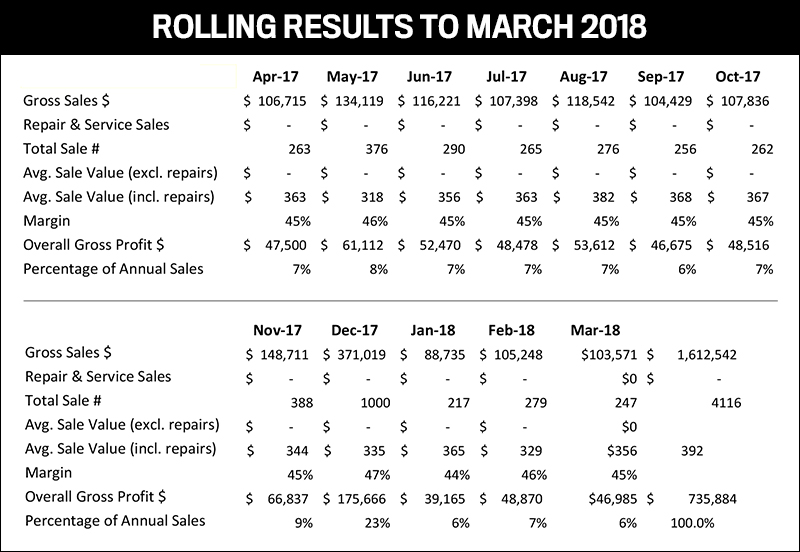

MARCH RESULTS across our same-store data showed a slight decrease on rolling 12-month sales achieved since February.

Same-store data showed a drop in year-to-date sales to $1,612,542 from $1,616,481, a decline of 0.24 percent for the month. Twelve-month unit sales declined from 4,147 to 4,116, a decrease of 0.74 percent, with a slight increase in average sale achieved from $390 to $392 helping to offset the drop.

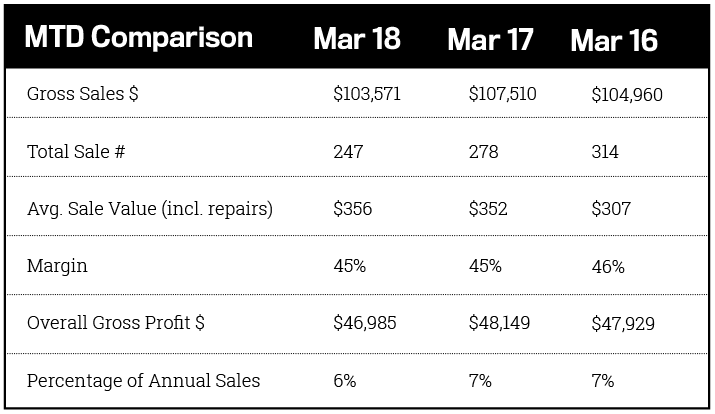

Month-to-date comparison data for sales show March sales results are below the equivalent period in 2016 after increasing during the 2017 year. Total monthly sales came in at $103,571, down from last year’s $107,510 and the March 2016 result of $104,960. Sales units continued their decline to 247 items, a drop of 11 percent from 2017 and 21 percent from 2016.

The average sale of $356 was ahead of last year’s equivalent amount of $352 and the 2016 average sale achieved of $307. Margin held at 45 percent with the result that gross profit was down 2.4 percent on 2017 and 2 percent on 2016 respectively.

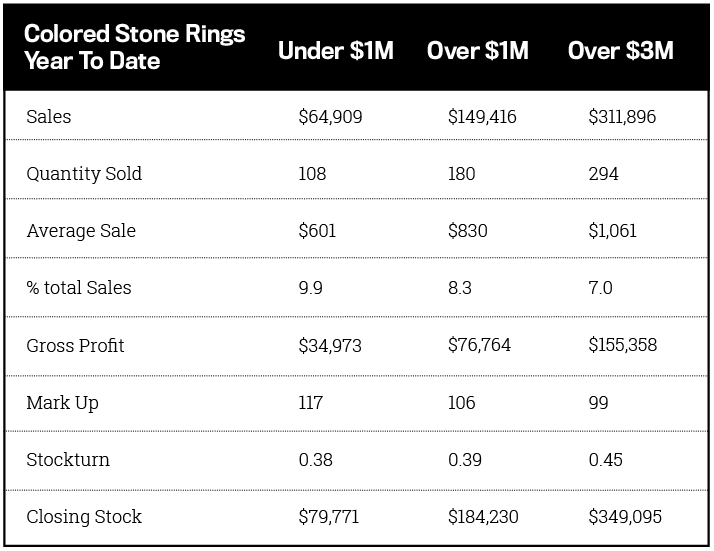

This month we focus on colored stones, an area often not given much priority by jewelers compared to other departments. Nevertheless, for most stores it can contribute up to 10 percent of sales and is an area that shouldn’t be neglected.

Advertisement

With the recent split of our data gathering into stores under $1 million sales, stores over $1 million sales, and stores over $3 million sales, we are better able to compare the impact that colored ring sales are having in each respective area.

Understandably, larger stores doing $3 million per year are able to achieve more sales and a greater volume of unit sales across these areas. Where they also gain, however, is in average sale achieved in colored stones. The difference between the average sale for a store doing less than $1 million and those doing $3 million is $460 ($1,061 – $601). That represents an average sale that is 76 percent higher, a significant difference. The largest stores are achieving 4.8 times as many sales as their smallest counterparts but, due to a lower markup (99 percent versus 117 percent), this converts into a gross profit that is only 4.4 times higher ($155,358 versus $34,973). They are doing these sales on only 4.3 times as much inventory, meaning their stock turn comes in better at 0.45 turns per year compared to 0.38.

Not surprisingly, medium-sized stores doing between $1 million and $3 million are sitting in the middle with unit sales 66 percent higher than the smallest stores, and average sale coming in 38 percent higher. Markup sits comfortably in the middle at 106 percent, but their stock turn more closely resembles the smaller stores at 0.39 times per year.

The law of diminishing return would tend to suggest that the more items a store holds, the lower its stock turn is likely to be, as eventually there will be far more selection than buyers. Clearly the $3 million plus stores haven’t reached this point and smaller stores should be asking the question as to how they are able to achieve this.

Based on the relatively low stock turn, small to medium stores are not understocked relative to sales, but a clue may sit in the price point that the largest stores are achieving. Are the smaller stores carrying items in the right price range relative to what the market wants?

Advertisement

This is a question to ask your own business. With diamond average sales sitting in the range of $1,500 to $2,500 for most stores, should colored stones be averaging a unit price as low as this? When compared to their diamond average, each store size looks like this:

There is a clear pattern of diamond averages being more than twice as high as colored stone averages, and that’s understandable given the more significant role that diamond plays in high-end bridal. The difference is slightly lower for stores doing more than $3 million, but still noticeable.

So what role do colored stones play in your store? Are you achieving an average sale in line with similar stores? Is the difference between your diamond and colored stone average sale similar? A comparison with your peers may just show an area of potential growth that you could be improving on.