Overall sales are up.

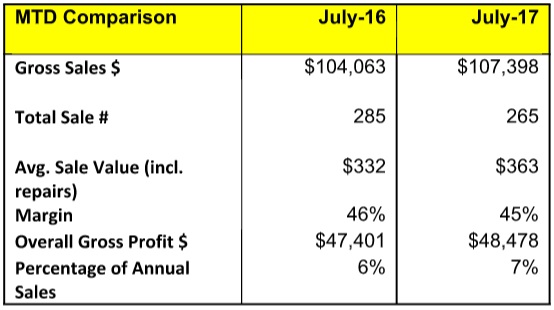

We’ve crossed the halfway mark of the financial year with more positive information from our selection of store data. A strong July sales figure of $107,398 was an increase from the 2016 July result of $104,063, a monthly increase of 3.2 percent. Rolling 12-month sales rose 0.21 percent for the year from June 2017.

The trend for reducing sales units continue with a fall in unit sales from 285 to 265 units, down 7 percent.

Average sale values continue to increase, however, with a jump of just over 9 percent from $332 to $363. Despite a 1 percent drop in margins, gross profit has increased from $47,401 to $48,478. But this increase was only 2.2 percent, lower than the sales increase. Had gross profit increased by the 3.2 percent level that sales increased by then the average store would have banked an additional $925 of profit, effectively doubling the profit increase achieved.

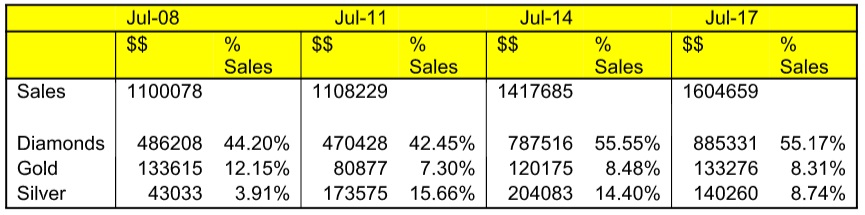

With unit sales decreasing and average retail sale prices increasing, its interesting to compare the product mix being achieved by stores versus previous periods.

The chart above illustrates the changing composition of the product mix for most stores over the last nine years. Back in 2008 the typical store was achieving 44 percent of sales in diamond product, 12 percent in gold and just under 4 percent in silver. Moving forward to the 2011 and 2014 periods it’s noticeable the impact that the bead market had on silver with it increasing its contribution to overall sales from 4 percent to around 15 percent before falling to just under 9 percent at present. Although the bead market may have tapered off, silver is still contributing nearly three times as much to total store sales as it did in 2008.

Diamonds represent the biggest turnaround. From just $486,000 in sales in 2008 the contribution of diamond jewelry has increased to nearly $886,000 in 2017, an increase of 82 percent at a time when total store sales increased by 45 percent. This has resulted in diamonds’ contribution to overall sales increasing from 44 percent to over 55 percent of storewide sales.

Advertisement

The level of interest in gold has shown a significant drop as an overall percentage. Sales are exactly in line with where they were in 2008 at $133,000, but as a percentage of overall sales we have seen a drop from 12 percent to around 8 percent. 2008-11 was a particular low point for gold with sales dropping in response to the increased interest in silver product.

So how do these numbers compare to your own store? Grab your latest year-to-date sales report and divide your total diamond product sales by the total storewide sales. How does it compare? If you are achieving less than 55 percent of sales in diamond product there may be untapped potential in this market.

What about your sales increase in diamonds since 2008? If you have old reports you should be able to compare your growth in diamond sales with the industry average. If your sales haven’t increased by 80 percent during this time the question is why not?

The main areas to look at here will be

- Inventory.

- Staff.

- Marketing.

How is your inventory? Do you have enough diamond product? Is it fresh or aged? Is it in the most popular styles for your market? Who is your market – bridal? Other?

What about your staff…do they know how to sell diamonds? Do you discuss diamonds regularly with them? Are you doing ongoing training – both in understanding diamonds and in selling? Do you give your best diamond seller the greatest opportunities or does everyone approach customers at the diamond counter?

Advertisement

How do you market your diamonds? Does your store say “diamonds” to people? Do you have diamonds prominently displayed in the best selling positions? If so what diamond market are you targeting and appealing to? Are you clienteling your best customers with new product opportunities? Are you gathering a database about your diamond customers?

Working through these questions will help you with growing your diamond busines, and you can apply them to other areas also. The important thing is to review your sales data and see where you are, then use this as your starting point to build your future diamond prosperity.