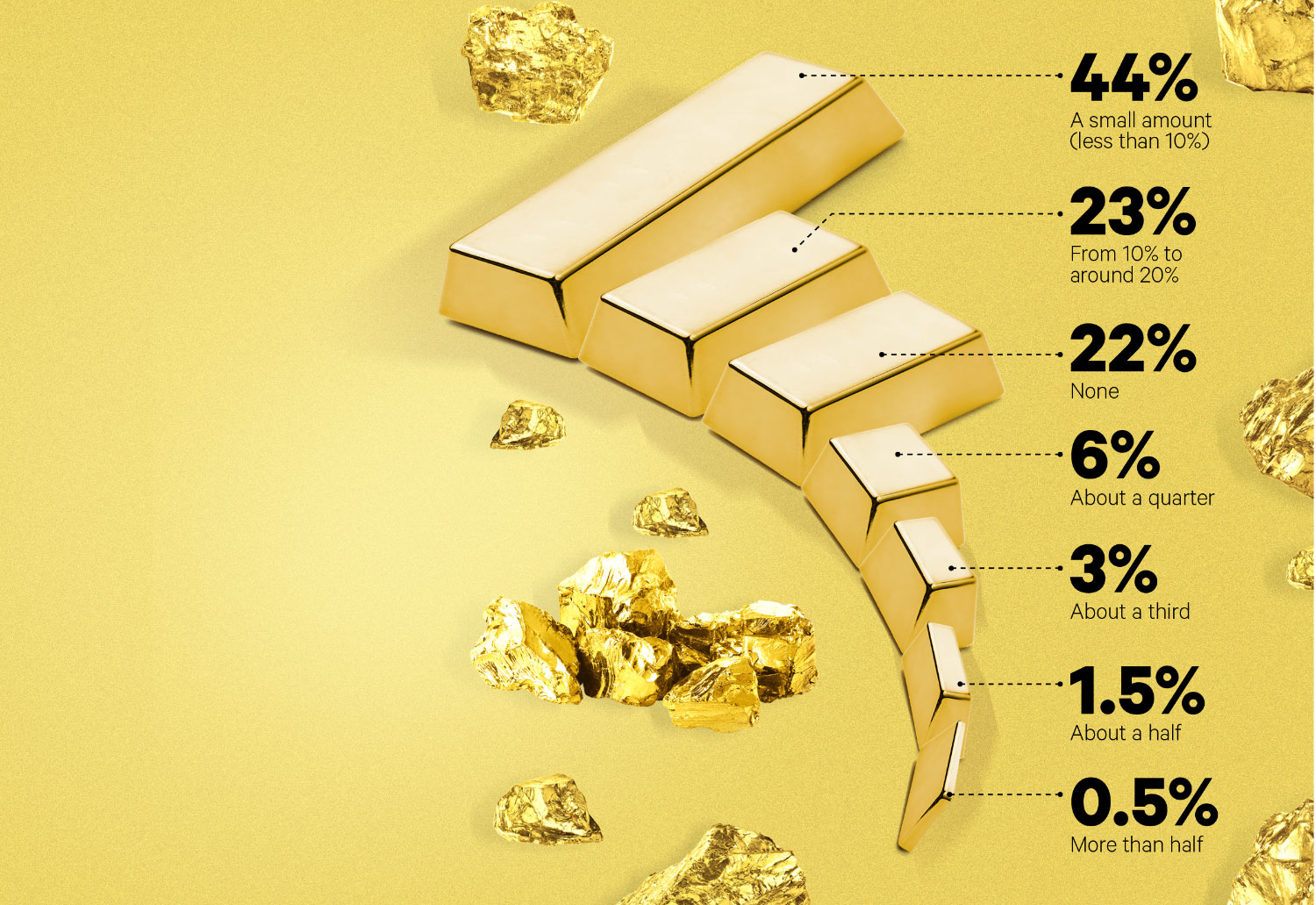

10. What proportion of profit does gold buying currently account for?

COMMENT: The surge in gold prices this year has brought windfall profits for some jewelers, caused sticker shock at others and made inventory replacement a scary decision for just about everyone. It has also allowed a significant number of jewelers to keep their doors open. This comment from an Oklahoma jeweler was typical: “Not only have people wanted to sell, I decided to scrap about $40K worth (at wholesale) of old semi-mountings, and the cash infusion helped us make payroll twice after the PPP funding ran out.” Back in 2009, in the middle of the Great Recession, 45% of jewelers told us that close to a half or more of their profit was coming from gold trading. That compares to just 2% in 2020, suggesting jewelers are in much better shape now compared to the last downturn. Still, if you haven’t aggressively gathered your floor sweeps yet, you probably should. In these times of uncertainty, you don’t want to be leaving cash under the carpet.