With growth in the number of stores whose data is being collected, we have updated our reporting system to further differentiate between the levels of store information we have. Our previous breakdown into stores over and under $1 million has now been further split to reflect stores that are doing in excess of $3 million in sales per year.

With growth in the number of stores whose data is being collected, we have updated our reporting system to further differentiate between the levels of store information we have. Our previous breakdown into stores over and under $1 million has now been further split to reflect stores that are doing in excess of $3 million in sales per year. With over 100 stores now fitting into this category, we have our first in-depth breakdown of the performance of large stores on their own, and how their results compare to smaller stores.

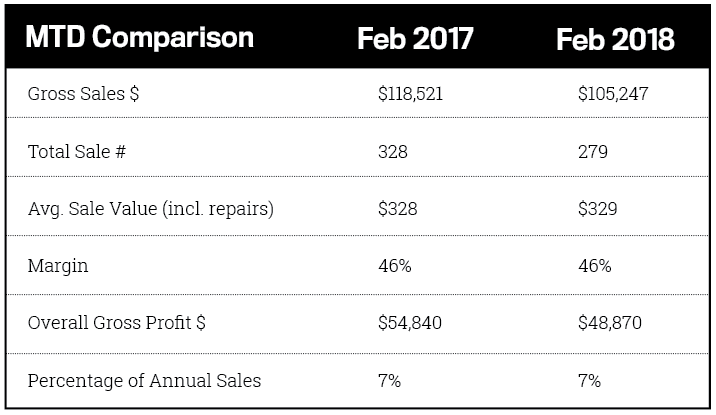

First, let’s look at the results for February. Same-store rolling 12-month data shows a decline insales achieved to $1.616 million from $1.629 million. However, this difference can be partially attributable to a change in the weighting of the data being reported thanks to the new category.

Average sale for the month of February remained similar at $329 on an average margin of 46 percent with unit sales down from 328 to 279 for the month (again allowing for an adjustment in data gathering). These numbers will no doubt continue to show a variation over the next 12 months until the new data-gathering works its way through.

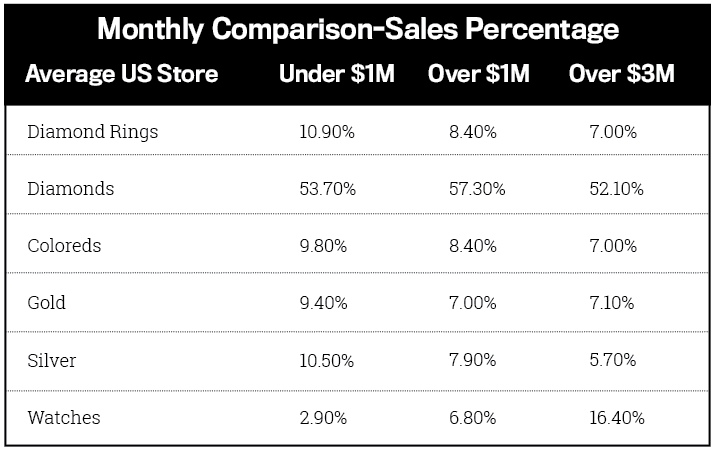

Now that we have an additional split of stores doing in excess of $3 million it is interesting to compare the sales makeup of each type of store.

Advertisement

Looking at the percentage contribution of each department across the categories, it’s interesting to see how larger stores make up their sales mix. Contrary to expectation, it’s not all coming from diamond rings, with larger stores showing the lowest sales percentage contribution from diamond rings at just 7 percent compared with smaller stores at 10.9 percent. Obviously this converts to a higher dollar value but is not the main driver of the extras sales.

Diamonds overall contribute just over 52 percent of $3 million store sales compared to 53.7 percent and 57.3 percent for under $1 million and over $1 million, respectively. In fact, the largest stores also receive a lower percentage of their sales from colored stone, gold and silver departments than the small and medium store performance.

It’s in the area of watches that the large stores make up the difference. Based on a sales percentage of over 16 percent, the average $3 million-plus store is doing a minimum of just under $500,000 per year in watch sales – a relatively significant sum. In fact, these larger stores can be doing as much from watch sales as a smaller store is achieving from all categories put together. Margins may be lower in this department, and the return rate of warranties will be higher than jewelry, but there is still obviously money being made in this area despite the arrival of cell phones, Fitbits and other time-measuring devices that will supposedly spell the end for the watch industry.

So are watches a big part of your business? Do you neglect them in favor of other areas that you feel warrant more attention?

We’ve highlighted the difference in watch sales between larger and smaller stores before, but never has it been more apparent than in the data we have here. The further split of the data shows that the larger the store, the more significant it seems watch sales become. Compare nearly $500,000 of sales versus $30,000 being achieved by the average $1 million store and you’ve accounted for almost 25 percent of the sales difference between the two types of entities.

Advertisement

It certainly provides food for thought.